BofA: ECB to Hike 50bp in July, Sept but Could Raise Eurozone Fragmentation Risks

- Written by: Gary Howes

Image © European Union, reproduced under CC licensing

The European Central Bank will raise its key Deposit Rate well above 0% before the year is done, but this risks raising Eurozone fragmentation risks warns Bank of America.

In a new research note BofA say it now sees a cumulative 150 basis points of Deposit Rate hikes this year, up 50bp on their previous assumptions.

They see sizeable 50bp moves in both July and September which is more hawkish than the market consensus which currently anticipates a more cautious 25bp move in July.

"Our call was already more hawkish than consensus, and is even more so now," says Ruben Segura-Cayuela, Europe Economist at BofA Europe in Madrid. "We can't see the ECB avoiding a 50bp move by September, at the latest."

Such a surprise could boost Euro exchange rates initially, but "we continue to worry this is too much too fast," says Segura-Cayuela.

Indeed, BofA's economist team describe themselves as "bears with a hawkish ECB call" in a recent note that comes days ahead of the ECB's June policy update, due Thursday 09.

The policy update should see the ECB confirm an end to its quantitative easing programme while confirming a first rate hike in July.

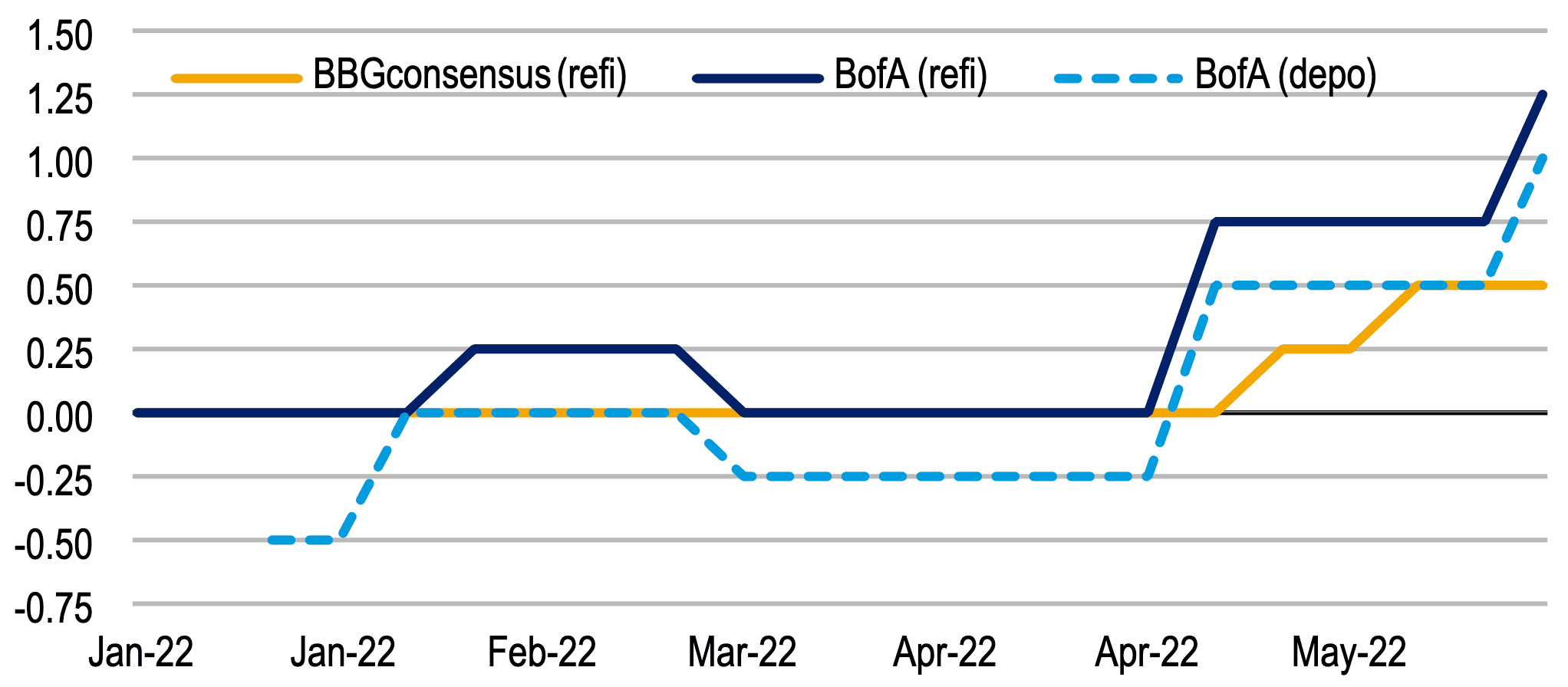

Above: Consensus vs BofA refi (and deposit rate) forecasts for end-22. "We may be macro-bears, but our ECB call for 2022 has been on the hawkish side of consensus for a while" - BofA. Image: Bloomberg, BofA Global Research.

But the haste to tackle inflation could mean Eurozone fragmentation risks rise quickly, "with Italy in the spotlight," says Segura-Cayuela.

"To be completely clear, we still don't understand the ECB's rush. We are self-declared macro bears, because we don't really understand how the economy can go through a very large energy price shock unscathed in the first place, never mind how the economy is supposed to cope with neutral rates when it is so far away from equilibrium. Hence we expect the central bank to be stopped out by the economy after all these hikes this year," he explains.

Nevertheless BofA have taken on board the reasoning of various members of the ECB's Governing Council of late, including that of President Christine Lagarde.

The ECB has made clear it wants to be seen to act against inflation and to lean against the risk of second round effects proactively.

Eurozone inflation reached 8.1% in May 2022, up from 7.4% in April 2022.

But BofA is concerned that raising interest rates rapidly would put unnecessary upward pressure on the so-called peripheral Eurozone countries such as Greece and Italy.

They already pay more than the likes of Germany and France on their sovereign debt and higher ECB rate hikes will inevitably push up their funding costs further.

The risk is the rise in funding costs for these countries becomes disorderly and sparks a fresh crisis.

"Just because the ECB doesn't address fragmentation risks doesn't mean they don't exist," says Segura-Cayuela. "The frequency of Italian debt sustainability questions is rising again".

Furthermore, the analyst says markets are not adequately considering the prospects of a Eurozone recession, "we have the impression that recession risks are much more readily acknowledged in the US than in the Euro area".

"To us, the Euro area risks seem much more elevated. Our part of the world has to cope with very high food and energy price inflation, a real household income squeeze close to 4% this year (more than during the Euro area crisis), uncertainty from the war in Ukraine, demand weakness and supply bottlenecks in China, slowing growth in the US and the UK, and the upcoming monetary policy tightening," says Segura-Cayuela.

What is the answer to the headache the Eurozone economy faces?

More fiscal support is the answer suggested by Segura-Cayuela. "Headwinds come from all sides, and fiscal policy, for now, is doing too little to compensate."

BofA suggests a more cautious approach to fiscal policy tools could prevail, in anticipation of higher funding costs on the back of monetary policy tightening.

A shift in the economic landscape will meanwhile prompt the ECB to put the brakes on its rate hiking ambition in 2023.

"We are bearish on the macro outlook and we think their hiking-cycle ambitions are likely to get stopped out in 2023," says Segura-Cayuela.