Euro Boosted by ECB's Lagarde

- Written by: Gary Howes

File image of ECB President Christine Lagarde. Photo by Sanziana Perju / European Central Bank.

Euro exchange rates rose at the start of the new week after European Central Bank President Christine Lagarde cemented expectations for a July interest rate hike.

"I expect net purchases under the APP to end very early in the third quarter," said Lagarde. "This would allow us a rate lift-off at our meeting in July, in line with our forward guidance."

The Euro rose sharply against most major currencies in the wake of the comments, with a quarter of a percent advance being registered against the Pound and a more substantial 1.0% gain coming against the Dollar.

"The conditions facing monetary policy have changed markedly. Three shocks have combined to push inflation to record highs," said Lagarde in a blog post aimed at addressing evolving investor expectations for future ECB policy.

Lagarde's comments follow those of other Governing Council members who have for weeks been priming investors for an imminent interest rate rise.

"In a remarkably explicit blog, ECB President Christine Lagarde today seems to have pre-announced the likely key policy decisions of the ECB’s9 June meeting. The ECB will end its net asset purchases in early July and raise rates at its 21 July and 8 September policy meetings," says Holger Schmieding, Chief Economist at Berenberg Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The shift in interest rate expectations have offered the Euro support following a run of losses, particularly against the U.S. Dollar.

"Rising interest rate expectations in the Eurozone have lifted the EUR recently," says analyst Ingvild Borgen at DNB Markets. "We believe the EUR will continue to strengthen".

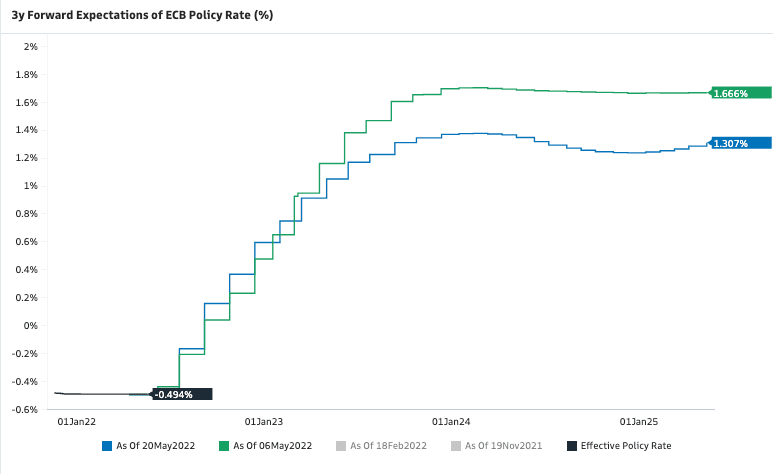

The market now anticipates 108 basis points of hikes from the ECB in 2022 with a terminal rate at 1.66%, up from the 1.30% terminal rate expected on May 06.

This lift in terminal rate expectations is proving a source of support for the Euro at a time when investors are lowering their expectations for the terminal level at other central banks.

Above: Money market expectations for the future of ECB interest rates. Image courtesy of Goldman Sachs.

The ECB has particularly closed the gap against the Bank of England where a further 128 basis points of hikes are expected over the remainder of the year.

The catch up in expectations helps explains some of Sterling's recent weakness against the Euro: the Pound to Euro exchange rate has fallen from levels near 1.21 in mid April to 1.1789 at the time of writing. (Set up your free FX rate alert here).

The ECB feels emboldened to act on its ultra-low interest rate settings by the belief inflation expectations in the Eurozone are finally moving higher.

Lagarde explains that a series of shocks such as Covid and the Ukraine war have contributed to higher global inflation, which has in turn helped push up inflation expectations amongst Eurozone businesses and consumers.

"Inflation expectations are becoming centred around our target, rather than at much lower levels like before the pandemic," says Lagarde.

"All this suggests that, even when supply shocks fade, the disinflationary dynamics of the past decade are unlikely to return. As a result, it is appropriate for policy to return to more normal settings rather than those aimed at raising inflation from very low levels," she adds.

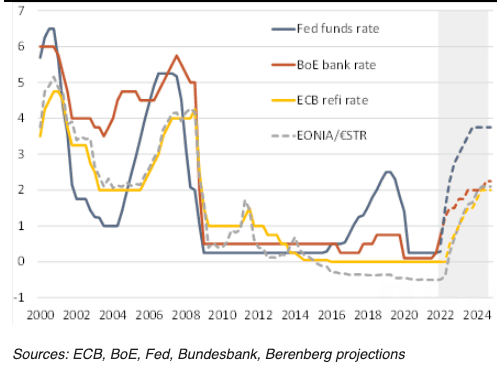

Above: ECB interest rates will ultimately catch those of the Bank of England.

Lagarde adds Eurozone economic growth is likely to remain supported thanks to continued tailwinds from the reopening of the economy and the high stock of accumulated savings and the fiscal support introduced to offset higher energy bills.

"The labour market has also rebounded much faster than expected, with unemployment falling to a historic low," she says.

Based on the current outlook, Lagarde says the ECB will likely be in a position to exit negative interest rates by the end of the third quarter.

Lagarde‘s announcement that the ECB will likely "exit negative interest rates" by the end of the third quarter leads Berenberg's Schmieding to believe the July and September rate hikes will be by 25bp each.

Berenberg expects 25bp rate hikes in July, September and December this year, followed by three such moves in 2023 and two further hikes in 2024.

"Lagarde’s blog is remarkable in a further respect. As one of the leading doves on the ECB council, she finally admits that, abstracting from all the special factors at play at the moment, longer-term structural forces will raise inflation lastingly beyond the low rates that prevailed from 2012 to 2021. Put differently: The new normal of low inflation and low nominal rates is over for good," says Schmieding.

Economists at Commerzbank expect the ECB to raise the deposit rate by 25 basis points at each of its seven meetings between July and April, from -0.5% at present to then 1.25%.

"After that, we expect a pause in rate hikes because inflation is likely to temporarily settle back near the Bank's 2% inflation target next spring," says Dr. Michael Schubert, Senior Economist at Commerzbank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes