Odds of a U.S. Recession Back to 50%: Macro Hive

- Written by: Dalvir Mandara, Bilal Hafeez at Macro Hive

Image © Adobe Images

U.S. 10y treasury yields are getting closer to 3% – a level not seen since late 2018.

But short-term yields are moving up faster with U.S. 2y yields jumping 33bps over the past week compared to the 10y’s 18bps increase.

All of this due to the market increasingly pricing 50bps hikes by the Federal Reserve at each meeting in 2022.

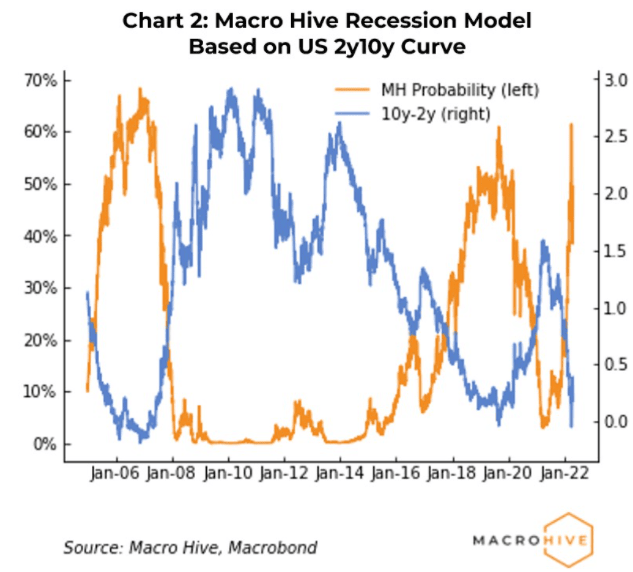

These moves have seen the U.S. 2s10s curve re-flatten, which has led our recession model to once again assign a 50% chance of recession in the next twelve months.

Equities appear to have taken note with notable weakness.

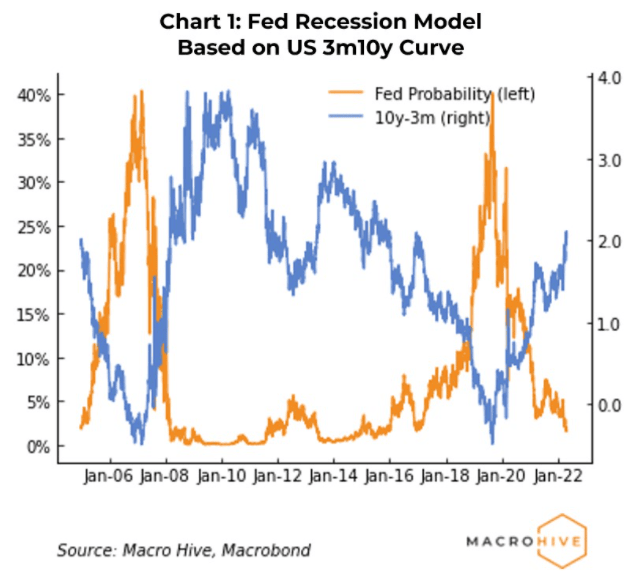

Meanwhile, the Fed’s recession model, which uses the 3m10y part of the yield curve, continues to give only a 2% probability of recession.

About the Model

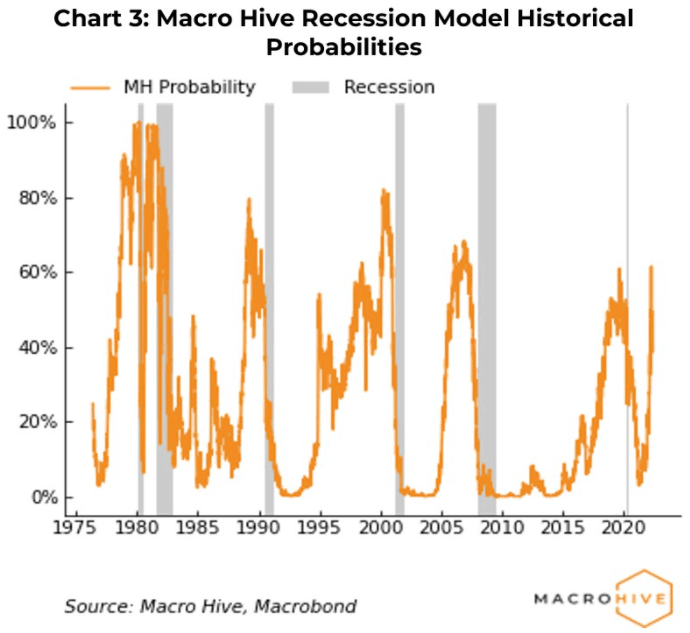

Macro Hive introduced two models for predicting US recessions using the slope of the yield curve.

When long-term yields start to fall towards or below short-term yields, the curve flattens or inverts.

This has often predicted a recession in subsequent months.

One model from the Fed is based on the 3m10y curve and the second is our modified version based on the 2y10y curve.

The two-year would better capture expectations for Fed hikes in coming years.

It is therefore more forward-looking.

So, their preferred yield curve is the 2y10y curve (10-year yields minus two-year yields)

Content courtesy of Macro Hive.