Bank of England: This is Still a Hawkish Central Bank says BofA

- Written by: Gary Howes

Image source: Bank of England. Credit Laura Bell.

The selloff in Pound Sterling and rates markets following Thursday's Bank of England policy meeting testifies to the scaling back of investor expectations for the number of additional interest rate rises due over coming months.

But UK economist Robert Wood at Bank of America says this remains a hawkish central bank and there is a risk markets get too dovish.

"Caution and uncertainty yes, but the BoE in our view continues to signal a series of rate hikes will most likely be needed," says Wood.

Money market pricing - as per the OIS market - shows there are now 123 basis points of hikes anticipated for 2022, down on the 134 points expected ahead of the meeting.

This still puts Bank Rate towards 2.0% by year-end, which if reached would slow economic activity said the Bank in a statement.

"The BoE's forecasts implicitly suggest the BoE sees neutral somewhere between 1 and 1.5%, which we think explains some of the BoE's caution," says Wood.

The BoE noted inflation expectations have surged and this will offer a compelling reason to raise interest rates further, but gradually.

Although they acknowledged UK consumer confidence has fallen sharply, with Bank of America pointing out they have actually reached recessionary levels.

"The BoE does not want to, in our view, accidentally tip the economy into recession," says Wood.

The BoE said the surge in inflation - it now sees inflation peaking at 8% - will do enough to depress economic activity and prompt falls in inflation over the medium-term timeframe.

"Further out, inflation is expected to fall back materially, as energy prices stop rising and as the squeeze on real incomes and demand puts significant downward pressure on domestically generated inflation," said the Bank's statement.

But Bank of America says there is a risk of becoming too 'dovish' in reading the BoE's messaging.

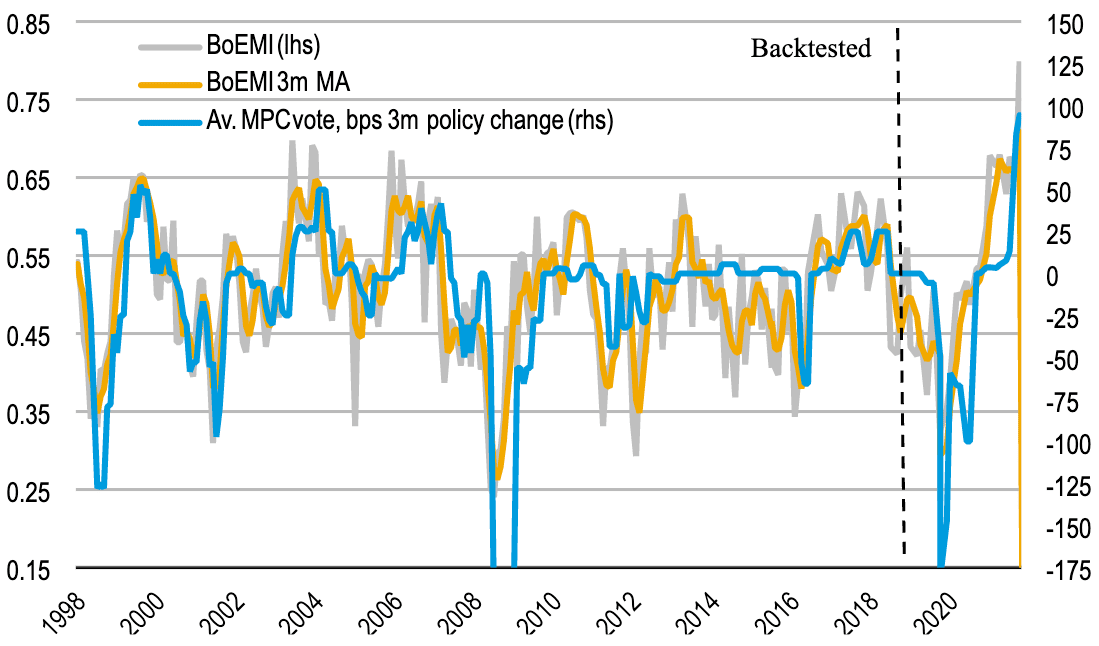

In fact, Bank of America's proprietary 'BoE Mood Indicator', which uses natural language processing to measure the hawkishness of the BoE minutes, rose to a startling all-time high (most hawkish) reading.

Above: BofA Bank of England Mood Indicator. "Most hawkish BoE ever on our proprietary mood indicator" - BofA. See footnote for further notes.

"The BoE highlights strong wage growth, tight labour market, stronger than expected GDP growth, inflation expectations at a record high," says Wood.

The Bank of England also said service price inflation has picked up, although to a lesser extent than other components, with core services prices returning to their pre-Covid trend.

"Underlying nominal earnings growth is estimated to have remained above pre-pandemic rates, and is still expected to strengthen over the coming year," it stated, adding:

"Given the current tightness of the labour market, continuing signs of robust domestic cost and price pressures, and the risk that those pressures will persist, the Committee judges that an increase in Bank Rate of 0.25 percentage points is warranted at this meeting."

Before the March decision the market had expected seven more 25 basis point hikes by next February, which would take Bank Rate to 2.25%.

Bank of America expect four more hikes, in May, June, August and November, taking Bank Rate to 1.75%.

Explainer: Bank of America's Bank of England Mood Indicator:

Average MPC vote scales QE into Bank Rate equivalent. BoEMI is scaled from 0 to 1, and reflects the proportion of 'hawkish' sentences in each publication. The indicator identified as BoEMI is intended to be an indicative metric only and may not be used for reference purposes or as a measure of performance for any financial instrument or contract, or otherwise relied upon by third parties for any other purpose, without the prior written consent of BofA Global Research.

This economic indicator was not created to act as a benchmark. This performance is back-tested and does not represent the actual performance of any account or fund. Back-tested performance depicts the theoretical (not actual) performance of a particular strategy over the time period indicated. No representation is being made that any actual portfolio is likely to have achieved returns similar to those shown herein.