4-year Highs for the Pound to Canadian Dollar: The Week Ahead Forecast

- Written by: Gary Howes

Image © Bank of Canada

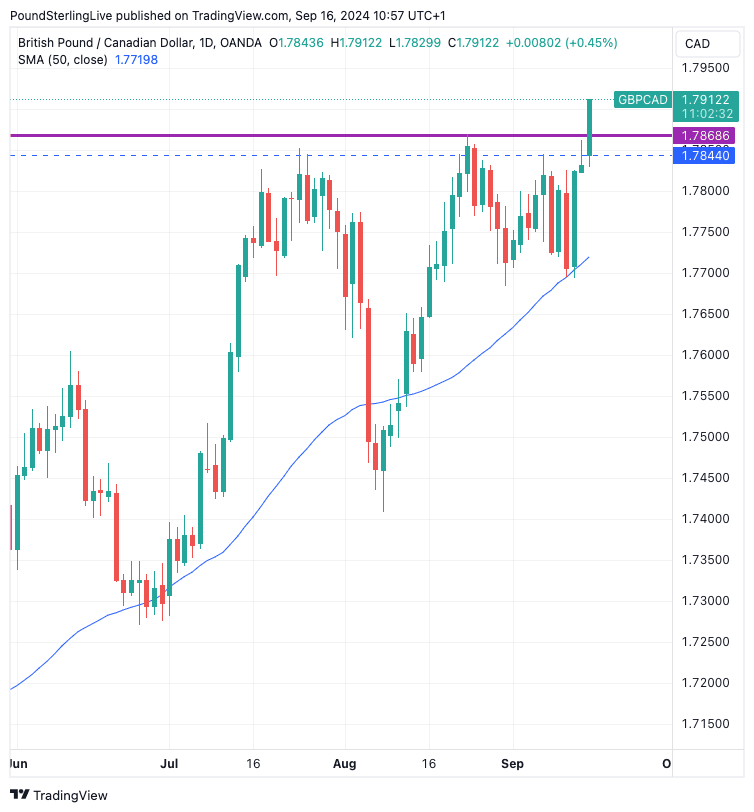

We are seeing a solid gain for the Pound to Canadian Dollar exchange rate (GBP/CAD) at the start of a new week that brings with it a new four-year best for CAD buyers.

The pair reached a high of 1.7912 on Monday, a level last seen in March 2020 at the outset of the Covid panic. The gain breaks a technical ceiling at 1.7844-1.7868, which has frustrated GBP/CAD upside for much of 2024.

A break would be confirmed by a succession of daily closes above 1.7868, signalling that a new and higher range will be in play.

Dips should be limited to the 50-day moving average, which is located at 1.7719, but we think the odds of this are limited and favour the upside in the coming days.

The trigger to the move higher in GBP/CAD lies south of the border, where the Federal Reserve looks set to cut interest rates by 50 basis points on Wednesday.

The market was expecting a vanilla 25bp cut, but Thursday saw a number of press reports suggesting a more generous 50bp is in play. This boosted stocks and weighed on the U.S. Dollar.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

The CAD is sensitive to Fed expectations as investors see a strong synchronicity between Canada and the U.S., owing to the interconnectedness of their financial systems and economies.

A 50bp cut from the Fed makes it easier for the Bank of Canada to cut by 50bp at the next meeting, given the slowdown in Canada's economy is acute. This will weigh on Canadian interest rate expectations, bond yields and the Canadian Dollar.

The immediate downside risk to GBP/CAD would be that rumours of a 50bp cut at the Fed were unfounded, and it chose to cut by 25bp instead. The kneejerk move higher in USD would aid CAD and weigh on GBP/CAD, potentially taking us back to 1.7868.

We suspect that this level will turn into support for the exchange rate meaning downside scope will be limited from here.