GBP/CAD Week Ahead Forecast: Downtrend Invalidated

- Written by: Gary Howes

Image © Adobe Stock

The Pound to Canadian Dollar exchange rate (GBPCAD) has recovered enough to invalidate the recent downtrend but it remains too soon to call an outright rally given the risks associated with this week's Bank of England decision and the imminent release of GDP figures from Canada.

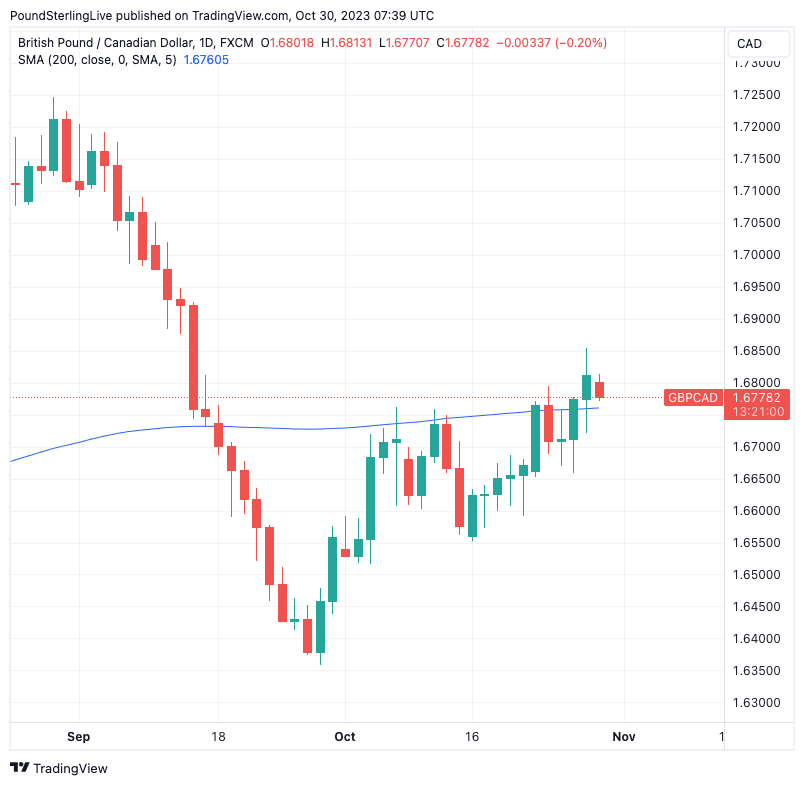

The GBPCAD exchange rate has rallied through October and is now at 1.6774 at the time of writing, which puts it just above the 200-day moving average at 1.6760 and invalidates the recent downtrend.

Our Week Ahead Forecast analysis uses a simple rule whereby we call an exchange rate's trend depending on which side of the 200-day MA it is on. This simply allows us to assess where the balance of risks lies over the foreseeable future.

Above: GBPCAD at daily intervals with the 200-day moving average illustrated. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

Note in the above that the 200-DMA has proven a source of resistance over recent weeks (the exchange rate has hit the line but was then repulsed), and we would look for it to provide support in the near term.

But more professional strategists have also picked up on the GBPCAD's break above the 200-day MA, saying this helps stabilise the Pound's outlook against the Loonie.

"The BoC meeting fuelled further CAD selling that has seen GBP/CAD break above the 200-DMA around 1.6760. The break of that technical level makes us wary of the potential for some further upside over the near-term," says Derek Halpenny, Head of Research for Global Markets at MUFG Bank Ltd.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

MUFG's strategists had been sellers of the GBPCAD but have cut the position on recent technical developments.

"Events in the Middle East could flare up again, which would help, but a broadening of the conflict is not our core view and hence the technical break above the 200-day MAV is enough for us to cut this position and reassess," says Halpenny.

Turning to the calendar, Canadian GDP is due for release at 13:30 GMT on Tuesday, with the market poised for a reading of 0.1% growth month-on-month in August.

Should the outcome beat expectations, then CAD can rise.

"A sharper rebound may nonetheless not be enough to help the CAD recoup some of the ground lost recently, as in the end global risk appetite and the broad USD direction could prove more influential," says Crédit Agricole.

The Bank of England forms the highlight of the coming week for the British Pound and the risks associated with the event will likely cap any strength in the currency.

Investors could opt to lower exposure to the Pound in the lead-up to Thursday's decision which is likely to see interest rates left unchanged at 5.25%.

On balance, the Bank of England's policy decisions have tended to undermine the Pound in the current hiking cycle, as policymakers have tended to err on the cautious side.

This cautious reaction function could result in the Bank inadvertently giving a green light to market participants to bring forward rate cut expectations, which can weigh on the Pound.

The Bank will be keen to stress interest rates must stay at current levels for an extended period, particularly given wage rises are elevated and could contribute to inflation remaining above target for a long period.

"With the GBP already weighed down by weak data, the currency could benefit from confirmation of the BoE's 'higher for longer' outlook," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

But the 'higher for longer' message could be undermined by how the Monetary Policy Committee (MPC) votes.

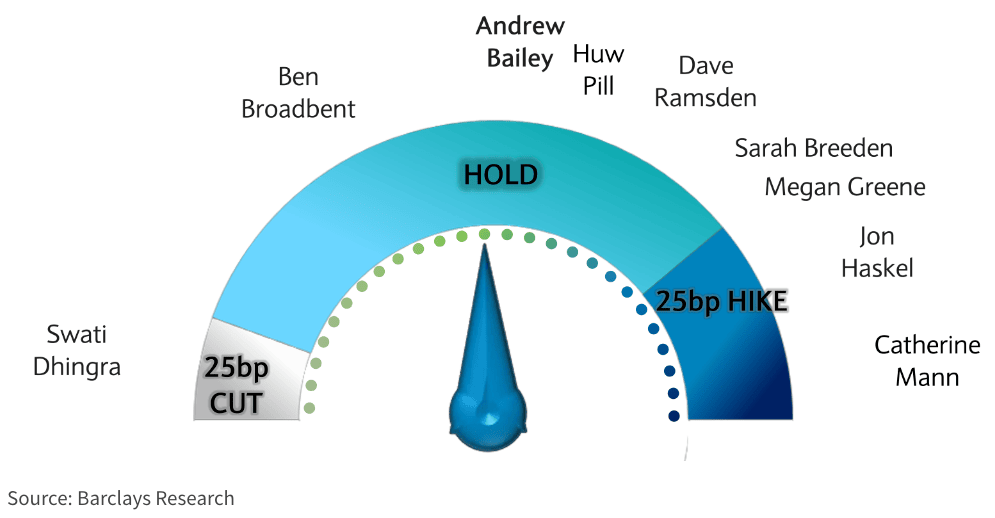

In particular, we are wary that Swati Dhingra, the most 'dovish' member of the MPC, will vote for a rate cut.

Economists at Barclays expect Dhingra to vote for a cut on Thursday, saying in a research note: "We expect the MPC to hold Bank Rate at 5.25% at the 2 November meeting, with a base case of a split vote of 1-6-2, reflecting the finely balanced nature of the decision and plausible arguments on both sides (Dhingra to vote for cut and Mann and Haskel to vote for hike)."

Should Dhingra vote for a cut, the MPC will be signalling rate cuts are actively being discussed, making the Bank of England the first to communicate that an easing of policy is now on the horizon.

Therefore, this single vote and its necessary acknowledgement in the accompanying minutes, risks undermining any unity on a 'higher for longer' message the Bank is trying to convey.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Money markets will likely bring forward expectations for rate cuts in 2024, pressuring UK bond yields relative to those of the Eurozone and U.S.

The mechanical transfer of these expectations to foreign exchange markets would imply a weaker Pound.

However, any downside risks from the vote composition could be countered by an uplift in the Bank's economic forecasts.

"Updated economic projections should provide some food for thought," says Nikesh Sawjani, Senior UK Economist at Lloyds Bank. "The BoE’s forecasts will be conditioned on a market-implied path for Bank Rate that will be around 75bp below where it was for the August."

Expectations for lower rates in the future "imply a less tight policy stance and lift the Bank of England’s projected level of GDP and CPI projections across the forecast horizon," says Sawjani.

Lifting inflation and growth projections could limit the 'dovish' tendencies of the MPC and afford the Pound some downside protection.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes