GBP/CAD Forecast: Uptrend in Jeopardy

- Written by: Gary Howes

Image © Adobe Stock

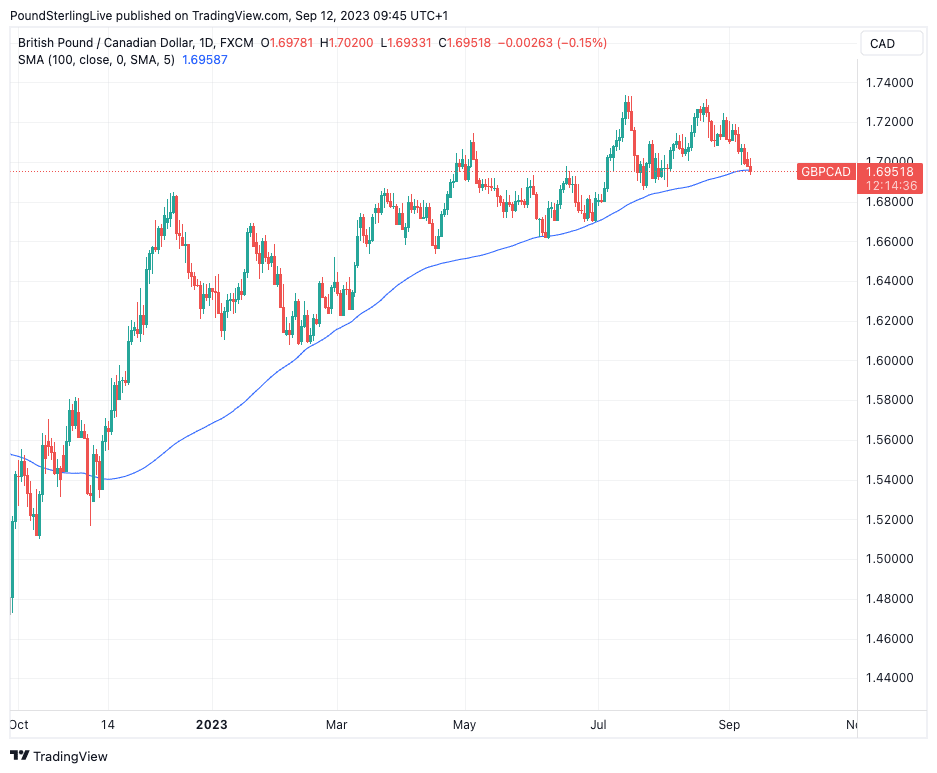

The Pound to Canadian Dollar exchange rate (GBPCAD) has been edging lower through the August-September period and is now at a key support zone where failure could confirm the 2023 uptrend has likely ended.

GBPCAD rose to a high of 1.73 on August 22 but was rejected for the second time in 2023, ensuring the creation of a 'double top' on the daily charts, a pattern that can often signal a trend is at risk of turning lower.

The recent run of losses now takes GBPCAD back to 1.6950, where the 100-day moving average (DMA) is located:

Above: GBPCAD at daily intervals showing the 100-day moving average. A key test of this technical area is underway.

The 100-DMA is a key momentum indicator and we observe that GBPCAD has not traded below here since November 2022 which would be consistent with the uptrend we have seen over recent months.

There is the chance support might emerge here once more and if the daily closes this week confirm support has held then the door will be held ajar to a restest of that 1.73 resistance line once more.

But a break below here could well signal a change in direction is underway and lower levels over the coming days and weeks could be in prospect.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

The developments come as the Canadian Dollar is underpinned by a broader rebound in the commodity currency complex which has been underpinned by improved sentiment on China.

Pound Sterling has meanwhile come under pressure of late as markets anticipate an end to the Bank of England's interest rate hiking cycle which has resulted in lower UK bond yields.

The lower yields in turn lower the attractiveness of UK bonds - a significant investment asset - for international investors, lowering the demand for Sterling to finance such investments.

Data out Tuesday meanwhile showed UK wages rose at record rates in July, which keeps alive the prospect of a Bank of England interest rate hike to 5.0% on September 21, giving the Pound a clear rates advantage over most rival developed market currencies.

However, the odds of a November hike to 5.75% are relatively limited given the ONS jobs report for September showed an increase in unemployment in July, official confirmation of a deterioration in labour market dynamics seen in more timely surveys of the economy.

The trend is consistent with an easing in the labour market, something that has appeared to deny the Pound the outperformance of recent months.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes