Canadian Dollar is Forecast to Extend Recovery by Commerzbank

- Written by: Gary Howes

- CAD recovery has legs says Commerzbank

- EUR/CAD to steady ahead of fall in 2024

- GBPCAD forecast to trickle lower from here

- As USDCAD loses ground

Image sourced Flickr, reproduced under CC 2.0 conditions.

The Canadian dollar can continue its recovery against the Pound and U.S. Dollar according to new research from global investment bank Commerzbank, which also shows a more determined advance against the Euro for 2024.

The research sees Commerzbank update its forecast profile for the Canadian Dollar based on the Bank of Canada's (BoC) evolving policy stance and the robust nature of the country's economy.

A recent interest rate hike by the BoC and the positive economic indicators have provided a boost to the CAD's prospects in the medium term, according to the findings.

"The Bank of Canada surprisingly ended its interest rate pause at the beginning of June and raised the key interest rate to 4.75%. Further steps are expected. The CAD benefited from this, especially since the Fed paused shortly thereafter and it seems close to the peak in interest rates. We maintain our outlook and see further moderate CAD recovery potential in the medium term," says Elisabeth Andreae, FX Analyst at Commerzbank.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

After the BoC's decision to raise the key interest rate by 25 basis points to 4.5% in January, it became the first among the G-10 central banks to enter an interest rate pause.

Initially, this weighed on the Canadian Dollar but it soon witnessed a turnaround due to surprisingly strong economic and inflation data, which pushed interest rate expectations higher.

Andreae explains, "Surprisingly strong economic and inflation data pushed interest rate expectations noticeably higher again, from which the CAD benefited. The housing market also seems to be recovering after significant price corrections."

Andreae says a recent development that contributed to the CAD's recovery was the BoC's decision to end its interest rate pause in June and raise the key rate by 25 basis points to 4.75%. This move signalled the central bank's confidence in the country's economic outlook.

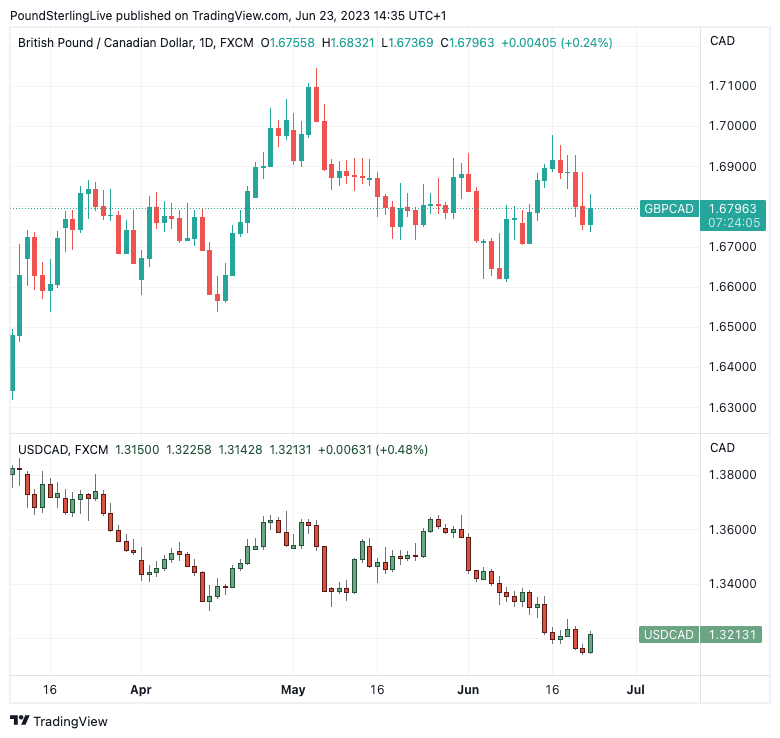

Above: GBPCAD and USDCAD (bottom) at daily intervals.

"Moreover, the BoC surprisingly ended its interest rate pause in June and raised its key rate by 25 basis points to 4.75%. It left the door open for further steps. In addition, the Fed paused shortly thereafter. The CAD benefited accordingly," she says.

Commerzbank maintains its positive outlook for the CAD, given the robustness of the Canadian economy and the hawkish stance of the BoC.

The limited CAD recovery potential against the USD is expected to continue, with the currency benefitting if the interest rate differential between the Federal Reserve and the BoC narrows or turns positive in the medium term.

Andreae concludes, "We see further limited CAD recovery potential against the USD due to the robust economy and a hawkish BoC. CAD should benefit if the interest rate differential between the Fed and the BoC narrows or turns positive in the medium term."

The Canadian Dollar is forecast by Commerzbank to trade at USD/CAD 1.32 by the end of the third quarter and 1.30 by year-end before reaching 1.29 by the end of the first quarter 2024 and 1.28 by the end of the second quarter.

The Euro-Canadian Dollar forecast profile gives 1.48, 1.48, 1.44 and 1.41 over this timeline.

Based on Commerzbank's EUR/GBP forecast profile, the Pound-Canadian Dollar cross is forecast at 1.64, 1.63, 1.58 and 1.53 for the respective points in the future.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes