Canadian Dollar Forecast: Banks and Immigration Spell H2 Rebound says National Bank of Canada

- Written by: Gary Howes

- CAD has struggled over past year

- Thanks largely to lower commodity prices

- But domestic banks are strong

- With immigration propping up deposits and labour market

- H2 rebound on the cards says NBC

Image © Adobe Stock

The Canadian Dollar should trend stronger against the Euro and British Pound into year-end while remaining range-bound against the U.S. Dollar as Canada benefits from a strong banking sector and elevated immigration.

This is according to the National Bank of Canada (NBC) whose latest foreign exchange forecasts and research show the Canadian Dollar will reach its lows in this quarter before embarking on a more sustained recovery.

Stéfane Marion, Chief Economist and Strategist for NBC, says the Canadian Dollar will underperform key rivals over coming weeks thanks largely to the recent drop-off in global commodity prices.

"Commodity prices are down," says Marion. "In light of the recent drop in commodity prices, we expect the USD/CAD to remain in the 1.33 to 1.38 range over the next few quarters."

The below chart shows that Canada's key commodity exports have fallen in value on global markets of late, denting foreign exchange earnings and explaining CAD's relative underperformance over the past year.

Over a one-year timeframe, CAD is down 6.40% against the Euro, 4.90% against the Pound and 2.80% against the Dollar. In fact, the currency has only recorded advances against the Yen and Krone.

But analysts at NBC say Canada's fundamentals remain supportive of the Candian Dollar, which is forecast to appreciate during the second half of the year.

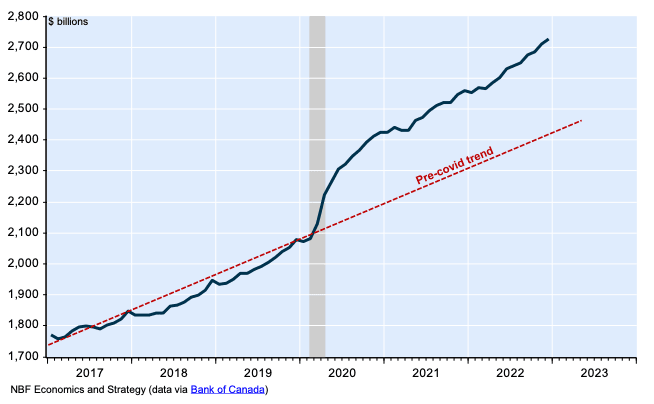

A key source of support for the economy and currency will be heavy levels of immigration which are underpinning demand, the labour market and bank deposits. Bank deposits are of particular interest given the recent SVB bank failure and subsequent crisis in regional U.S. banks which have hurt the Dollar.

"Deposits at Canadian chartered banks continue to trend up... this dynamic reflects a regulatory environment for Canadian chartered banks that is much tighter than in the U.S. and less conducive to the erosion of deposits to money market funds," says Marion.

"Canada's population growth continues to support banks' deposits," he adds.

Canada's most recent labour market report for April meanwhile revealed 41K jobs were created, confirming strong economic fundamentals.

NBC says the labour market is supported by another significant increase in the working-age population, which has already grown by a record 276K in just four months.

"This surge, driven by strong immigration and an influx of temporary residents, is boosting aggregate demand and household formation," says Marion.

The Governor of the Bank of Canada, Tiff Macklem, recently stated that further progress on disinflation will be required before he can consider a change in monetary policy.

Although the Bank of Canada has paused its rate hiking cycle, incoming data suggest it could be too soon to consider cutting interest rates.

With most global central banks nearing the end of the tightening cycle the prospect of rate cuts will be of increasing concern to currency markets.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Those that cut the fastest and furthest are likely to see their currencies depreciate. The CAD can therefore be supported if the Bank of Canada doesn't cut, or at least cuts less than its peers.

Given the above, NBC forecasts further Candian Dollar weakness in the near term, but strength in the second half of the year should be anticipated as Canada's strong fundamentals shine.

The bank forecasts the Pound to Canadian Dollar exchange rate (GBPCAD) to end the second quarter at 1.71, up from the current 1.6872.

But the pair will fall to 1.67 by the end of the third quarter and 1.65 by the end of the final quarter.

For the Dollar-Canadian Dollar exchange rate (USD/CAD), NBC pencils in an end-Q2 rate of 1.38, up from the present 1.3390. By the end of the third quarter, the pair is expected back down to 1.35 and then 1.32 by year-end.

The Euro to Canadian Dollar exchange rate (EUR/CAD) is forecast to trade at 1.50 by the end of the second quarter, up from 1.4672 presently. But the pair then falls to 1.49 by the end of the third quarter and 1.47 by year-end.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes