Pound / Canadian Dollar Charts Warning of Slide Below 1.69

- Written by: James Skinner

- GBP slide & CAD rally weighs on GBP/CAD

- Double top on charts warns of further loss

- Slippage to 1.6880 likely, Scotiabank says

- TD Securities eyeing 1.68 on BoC repricing

- December CPI may elicit January rate rise

Image © Adobe Stock

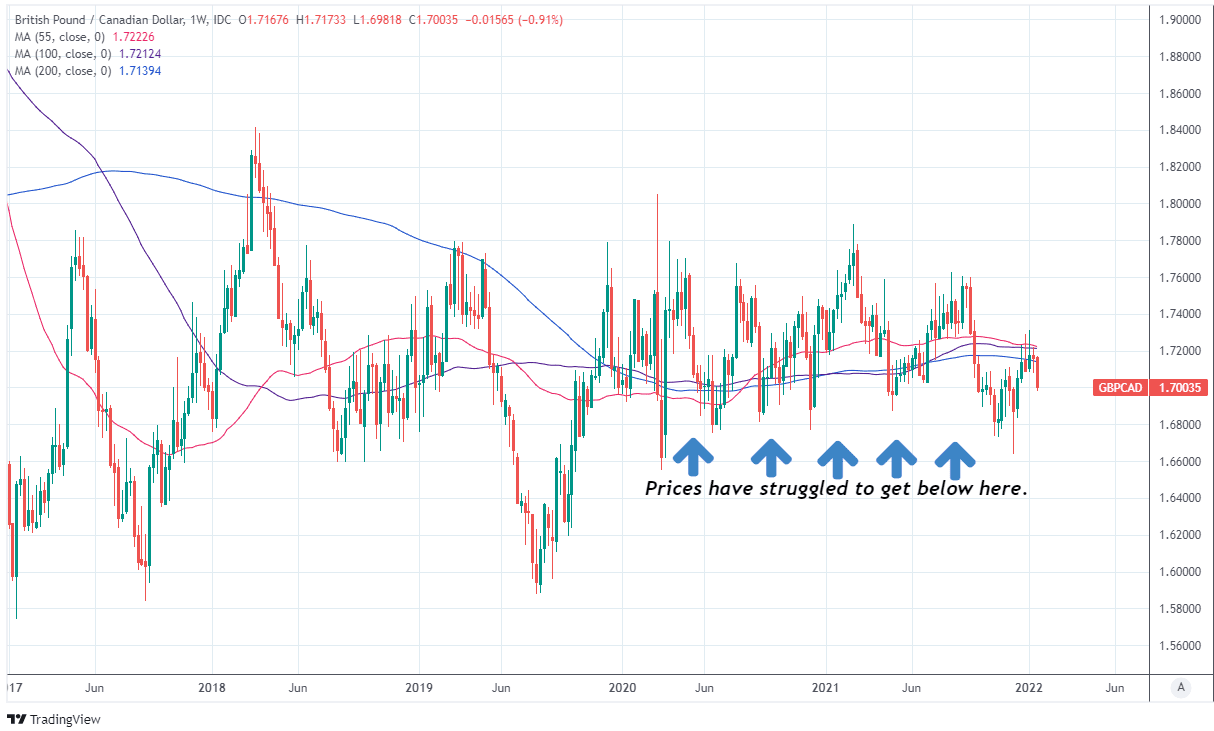

The Pound to Canadian Dollar exchange rate fell beneath an important level of technical support ahead of the midweek session, which has triggered a double top formation on the charts that could see Sterling’s slide take it beneath 1.69 over the coming weeks, according to Scotiabank.

Sterling ceded ground to around half of its G10 counterparts during the opening half of the week including a Canadian Dollar that topped the major currency rankings after an important Bank of Canada (BoC) raised the market perceived probability of an interest rate rise this month.

GBP/CAD was the biggest faller in the Sterling exchange rate complex as a result, with GBP/CAD falling beneath an important technical landmark at 1.7085 and leading to losses equal to around three quarters of a percent.

That fall beneath 1.7085 took place on Tuesday and was sustained overnight into Wednesday, leaving behind in its wake on the charts a confirmed double top formation that warns of further declines for Sterling in the days and weeks ahead.

“Today’s clear (so far) break of 1.7085 rather suggests more downside risk for the GBP in the next 1-2 weeks. Assuming a double top at 1.7290, losses could extend to 1.6880. We spot resistance initially now at the 1.7085 breakdown point,” says Juan Manuel Herrera, a strategist at Scotiabank.

Above: GBP/CAD shown at daily intervals.

- Reference rates at publication:

GBP to CAD spot: 1.7140 - High street bank rates (indicative): 1.6540 - 1.6660

- Payment specialist rates (indicative: 1.6986 - 1.7020

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

The double top formation is a reversal pattern that occurs when prices stall twice over in an uptrend and at roughly the same level, although the pattern is only confirmed when prices break beneath the lowest point in between the two stalling points or highs.

In this instance for GBP/CAD, the intervening low between the two relevant highs is the 1.7085 level that was lost in Tuesday’s trading session, and which had been watched closely by the Scotiabank team since Sterling topped out against the Loonie in the earliest days of January.

“Short-term prospects are bearish for the cross but we still think longer run signals imply a major low/reversal is in here around the late 2021 low. Near-term dips towards 1.67/1.68 may be attractive from a GBP long point of view,” Herrera said in a Tuesday review of GBP/CAD’s charts.

This week’s losses have fully reversed gains made by the Pound to Canadian Dollar rate since mid-December when the Bank of England (BoE) surprised the market by lifting its interest rate from 0.1% to 0.25%, and are a victory for the research team at TD Securities.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“The Q4 Business Outlook Survey released by the BOC this week was as hawkish as they come. It is clear that the BOC - among others - face pressure to act boldly to tame inflation - actual and expectations. With 67% of respondents now expecting inflation above the BOC's range over the next 2y, a move by the BOC next week now looks likely,” says Mazen Issa, a senior FX strategist at TD Securities.

“While this is not our base case, the CAD could be a leader in this regard. We have been long CAD vs. GBP (targeting 1.68) on the basis that the BOC could act this month and that GBP was overpriced (it still is). We maintain this position ahead of next week's meeting,” Issa and colleagues wrote in a research briefing on Tuesday.

Issa and TD colleagues were quick to recommend on January 10 that clients of the bank bet on a decline from 1.7190 to 1.68 by the Pound to Canadian Dollar rate, citing a strong December employment report that was seen as likely to raise the probability of a January rate rise from the BoC.

At the time financial markets gave little credence to the prospect of a BoC raising its cash rate to 0.50% on January 26, although since then the probability implied by pricing in the overnight-indexed-swap market has risen to around 40% after the implied cash rate rose to 0.35% this week when the BoC’s latest survey showed Canadian firms widely anticipating steep increases in wage bills and a protracted period of above-target inflation.

Above: GBP/CAD shown at weekly intervals.