Pound / Canadian Dollar Week Ahead Forecast: Recovery Brings 1.73+ into Contention

- Written by: James Skinner

- GBP/CAD recovery rally puts 1.73 in crosshairs

- With support seen at 1.7085, 1.7008 & 1.6938

- After CAD lags GBP et al in rebound of risky FX

- Amid virus restrictions & BoC policy uncertainty

- BoE’s rate lift-off aiding GBP/CAD in short-term

Image © Adobe Stock

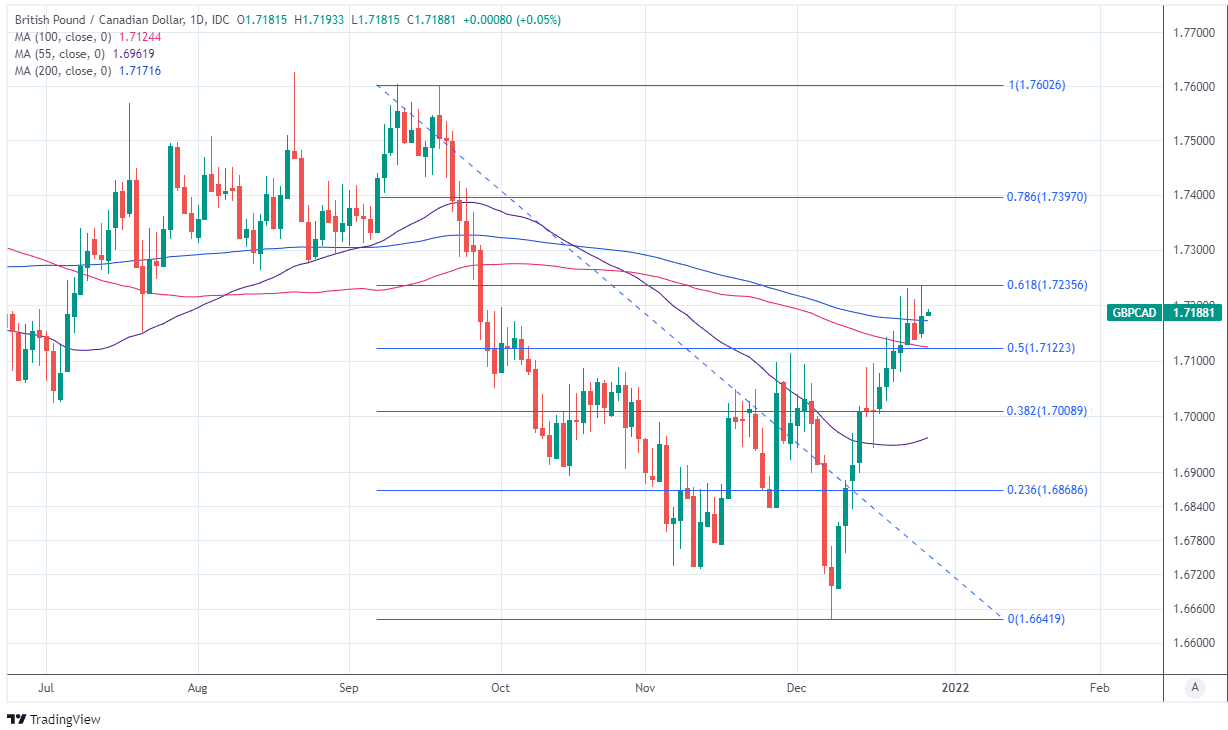

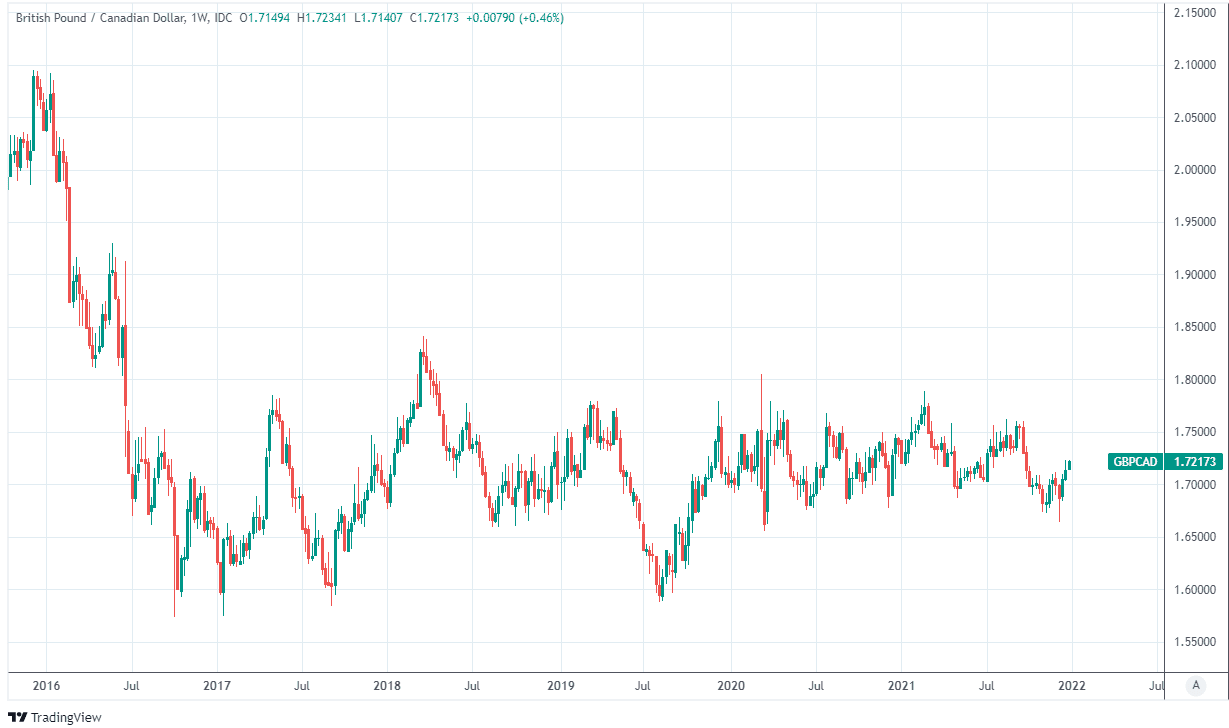

The Pound to Canadian Dollar exchange rate has reversed nearly two thirds of its final quarter decline in recent weeks but could have scope to attempt a recovery of the 1.73 handle if the Loonie continues to underperform other risky currencies like Sterling into year-end.

Sterling rose against most major currencies and in the process overcame a series of technical resistance barriers in its recovery against the Canadian Dollar during the week to Tuesday, which has opened a window of opportunity for an attempted return to levels not seen since late September.

GBP/CAD climbed more than 3.5% during December, lifting it back above 1.72 while clearing a path toward 1.73 upon entry into the final week of the year.

“Progress—on a sustained basis (i.e., a daily close at least)— would be a big plus for the GBP and suggest scope for the cross to push on towards the upper end of the broader range in place this year,” says Shaun Osborne, chief FX strategist at Scotiabank, in a research note last Monday.

“We look for a daily close above 1.7125 to trigger further GBP strength towards 1.7225/50 and, potentially, the 1.7375/00 zone in the next 1-2 weeks. Support is 1.7085/95,” Osborne and colleagues also said in advance of GBP/CAD’s rally.

Recent Pound-to-Canadian Dollar gains would be more limited if not for Sterling having caught a bid when several studies suggested ahead of the festive break that the Omicron variant of coronavirus could be a lesser threat to public health than previous strains.

Above: GBP/CAD at daily intervals with Fibonacci retracements of September decline indicating likely areas of technical resistance.

- Reference rates at publication:

GBP to CAD spot: 1.7209 - High street bank rates (indicative): 1.6608 - 1.6727

- Payment specialist rates (indicative: 1.7089 - 1.7123

- Find out about specialist rates, here

- Set up an exchange rate alert, here

Research carried out in England, Scotland, and South Africa found the risk of hospitalisation to be between 15% and 80% lower with omicron than the delta variant, meaning it could turn out to be a lesser headwind for some economies than earlier editions of the disease.

This encouraged investors to revive wagers suggesting the Bank of England (BoE) could be likely to lift Bank Rate four times and as far as 1.25% next year, lifting Sterling exchange rates in the process, although GBP/CAD’s December rally also owes itself to an underperformance of the Canadian Dollar.

The GBP/CAD rebound dates back to December 09 and a Bank of Canada policy decision in which it continued to suggest interest rates are unlikely to rise before the second quarter of next year, disappointing a part of the market that looked for the cash rate to rise to 0.5% in January.

“Our house view is for 4 BoC rate hikes and 3 Fed hikes in 2022, with the BoC going first in April. We expect USDCAD to drift slightly lower in H1 of 2022, but general USD strength should limit the loonie's gains, just like in H2 of 2021. With that in mind, we wouldn't look for USDCAD to move much below 1.25 in H1,” says Greg Anderson, global head of FX strategy at BMO Capital Markets.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Loonie has been in retreat for much of the time since December’s decision and ceded ground to all major currencies other than the Euro, Yen and Swedish Krona last week, a period in which some Canadian provinces reintroduced restrictions on business activities due to coronavirus infections.

New restrictions may be a part of why the Canadian Dollar has overlooked positive economic data in recent days to remain on its back foot against most currencies except the U.S. Dollar, which itself beat a retreat from all major rivals except the Japanese Yen last week.

“GDP is still running modestly ahead of the Bank of Canada's 4% forecast contained within the October MPR albeit probably not by enough to change the timing for the output gap closing and the first interest rate hike,” says Andrew Grantham, an economist at CIBC Capital Markets.

Official data suggested last Friday that Canada’s economy recovered faster this quarter than Bank of Canada policymakers anticipated in their latest forecasts, although not fast enough to mean the BoC would be likely to begin lifting its cash rate any faster than already guided for.

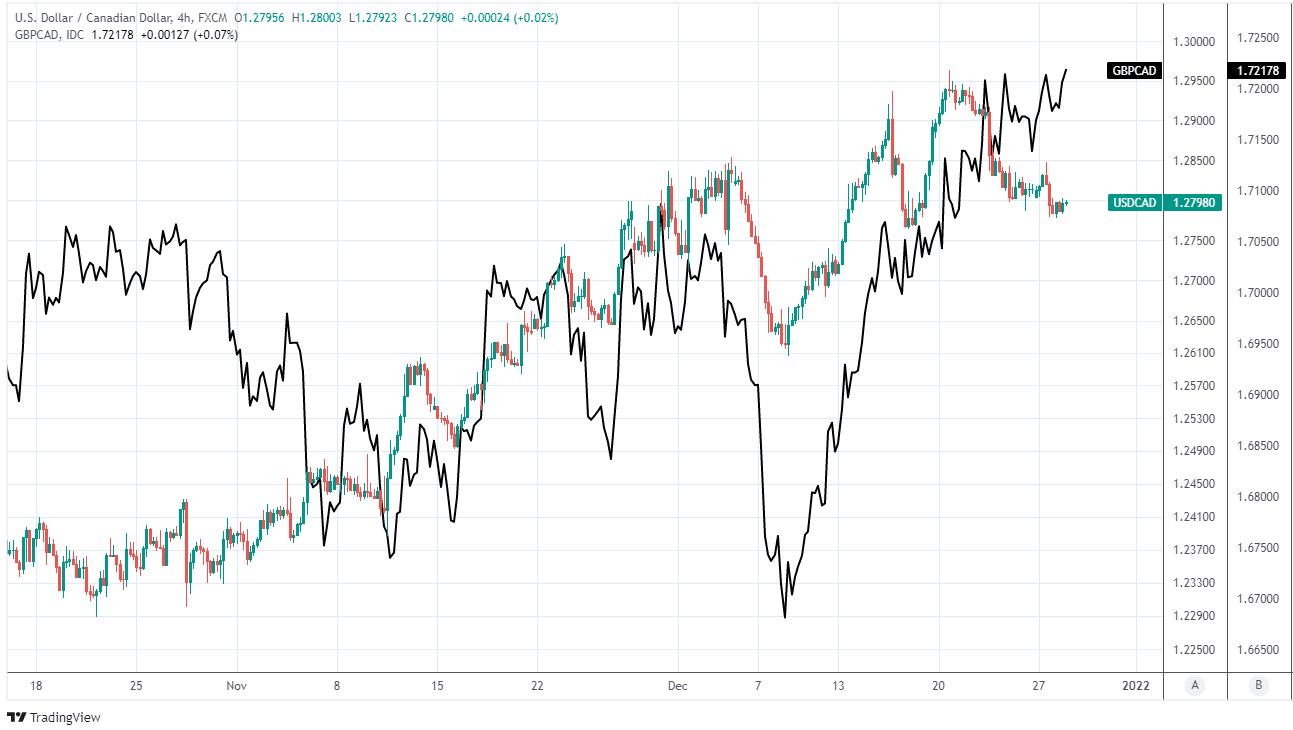

The trajectory of USD/CAD and momentum behind it are important influences on the Pound-to-Canadian Dollar rate and could be the difference between whether Sterling’s recovery takes it back above 1.73 over the coming weeks or ends with a capitulation back toward 1.70.

Above: USD/CAD shown at 4-hour intervals alongside GBP/CAD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“The CAD is ending 2021 more or less exactly where it started (1.2725). A resilient economy and the prospect of the BoC starting off its tightening moves early in 2022 suggest to us that the CAD can do well in the coming year,” says Shaun Osborne, chief FX strategist at Scotiabank.

“USDCAD softness through 1.2760 over the next few days should set spot up for a further dip into the very early part of January but a rebound from the mid-1.27s would risk a USD retest back to 1.28/1.29,” Osborne and colleagues said in a note on Friday.

With the influential Sterling exchange rate GBP/USD having recovered back above 1.34 in late December, GBP/CAD would be likely to trade tentatively above 1.73 if USD/CAD attempts to recover back to 1.29 for any reason over the coming days or in early January.

However, any further USD/CAD correction to the downside would at the least be likely to constrain the Pound-to-Canadian Dollar recovery, as GBP/CAD always closely reflects the relative performances of USD/CAD and GBP/USD.

There are no central bank policy events or major economic figures due in the week ahead, which leaves only the typically lower trading volumes of holiday market conditions to determine price action in the Pound-to-Canadian Dollar rate.

Above: GBp/CAD rate shown at weekly intervals.