Pound-Canadian Dollar Week Ahead Forecast: Short-lived Visit to March Highs Possible

- Written by: Gary Howes

- GBP/CAD support at 1.7140, may see 1.74+

- If USD trend, PMIs & BoE provide a lift to GBP

- But upside limited in duration by CAD outlook

- As BoC policy could see CAD recovery in July

Image © Adobe Images

- GBP/CAD reference rates at publication:

- Spot: 1.7240

- Bank transfer rates (indicative guide): 1.6640-1.6760

- Money transfer specialist rates (indicative): 1.7080-1.7123

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Canadian Dollar rate could have scope to edge higher and as far as three-month highs over the coming days, although gains for Sterling could be cut short before long by what remains a bullish outlook for Canada’s Loonie.

Sterling entered the new week trading above 1.72 against the Canadian Dollar and at what were its highest levels since early May following a five-day period in which a sharp rebound in U.S. exchange rates proved supportive of GBP/CAD.

But the Pound-to-Canadian Dollar rate could be seen trading back above 1.74 over the coming days if the U.S. Dollar remains on its front foot, UK economic data continues to point toward a recovery in progress and the Bank of England (BoE) remains on guard about risks to its inflation target.

The week ahead offers only limited new insight into Canada’s still-upbeat economic performance and prospects, which leaves the Pound-to-Canadian Dollar rate to take its cues from international factors ahead of Wednesday’s IHS Markit PMI surveys from the UK and Thursday’s monetary policy decision from the Bank of England (BoE).

“GBP has traded on a broadly stable footing against the EUR in recent weeks, suggesting that much of the variability we've seen in the pound remains more dollar-driven — this week in particular,” says Ned Rumpeltin, European head of FX strategy at TD Securities.

“On our dashboard sterling remains a well-populated trade alongside CAD and EUR. As such, we think the move lower could have a bit further to run, but buying interest could emerge with more confidence if we manage to push lower toward [GBP/USD] 1.38,” Rumpeltin says.

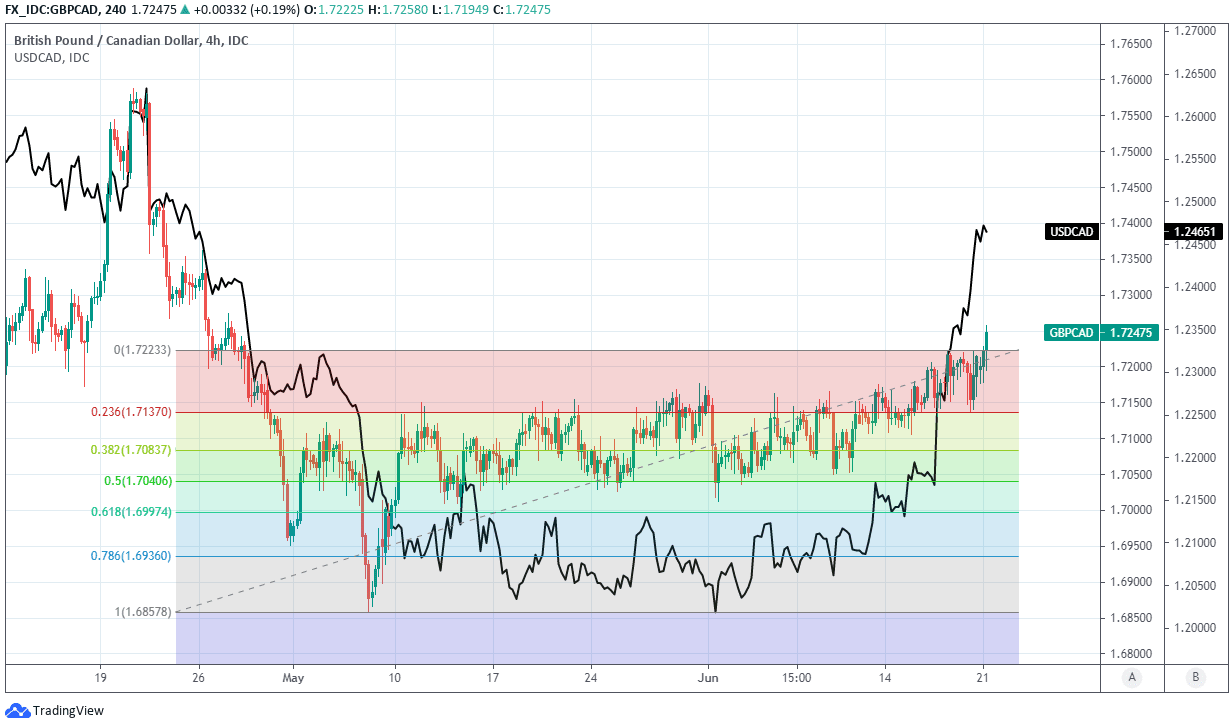

Above: GBP/CAD at four-hour intervals with Fibonacci retracements of May recovery and USD/CAD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Pound-to-Canadian Dollar rate is substantially influenced by the main Sterling exchange rate GBP/USD and USD/CAD, which were both edging higher on Monday in what is a typically supportive combination for GBP/CAD.

This was after GBP/USD lifted off from the above-referenced 1.38 area while lingering appetite for the U.S. Dollar in other parts kept USD/CAD elevated at its highest level since late April and the point when the Bank of Canada (BoC) announced the second reduction to what is now a -C$3 billion per week quantitative easing programme, a decision which preceded an extended rally by the Canadian Dollar.

“We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. Based on our latest projection, this is expected to happen sometime in the second half of 2022,” BoC Governor Tiff Macklem told the Standing Senate Committee on Banking, Trade and Commerce last week.

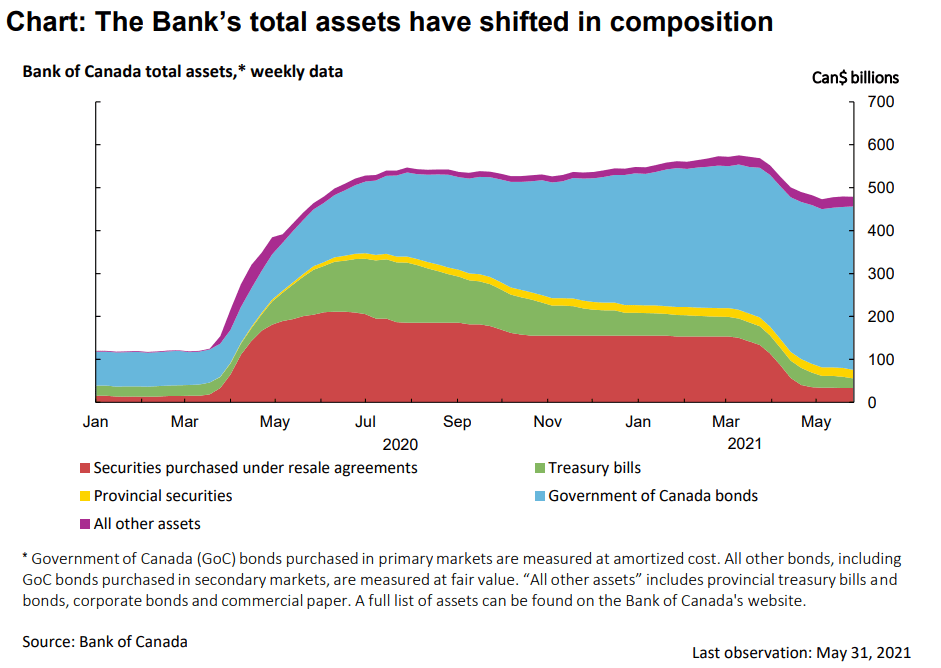

“The Bank currently holds more than $350 billion of Government of Canada bonds, representing about 45 percent of the outstanding stock of nominal bonds. Looking ahead, further adjustments to the pace of net purchases will be guided by our ongoing assessment of the strength and durability of the economic recovery,” Governor Macklem later added.

Above: Bank of Canada balance sheet showing total assets in decline as government of Canada bond holdings shrink.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

The BoC has begun to wind down what was on at least one measure the most aggressive quantitative easing programme in the world, and put the market on notice back in April that an increase of the record low 0.25% cash rate could come as soon as the second half of next year in what is potentially a supportive factor for the Loonie on an ongoing basis.

But Canada’s Dollar got little help from the BoC last week or on Monday and has instead been weighed down by an advancing U.S. Dollar, which rose against all of its counterparts last week including after the Federal Reserve indicated that its own interest rate is also likely to rise before long and as early as 2022 potentially: This could potentially support both the U.S. Dollar and GBP/CAD through the current week.

“The USD lifted sharply last week because market participants reassessed the timing of a FOMC tightening cycle. The ‘dot plot’ suggests the FOMC’s tolerance for an inflation overshoot may be less than we previously thought. We now expect the FOMC to start tapering its asset purchases in October compared to our previous estimate of December,” says Kim Mundy, a strategist at Commonwealth Bank of Australia.

“While the FOMC consider the acceleration in inflation is transitory, Chair Powell acknowledged the risk “that inflation could turn out to be higher and more persistent.” In our view, signs that the FOMC is growing less certain about the inflation outlook is important for the policy outlook, and can support the USD,” Mundy says.

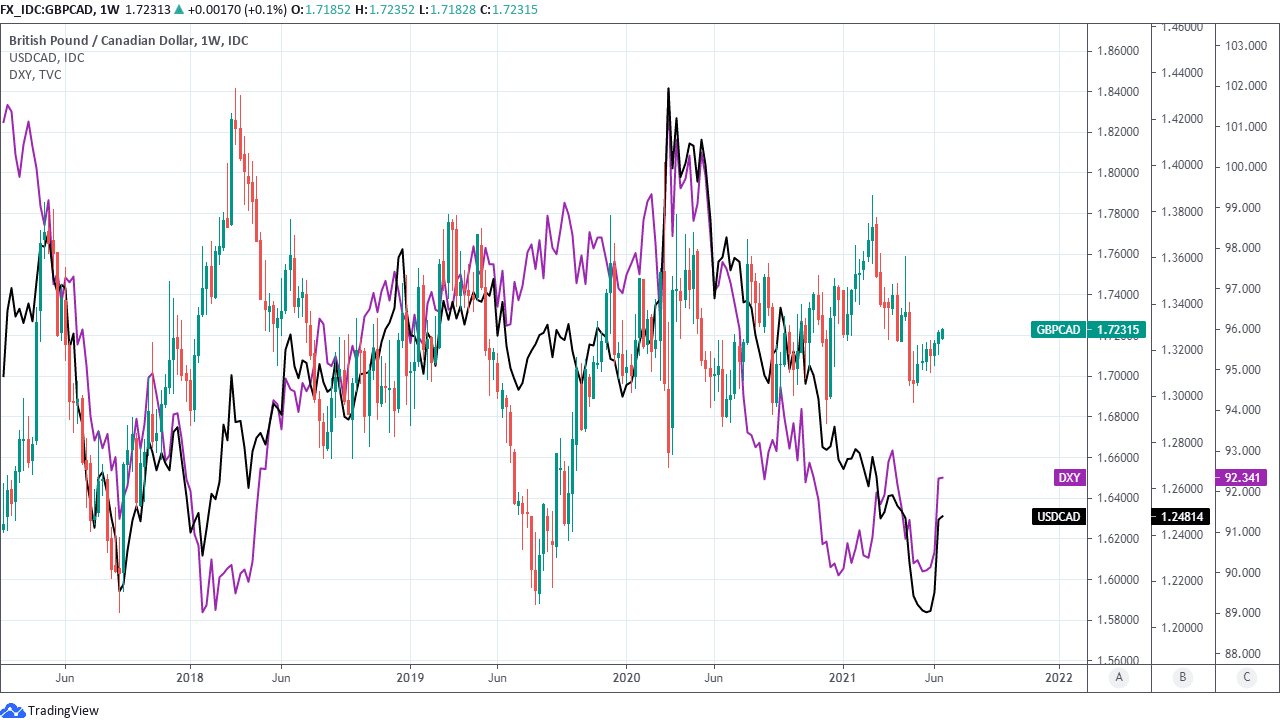

Above: Pound-to-Canadian Dollar rate shown at weekly intervals with USD/CAD and U.S. Dollar Index.

The UK and Canadian event calendars come alive only from Wednesday while before then Fed Chairman Jerome Powell will appear before a special committee in Congress where he will doubtless be pressed on the outlook for U.S. monetary policy, which will in turn provide him with an opportunity to clarify the bank’s position, thus potentially reinforcing or reversing the U.S. Dollar trend.

“We think that if the Fed does turn more hawkish in the medium term, the chances of the BoC following suit are strong. Arguably even, the CAD’s softening from the 1.20 perhaps gives the BoC the cover to further pursue its own tapering process at the July policy meeting,” says Shaun Osborne, chief FX strategist at Scotiabank.

“Realistically, however, we must assume that market momentum may take the USD a little higher (USD/CAD: 1.25) still before the rebound settles, especially with next week full of Fed speakers and little Canadian data,” Osborne says.

GBP/CAD tends to be positively correlated with USD/CAD so 19:00 London time on Tuesday is potentially an important moment for Sterling although thereafter Wednesday morning at 09:30 will see the latest IHS Markit PMI surveys covering the UK’s services and manufacturing sectors released in a turn of events that could underpin the Pound if they continue to indicate a robust recovery from another economic shutdown in the first quarter.

But the highlight of the week is Thursday’s 12:00 policy decision from the BoE: This could potentially lift GBP/CAD back above 1.74 if, as USD/CAD follows the path indicated by Scotiabank, the BoE’s continued awares of upside risks to its inflation target further foments the GBP/USD rebound that was in progress Monday.

Last week UK inflation figures for the month of May showed both the main consumer price index and the adjusted measure that overlooks energy prices each rising to or above the 2% target of the BoE, and what-if-anything the BoE’s policymakers read into this could be informative of the tone adopted by the bank and Governor Andrew Bailey in this week’s update as well as those in the months ahead.