Canadian Dollar Downgraded at TD Securities

Image © Mike Mozart, reproduced under CC licensing

TD Securities - the investment bank arm of Canadian lender TD Bank - have downgraded their forecasts on the Canadian Dollar.

"The strategic outlook for the CAD has shifted considerably to the downside," says Mazen Issa, Senior FX Strategist at TD Securities in New York, "this follows a deeper slowdown to growth in H2-2018 and a near-capitulation by the Bank of Canada."

Economists at TD Securities now think the Bank of Canada (BoC) has marked an end to its tightening cycle. The Bank has raised interest rates five times since 2017, setting the bench-mark lending rate at 1.75%, its highest in almost a decade.

Interest rates are important for the Canadian Dollar: currencies tend to strengthen at the start of an interest rate hiking cycle as investors tend to seek out better returns on their capital.

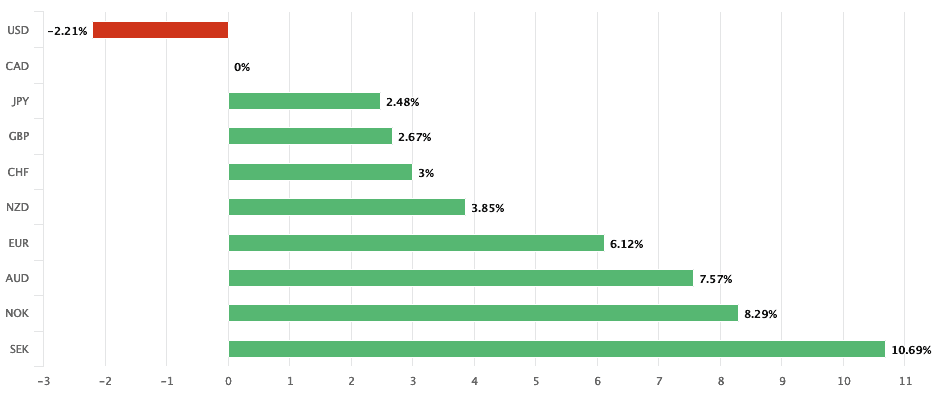

The rate-raising regime has seen the Canadian Dollar outperform the majority of its rivals over the past year.

Above: Canadian Dollar performance over the past year

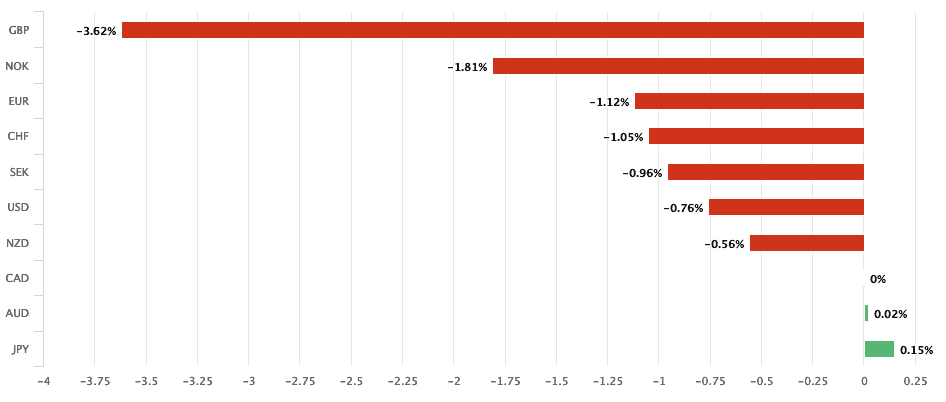

However, growing expectations of late for that regime to end is likely to weigh on the currency's outlook

Above: Canadian Dollar performanc eover the past month

"If policymakers move this year, it is more likely to be a cut," says Issa. "The global backdrop remains an important driver for the CAD. It is now clear, however, that the domestic economy has a real problem on its hands. These should sustain broad CAD weakness going forward."

Issa says the BoC can no longer ignore domestic demand has now contracted two quarters in a row, with the fourth quarter 2018 registering -1.5%.

The last time this happened was in 2015.

Then, the economy registered a technical recession and the Bank provided "insurance cuts" due to the collapse in oil prices. This has been compounded by the fact that there has been a lack of an investment pick-up in Canada - a key hallmark of past BoC optimism," says Issa.

Strategists at TD Securities are actually already engaged in bets against the Canadian Dollar, selling it against various G10 currencies.

With regards to the U.S.-Canadian Dollar exchange rate, "we have revised our forecast higher for USD/CAD. We see persistence around the 1.36 level this year," says Issa.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement