Australian Dollar Runs Rampant as RBA Rate Hike Fears Stoked By Inflation Beat

- Written by: Gary Howes

Image © Adobe Images

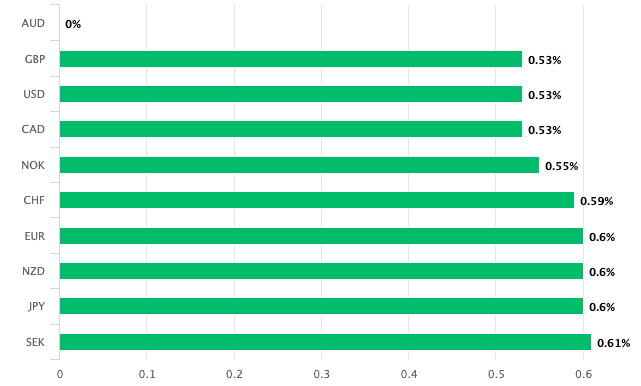

The Australian Dollar is off to the races today, making significant gains against all its G10 peers after Australian inflation beat expectations.

The Pound to Australian Dollar exchange rate dropped by more than half a per cent to 1.8968 after Australia's monthly CPI inflation release showed prices rose 4.0% year-on-year in May, up from 3.6% in April and 3.5% in March. The consensus estimate was for 3.8%.

"AUD/USD climbed by about 40pips towards 0.6680 after the Australian CPI indicator for May surpassed economists’ expectations," says Carol Kong, an analyst at Commonwealth Bank of Australia.

The monthly inflation release is only a partial snapshot of Australian price developments and is not as complete as the quarterly compilation, which the Reserve Bank of Australia (RBA) is more attuned to. But it does show the direction of travel for inflation, and these numbers will make policy makers uncomfortable.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The most significant price rises were in housing, food and non-alcoholic beverages, transport, and alcohol and tobacco. A measure of inflation that excludes volatile items and holiday travel remained sticky at 4%.

The clincher for market opinion was the trimmed mean measure of inflation, which surged to a six-month high of 4.4% vs. 4.1% in April. This is a particularly relevant measure for the RBA. As a result, financial markets are now pricing about a 40% chance of a rate hike at the RBA’s next meeting in August, up from about 20% prior to the CPI release.

Following the inflation figures, Australian bond yields jumped, a signal that the odds of an interest rate increase had risen. Rising yields, meanwhile, help stir demand for the Australian Dollar as global investors seek out high-yielding assets.

"Expectations of a near-term RBA rate hike will likely keep AUD supported," says Kong.

The RBA will be the final major G10 central bank to cut interest rates in the current cycle (excluding the Bank of Japan), and analysts at Citi say this is one reason they are positioned for further strength in the Australian Dollar.

"With the RBA expected to be the last to ease financial conditions among its peers, AUD's resilience continues show with a solid floor above the 0.65 level versus USD, targeting the 0.68-0.69 area in the pair," says a note from Citi.

Last week, the RBA kept interest rates unchanged but expressed concern that "inflation remains above target and is proving persistent."

Speaking to the press last week, Governor Michelle Bullock said the government's new tax cuts could boost consumption growth in the coming months. This would work against the RBA's efforts to reduce demand, which would help bring inflation down.

Bullock also said the RBA board did not discuss cutting interest rates but did discuss raising them amidst strong consumption. The odds that the RBA will give further consideration to a rate hike have risen after these inflation numbers.

The second-quarter CPI inflation report is due at the end of July and will be a key data point shaping the RBA’s August 6 policy decision.

"Overall, the bar for an RBA rate hike is low as the Board has already been discussing the option of raising rates further in recent meetings," says