GBP/AUD Rate Week Ahead Forecast: Key Resistance Stymies the Comeback

- Written by: Gary Howes

Image © Adobe Images

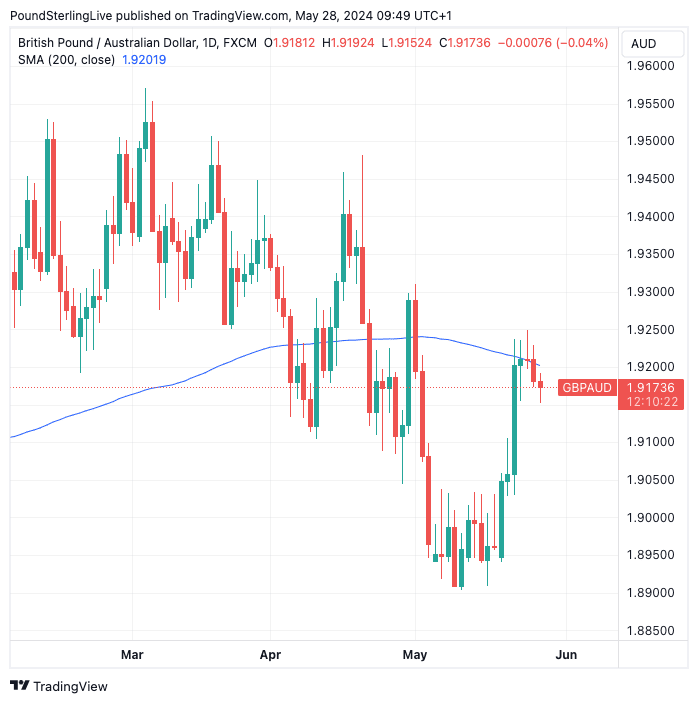

The recovery in the Pound to Australian Dollar exchange rate appears to have stalled at the 200-day moving average (DMA) and raises the potential for a resumption of selling pressures in the coming days.

Last week's 1.30% gain took the pair to a new one-month high at 1.9250, but this is where the rally topped out, with the exchange rate retreating to just below the 200 DMA, which is currently located at 1.9201.

Above: GBP/AUD at daily intervals showing the 200 DMA. Track GBP/AUD with your own custom rate alerts. Set Up Here

The above chart shows the 200 DMA to be an important area of resistance. Despite a number of attempted breaches, the pair has failed to close above the line on a daily basis. We would want to see daily closes above here to suggest the tide has turned on the recent multi-week period of weakness.

Given this, we view last week's rally as a correction in a broader downturn, and we can expect further losses in the coming days back towards 1.91 and then 1.9050.

Only a clear break above the 200 DMA involving daily closes above the line would invalidate the soft tone and suggest the exchange rate is entering an uptrend.

The Australian Dollar was broadly firmer and rose against most peers in the early part of the week despite cautious market sentiment. Gains were sustained even after Australia's April retail sales came in weak, rising 0.1% m/m last month, below the 0.2% forecast.

The key highlight from Australia in the coming week is April's CPI inflation release due Wednesday, where annual inflation is expected to dip to 3.4% from 3.5% in March.

These figures will help inform expectations for the all-important second-quarter release, that will ultimately impact thinking at the Reserve Bank of Australia (RBA).

The RBA is not expected to cut interest rates until early 2025, which is supporting interest rates in Australia relative to regions where central banks are expected to cut sooner.

This has offered AUD support against the likes of EUR and GBP and can continue doing so until markets sense the timing of an RBA rate cut can be brought forward. Should this week's inflation print come in above expectations, the AUD would find itself supported as investors will gain confidence that the RBA will be the last G10 central bank to cut interest rates.