GBP/AUD Week Ahead Forecast: Bulls Frustrated by AUD Resilience

- Written by: Gary Howes

Image © Adobe Images

Although the Australian Dollar still looks vulnerable to a further deterioration in market sentiment, buoyant global commodity prices and a strong domestic jobs report should limit the downside in the coming weak.

The Australian Dollar was one of the biggest losers in the G10 currency family after markets last week slashed expectations for Federal Reserve interest rate cuts. Data released last week showed inflation is rising again amidst enduring U.S. economic resilience, which means U.S. interest rates will need to stay at current levels for many months yet.

The Pound to Australian Dollar exchange rate (GBP/AUD) recovered from its April lows as markets slashed the number of rate cuts expected from the Fed in 2024 to just one, with pricing showing this will most likely come in September.

The Australian Dollar is highly correlated to global growth and market sentiment, ensuring it sold off alongside stock markets and commodity prices. Should global markets come under further pressure this week we would expect GBP/AUD to move higher.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Yet, we note Aussie weakness has proven relatively contained and there have been no major technical deteriorations in the charts that speak of a rout. This is likely reflective of the ongoing rally in global commodity prices, particularly in iron ore, which is Australia's main foreign exchange earner.

GBP/AUD recovered to 1.9290 at one point last week but has since pared that advance to 1.9212 by the time of writing on Monday. The exchange rate is oscillating around the 200-day moving average at 1.9233, clearly indicating that it is struggling to establish a clear directional trend.

Near-term support is seen at 1.9194, which is the 38.2% Fibonacci retracement of the 2024 rally.

Above: GBP/AUD at daily intervals showing the 200 DMA and Fibonacci retracement levels of the 2024 rally. Track GBP/AUD with your own custom rate alerts. Set Up Here

We think the Australian dollar has weathered the significant rerating in Fed interest rate expectations relatively well, which speaks to a degree of resilience that could limit further GBP/AUD upside.

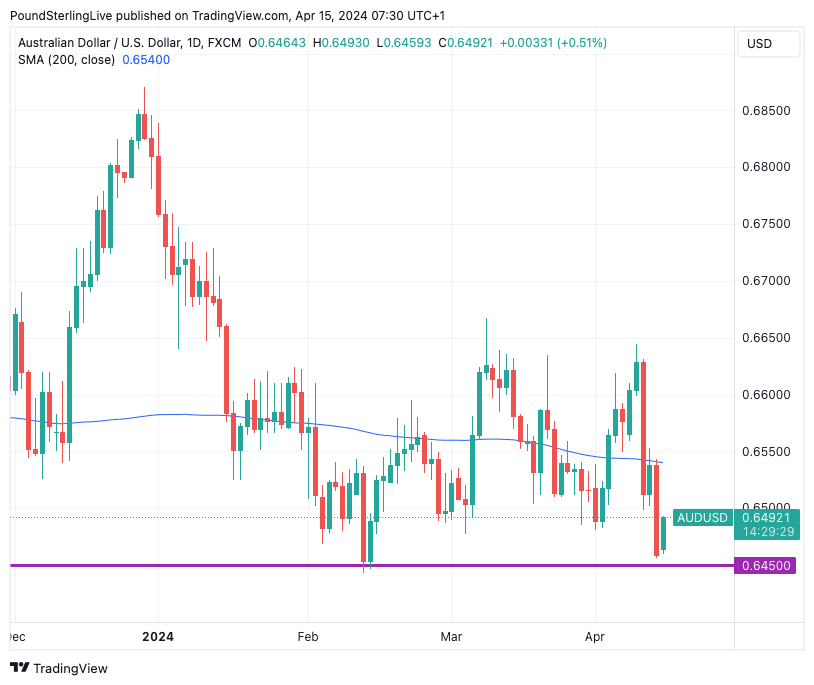

This resilience is also apparent in AUD/USD, where subsequent moves will be important for GBP/AUD as a breakdown here would lead to weakness across the Australian Dollar complex.

The AUD/USD support at 0.6480 is the line in the sand to watch, a break below here opens a rapid decline to the November 2023 lows at 0.6282. All else being equal, such a breakdown in AUD/USD could translate into a 2.5% gain for GBP/AUD, taking the pair up to approximately 1.9670.

Above: AUD/USD at daily intervals.

Currency market strategists at Commonwealth Bank of Australia say they expect AUD/USD to consolidate this week after last week’s fall, which speaks of further consolidation in GBP/AUD around the 200-day Moving Average at 1.9233 and above the Fibo support level at 1.9194.

"A further ramp up in geopolitical tensions poses a downside risk to AUD/USD. AUD/USD has support at 0.6419 (23.6% fibbo). Given our new FOMC rate cut profile, the risk lies towards a weaker AUD/USD than we currently forecast," says Carol Kong, a currency analyst at Commonwealth Bank of Australia.

Kong adds that AUD/USD may experience intraday volatility on Thursday if the Australian labour force data throws up another surprise.

The labour market data print is the week's highlight for the Aussie, with investors prepared for a 7.2K increase in jobs in March, as the market comes down from February's bumper 116.5K reading. It was February's job market strength that signalled that the Reserve Bank of Australia has a 'tight' labour market on its hands that would preclude it from cutting interest rates until year-end, something that has provided additional support to AUD in March and April.

We are also watching China's GDP figures for March and the first quarter, due for release on Tuesday morning. Any negative surprises here could undermine AUD owing to the strong trade linkages between Australia and China. (AUD is considered a financial proxy for investors seeking exposure to China, something that was on display late last week following the release of disappointing Chinese trade numbers).

The UK has a busy domestic calendar with inflation and wage figures on tap, which could heavily influence GBP/AUD. For a full breakdown of what to expect, please see our main Week Ahead report.