GBP/AUD Week Ahead Forecast: Action Stations

- Written by: Gary Howes

- GBP/AUD is in an uptrend

- But is struggling at a solid resistance line

- Bank of England is key risk for GBP

- Aussie inflation and retail sales in focus

Image © Adobe Images

The technical outlook for the Pound to Australian Dollar exchange rate remains constructive, but it will take a combination of a 'hawkish' Bank of England and soft Australian Dollar inflation numbers to deliver a break of a key resistance line this week.

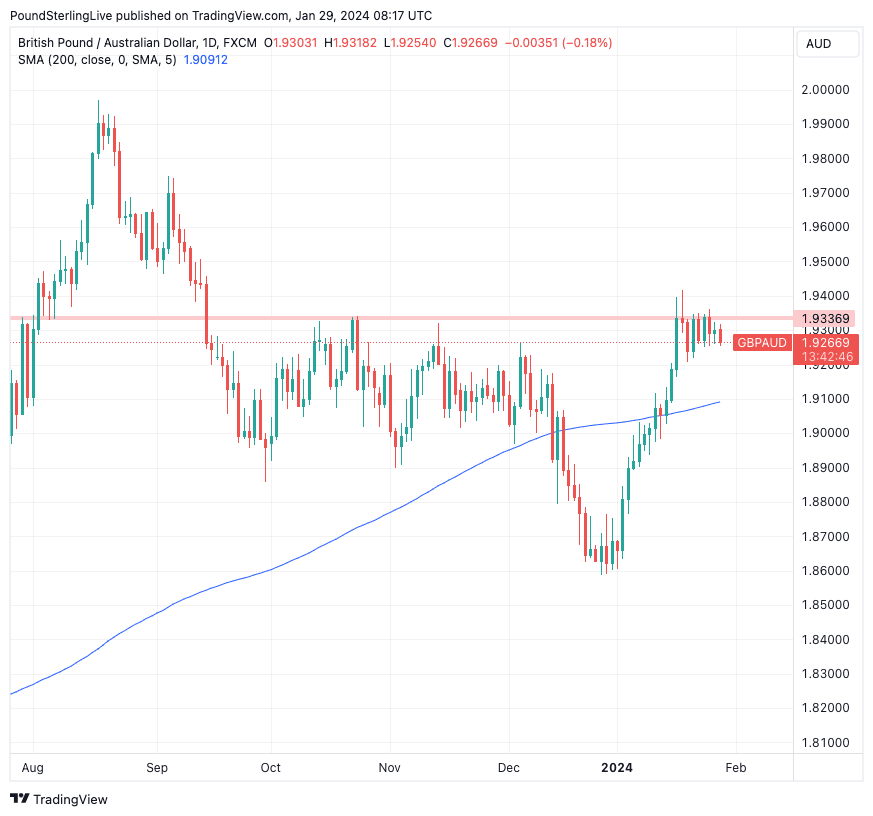

A look at the below chart reveals the 2024 uptrend has hit the firm level of resistance located in the 1.9340 region, which forms the upper end of a range that dominated 2023:

Above: GBP/AUD at daily intervals.

The pair is in an uptrend, as evidenced by it being above the 200-day moving average (blue line), but consolidation appears to be an immediate-term prospect.

Note that positive risk sentiment at the start of the new week has pressured the GBP/AUD lower, with the Aussie also finding support from firm commodity prices (oil and iron ore are up).

We would be wary that any extension of the commodity rally /risk-on sentiment could keep GBP/AUD capped at 1.9340, with a pullback towards 1.92200 being highly likely.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

But, this is a big week in terms of events and data for Pound-Aussie. Sean Callow, Senior Currency Strategist at Westpac, says the exchange rate is an "obvious focus" this week with the Bank of England's February policy update due Thursday.

"The Bank of England’s benchmark rate is 5.25%, well above the RBA's 4.30%. The fact that 3 members of the BoE’s policy-making committee voted for a rate rise at the December meeting makes it hard for markets to price in easing any time soon. A steady hand is very likely, maintaining the pound's attractive yields," he says.

Further GBP/AUD upside is possible should the Bank of England push back against current market expectations for over 100 basis points of cuts to be delivered in 2024.

Track GBP/AUD with your own custom rate alerts. Set Up Here

The domestic agenda in Australia is busy, with December retail sales figures coming out Tuesday at 00:30 GMT and the market anticipating a -0.9% reading month-on-month, down on November's solid 2.0%.

Should the numbers undershoot this expectation, as some economists expect, the Aussie could come under some near-term pressure.

"The domestic data flow shifts into high gear," says Stephen Wu, Economist at Commonwealth Bank of Australia. "The first cab off the rank is December retail trade. We expect a very large 4.0% contraction in the month."

Wu explains this undershoot reflects the change in consumer spending patterns because of Black Friday, something Commonwealth Bank sees in its proprietary Household Spending Insights (HSI) indicator.

But the big domestic event in the coming week is inflation figures for the final quarter of 2024, which will have a marked impact on Reserve Bank of Australia policy.

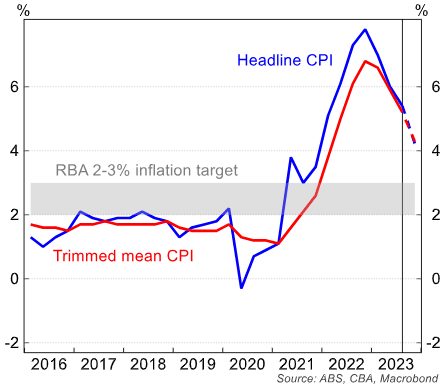

Above: Australian CPI inflation, year-on-year.

The market looks for a reading of 0.8% quarter-on-quarter, down from 1.2% previously, and 4.3% year-on-year, down from 5.4% in the third quarter.

The market already leans towards the RBA being one of the last major central banks to cut interest rates in 2024, offering the Aussie some yield support.

But an undershoot in the inflation data would prompt markets to price in a more aggressive rate cutting regime, potentially putting the Aussie under pressure.

"Our expectation is that we will see headline inflation moderated to 4.2%/yr and the underlying pulse, as measured by the trimmed mean, eased to 4.3%/yr," says Wu.

"We also expect services inflation moderated too. With the ongoing contraction in real household disposable income, further large price increases are difficult to sustain," he adds.

The Australian Dollar will also remain attentive to developments in China, where efforts are underway to boost the economy.

Last week's efforts by the authorities to support the stock market and the People's Bank of China's interest rate cut announcement proved supportive of the Aussie.

"The fact that Chinese authorities are showing urgency seemed to be enough to limit the downside on the Aussie," says Callow.

Any further unexpected moves could trump domestic developments.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes