Australian Dollar Week Ahead Forecast: Staying Bid

- Written by: Gary Howes

- GBPAUD could test 1.9285 in most bullish scenario

- AUDUSD rise can continue this week says CBA

- Monthly Aus inflation is this week's focus

- Chinese PMIs will also be important

Image © Adobe Images

The Australian Dollar should remain constructively poised against most of its peers in the near term and could be supported by this week's data from Australia and China.

The Australian Dollar is a beneficiary of improved global investor sentiment linked to slowing global inflation, which has boosted equity markets and pro-cyclical currencies like the Aussie.

"As inflation across G10 extended its drop in recent weeks, investors' expectations of a dovish central bank pivot have blossomed and led to an easing of global financial conditions that gave market risk sentiment a boost. In turn, this fuelled the outperformance of G10 risk correlated currencies vs safe-havens like the USD, JPY and CHF," says Valentin Marinov, Chief FX Strategist at Crédit Agricole.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The Pound has also been an outperformer thanks to these global conditions as well as some improved domestic data, leaving the Pound to Australian Dollar exchange rate towing a tight line that can be expected to hold.

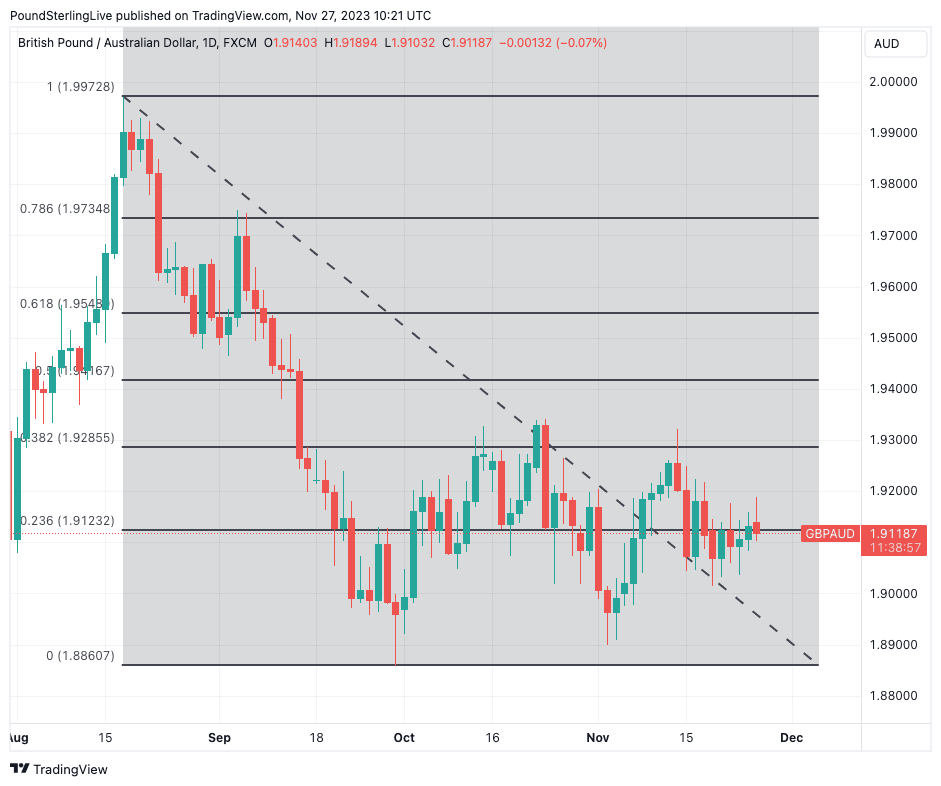

The chart below shows this line to be the 23.6% Fibonacci retracement move of the August-October drawdown; as can be seen, the line is proving to be something of a pivot for the exchange rate since September:

Above: GBPAUD at daily intervals. Track AUD with your own custom rate alerts. Set Up Here.

Any further gains over the coming days should be faded by traders towards 1.9285, which forms the 38.2% Fibonacci line, where resistance has thwarted gains since September.

This therefore forms our upside target for the pair in the short term.

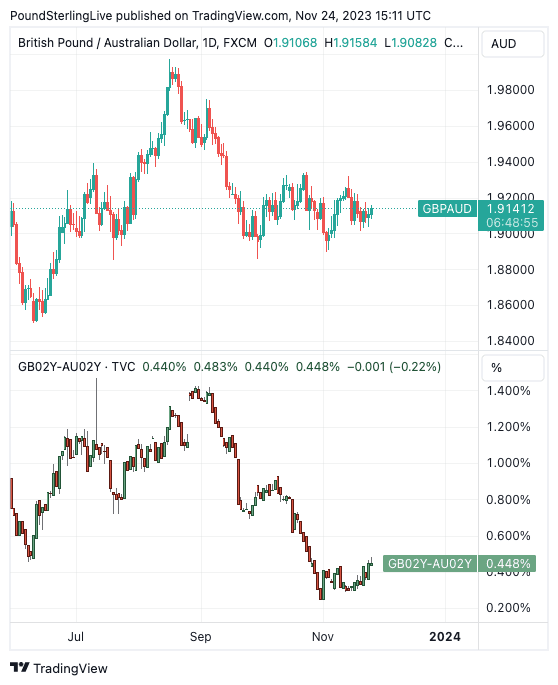

We are unlikely to see fireworks for GBPAUD over the coming days, given the relative outperformance of both Sterling and the Aussie, but looking further ahead, yield spreads appear to favour further downside, we are told.

"GBP/AUD has not followed the recent swing in yields in the Aussie’s favour, trading sideways since September, roughly 1.89-1.93. We see downside scope multi-week... a slip to 1.85-1.87 seems achievable into Q1 2024," says Shaun Callow, FX Strategist at Westpac.

Above: GBPAUD (top) and the UK vs. Aus two-year yield differential, which has fallen more than the exchange rate. Should GBPAUD be lower based on spread differentials?

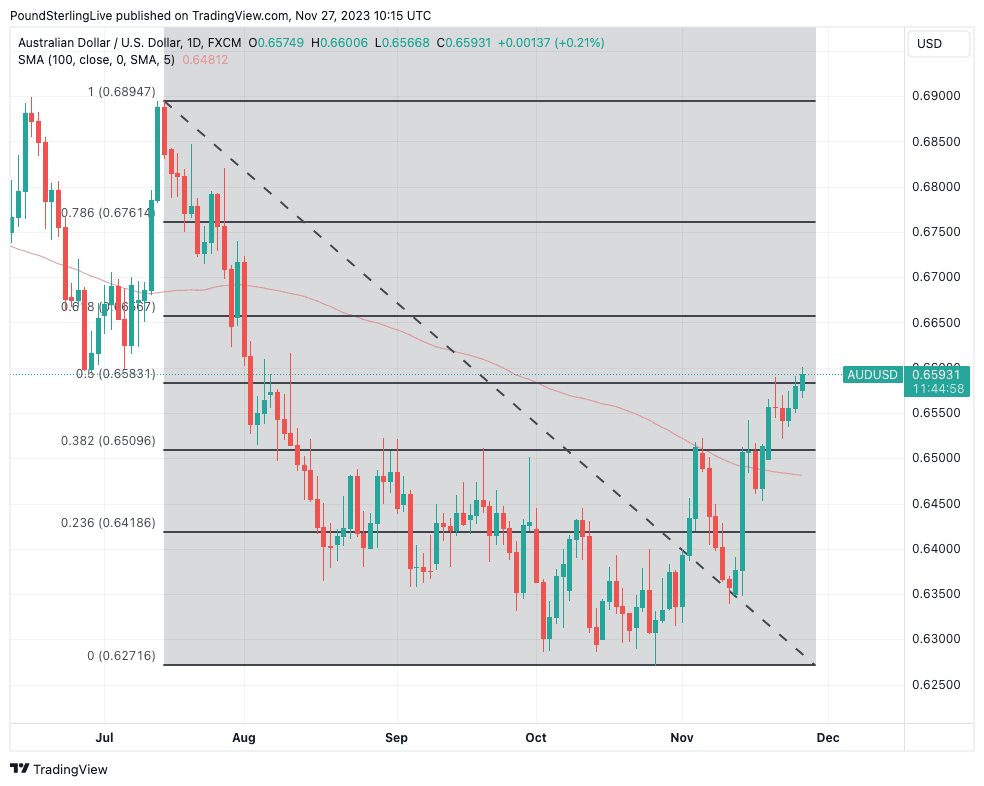

The Aussie Dollar maintains an upward bias against the U.S. Dollar, which strategists at Commonwealth Bank expect to extend.

"AUD/USD respected the 0.6600 resistance level last week. The weak USD will keep AUD/USD supported this week in our view," says Joseph Capurso, an economist at Commonwealth Bank of Australia (CBA).

CBA's strategists doubt AUD/USD will push above 0.6714 (50% fibbo) in the near term but an eventual unwind of speculators' shorts can also provide significant support to AUD/USD.

However, Capurso says an unwind of shorts is a medium-term rather than short-term risk.

Above: AUDUSD showing Fibonacci retracement zones, note the 50% fibbo referred to by Capurso.

The coming week sees the release of a raft of data concerning Australia's economy which will impact investors' expectations for the prospect of further rate hikes at the Reserve Bank of Australia (RBA).

Australian retail sales are out Tuesday at 00:30 GMT, with the market looking for a reading of 0.3% quarter-on-quarter for the third quarter.

Also on Tuesday, look out for another speech by RBA Governor Michelle Bullock.

Wednesday sees the release of October CPI inflation at 00:30 GMT, which is anticipated to read at 5.20%, down from the 5.60% recorded in September.

"The risk is a stronger CPI that pushes AUD/USD up through resistance and keeps it there this week," says CBA's Capurso.

Track AUD with your own custom rate alerts. Set Up Here.

Building approvals are to be watched on Thursday at 00:30, and a reading of 1.4% month-on-month is expected for October. Housing credit and other credit measures are also released on the day.

The rule of thumb is that the Australian Dollar will benefit if the data comes in above expectations, as it raises the prospect of another rate hike at the RBA in 2024.

"Australia’s monthly CPI release as well as retail sales and private-sector CAPEX data will impact market pricing for further RBA rate hikes. The first CPI monthly reading for Q3

includes mainly goods prices, which are experiencing slower inflation than services, which will weigh on inflation. Offsetting this, however, will be higher energy prices," says a currency note from Crédit Agricole.

Crédit Agricole says these data releases should bolster market pricing that has tilted in favour of another rate hike by the RBA.

However, analysts say the RBA will likely want to wait on the quarterly inflation data out in late January and the strength of Christmas sales before deciding whether to raise interest rates again.

It is also worth watching China this week, given the Australian dollar tends to act as a proxy for China.

Two PMI surveys are due, with the first being China's official PMI report on Thursday, where the market looks for a reading of 49.6.

"The composite index fell last month towards the key 50 level and continued to signal that the pace of growth in the economy has slowed significantly since the bounce earlier in the year after Covid restrictions were eased. Markets remain intently focused on the country’s struggling property sector, with recent reports that some developers may receive government financial support," says Hann-Ju Ho, Senior Economist at Lloyds Bank.

Another disappointment this month could weigh on the Australian Dollar.

The Caixin manufacturing PMI is due for release on Friday, and a reading of 49.3 is expected.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes