Australian Dollar In the Red Following RBA Decision

- Written by: Gary Howes

- Aussie interest rates unchanged

- Nov. rate hike not imminent either

- Suggests peak rates are truly here

- AUD loses value against all major peers

- Weak Chinese equities also act as a drag

Above: File image of Michelle Bullock. Image © RBA

The Australian Dollar has fallen against all its G10 currency peers amidst weak Chinese equity markets and following a decision by the Reserve Bank of Australia (RBA) to maintain interest rates and guidance which suggests it is in no hurry to hike again.

To be sure, it is hard to untangle whether it is the selloff in Asian and Hong Kong or the RBA's latest policy update that is behind the Aussie Dollar's underperformance, and a combination of both is the likely explanation.

The RBA has held the cash rate at 4.1% for the fourth month in a row, which was expected, but the guidance from the new RBA Governor Michele Bullock and her team suggests the bar to raising interest rates any further is elevated.

Australian inflation rose again in August according to the most recent monthly inflation report thanks largely to rising oil prices, but the RBA appears unfazed and opted to keep guidance largely unchanged, suggesting it sees the uptick as being temporary.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

If the RBA was to hike over the coming months it might have leant on this rise in inflation to alter guidance accordingly.

The central bank therefore remains reluctant to raise interest rates again; "there is nothing in this statement that suggests the RBA are close to pulling the trigger," says Damien McColough, an analyst at Westpac.

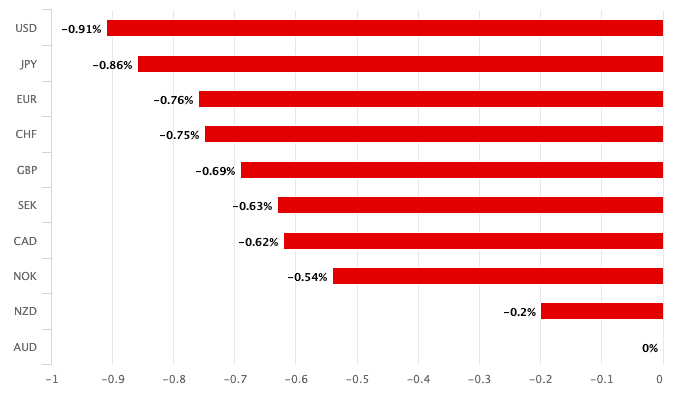

At the time of writing the Australian-U.S. Dollar exchange rate is 0.80% lower at 0.6313 and the Pound to Australian Dollar exchange rate 0.65% higher at 1.9115. The currency is meanwhile lower against all its G10 peers confirming an AUD-specific weakness:

Above: AUD performance on October 03.

The RBA said in a statement that, if anything, recent data are consistent with inflation returning to the 2-3% target range over the forecast period, with output and employment continuing to grow.

"We remain of the view that the hurdle to a further rate hike is high and that the most likely scenario is an unchanged cash rate well into 2024. We expect a gradual monetary policy easing cycle to get underway in May next year, progressively taking the cash rate down to a more neutral level," says Stephen Halmarick, Chief Economist at Commonwealth Bank of Australia.

The timing of the first interest rate cut will be a key theme for the Australian Dollar over the coming months. Currently, markets don't see a rate cut until at least the end of 2024, meaning if Commonwealth Bank is correct, then a readjustment lower in rate expectations must occur.

This would weigh on the Aussie.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Richard Franulovich, a Westpac strategist, says that downside risks for the Australian Dollar must be considered given the RBA maintained a status quo "some further tightening may be required" message.

To him, this suggests interest rate spreads might trend against the Australian Dollar. "We stick to our target of 0.6200 for the AUD/USD but revise our 0.6520 sell level from last week's Macro Trade FX Ideas down to 0.6500," says Franulovich.

However, economists at ANZ say another interest rate rise cannot yet be discounted as the RBA stated "some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe."

The third quarter inflation release - a more comprehensive set of data than the monthly series - will fall before the November policy decision and will likely be instrumental.

"While we still see the RBA on an extended pause, signs in the August monthly CPI that inflation might be running a little higher than expected are consistent with the risk that the RBA might tighten again this year or early next," says Adam Boyton, Head of Australian Economics at ANZ.

The RBA said in its statement that inflation in Australia has passed its peak but is still too high and will remain so for some time yet. Of particular interest to the RBA's board is inflation in the services sector: "the prices of many services are continuing to rise briskly," it noted.

"The Board’s concern about sticky services price inflation might be rising," says Boyton, although he concedes there is enough evidence elsewhere to suggest alarm bells are not yet ringing.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes