GBP/AUD Rate Week Ahead Forecast: GBPAUD Nears Key Support, Eyes on Jobs Data

- Written by: Gary Howes

- GBPAUD momentum continues to fade

- Meaning risks are to the downside short-term

- But 1.86 support remains significant

- Watch Aussie jobs report Thursday

- UK jobs are out Tuesday

- Federal Reserve provides major midweek test

Image © Adobe Stock

The Pound to Australian Dollar exchange rate (GBPAUD) remains under near-term pressure as a result of the setback experienced over the first fortnight of June and is trading at 1.8628 at the start of what promises to be another interesting week for the pair.

Jobs data out of both the UK and Australia will form the focus of the domestic data dockets while the Federal Reserve's midweek policy decision will offer a global context for GBPAUD performance.

The data and Fed decision comes as GBPAUD suffers a setback in June, having been in a strong uptrend for much of the year, stalling upward momentum and potentially inviting further declines over the coming days.

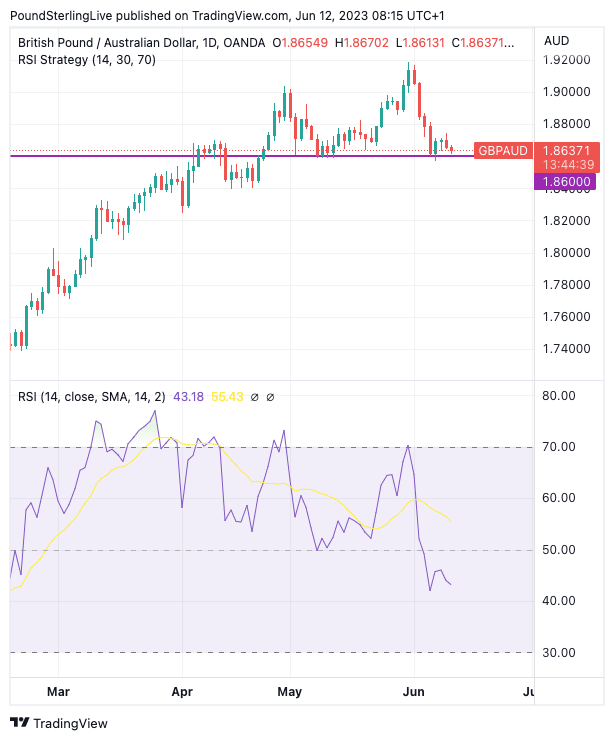

We note the Relative Strength Indicator (RSI) on the daily chart has now fallen below 50 and is thus advocating for further downside in the near term.

But a sizeable multi-week technical support level for GBPAUD is seen at 1.86, which is now close by, suggesting the pair can find some degree of support in the current area.

Above: GBPAUD at daily intervals with the RSI momentum indicator (lower panel).

The Australian Dollar could therefore well be set for another week of strength against Sterling, but much will depend on the outcome of Australia's jobs report, due on Thursday, and the tone of the U.S. Federal Reserve's midweek policy update.

Outperformance for the Australian Dollar - which was the second-best performing major currency last week - comes courtesy of the surprise Reserve Bank of Australia (RBA) interest rate hike and guidance that further hikes are possible. The decision to hike the cash rate to 4.1% has offered support to Australian bond yields, which is in turn boosting the currency.

"The RBA’s decision to raise rates and Governor Philip Lowe sounding hawkish and signalling more hikes to come gave the AUD a boost," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole. "Ultimately, the shape of the Australian economy will be demonstrated by the labour market data for May. The RBA cited a tight labour market and rising wages growth as key reasons for continuing to hike rates, so a softening in the labour market could begin building a case for the central bank to ease off rate hikes."

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

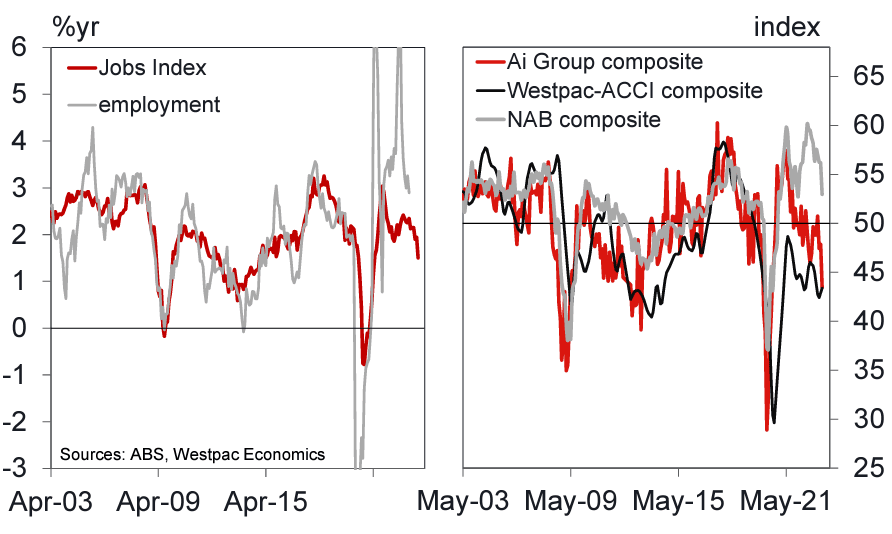

The market is looking for Australian employment to have risen 15.0K in May, marking a recovery on the -4.3K printed in April.

The unemployment rate is anticipated to have remained at 3.7% with the participation rate expected to come in at 66.7%.

Economists at Westpac are saying there is a chance the unemployment rate comes in below expectations which is a potentially bullish outcome for the Aussie Dollar, if correct.

"Critical to the near-term evolution for unemployment is the strength of labour demand. Indicators suggest it remains robust for now, but the outlook is uncertain. On the one hand, job vacancies and advertisements are at historically elevated levels, and hours worked are rising strongly. On the other, emerging evidence from other business surveys points to an unfolding softening in labour demand," says Westpac.

For May's report, Westpac's economists factor in a solid rise in participation back toward March's 66.8%, which would see the unemployment rate hold at 3.7%. But, given the aforementioned dynamics "we would view the risks for unemployment as being tilted slightly to the downside," says Westpac.

Above: Components of Australia's job index, image courtesy of Westpac.

Global investor sentiment is typically a strong driver of Australian Dollar value and this week's Federal Reserve policy decision could be key.

The Fed is expected to forgo another interest rate hike on Wednesday, but signal that a July hike is likely.

The overall tone of the guidance could be the single most important event for financial markets this week, with implications for the Australian Dollar.

If the Fed delivers a surprise rate hike U.S. yields could spike and equity and commodity markets could fall, bringing an end to Australian Dollar outperformance.

The Fed would however be expected to meet market expectations by forgoing a rate hike, but the tone about the prospect for future hikes could nevertheless still be considered 'hawkish'. If this were the case, the Aussie could come under pressure.

Turning to the GBP side of the GBPAUD exchange rate, two data releases this coming week provide the first real domestic test for the Pound for this month.

"The GBP remains one of the best-performing currencies in G10, mainly due to the superior quality of the incoming UK data as well as the build-up of BoE rate hike expectations," says Valentin Marinov, Head of FX Research at Crédit Agricole. "The latter continues to boost the rate appeal of the GBP across the board."

The UK is expected to have added 150K jobs during the three months to April, with the average earnings index (with bonus) expected to have increased at an inflation-boosting 6.1% in April.

UK GDP is meanwhile forecast to have risen 0.2% in the month of April, taking the year-on-year reading to 0.6%. A swath of industrial, manufacturing and trade data are also due for release on the day.

An undershoot in the data would potentially trigger a decline in the Pound, whereas a beat would keep the Pound elevated near current levels and hold GBPAUD above that 1.86 support line.

"Focus will be on the latest UK labour market data for May and the monthly GDP data for April. FX investors will want to see if the incoming data would give the GBP's flagging relative rate advantage another boost before buying the currency in the near term," says Marinov.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes