GBP/AUD Rate Week Ahead Forecast: Uptrend on Hold, RBA Minutes and Labour Market Data Offers Near-term Volatility

- Written by: Gary Howes

- Short-term GBP/AUD decline looks to be fading

- Medium-term trend remains constructive

- But patience required of AUD buyers

- RBA minutes due Tuesday

- Labour market stats out Weds and Thurs

Image © Adobe Images

The Australian Dollar will this week remain at risk of further weakness in global commodity prices, however, a busy domestic calendar will also provide some potential volatility in GBP/AUD.

Tuesday sees the Reserve Bank of Australia (RBA) release the minutes for its May meeting and investors will get a clearer sense as to whether the central bank will follow through with further rate hikes or if May's surprise hike was a one-off.

If the takeaway is further hikes are coming the Australian Dollar can find itself supported in the first half of the week. But, if the RBA signals it can afford to pause the cycle again, then the Aussie Dollar can come under pressure.

"RBA minutes this week will be important for the AUD," says Felix Ryan, analyst at ANZ.

Australian Dollars were bought widely at the start of the month after the RBA raised its cash rate from 3.6% to 3.85% in a May monetary policy decision that took economists and markets by surprise.

In particular, the RBA cited the persistence of domestic services inflation for the move, saying it was concerned inflation here was becoming more embedded.

Wednesday sees the release of Australia's wage price index, which should explain how domestic inflation is likely to progress.

Wages are a key determinant of inflation as rising wage rates can stimulate demand in the economy, which in turn pushes up prices.

Wages in Australia are expected to have increased 3.6% in the year to the end of the first quarter, an increase on Q4 2022's 3.3%.

Should the figure come in higher the RBA might sense that domestic inflationary conditions remain robust and therefore further interest rate hikes can be entertained.

This could prove supportive of the Aussie Dollar.

On Thursday the labour market is in focus again with the release of employment numbers. These are important from a domestic inflationary angle: strong employment begets higher wages, ultimately supporting inflation.

The employment change is expected to read at +25K for April, a slowdown on the previous month's increase of 53K.

An undershoot would potentially undermine the Aussie Dollar while an overshoot could prove supportive.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Commodities in Control

The Australian Dollar slipped half a per cent ahead of the weekend in a move that allowed pairs like GBP/AUD and EUR/AUD to regain some composure, having seen falls transpire through the course of May.

Some analysts we follow say the Australian Dollar's setback can be linked to a fall in commodity prices on the global stage, confirming non-Aussie factors are likely to be of great importance.

Chris Beauchamp, Chief Market Analyst at IG, says the broader Australian Dollar suffered a sharp reversal lower on Thursday amidst weakness in commodity prices.

He says this "seems to have negated any hope of a break higher for now" and suggests GBP/AUD downside pressures are easing.

Commodity prices have come under pressure as expectations build that the U.S. economy will suffer a slowdown over the year's second half. Meanwhile, China's economic rebound has been more tepid than analysts were expecting at the start of the year.

China matters greatly for the Australian Dollar as the world's second-largest economy is an engine of commodity demand.

"China's uneven recovery has weighed on sentiment in the base metals market. Copper fell to its lowest level in seven months after weak consumer inflation raised concerns of weak demand," says Felix Ryan, an analyst at ANZ.

"Weak Chinese inflation data added to the level of concern in metals markets," says Sean Callow, an analyst at Westpac.

GBPAUD Uptrend Still Alive, but Patience Required Near-term

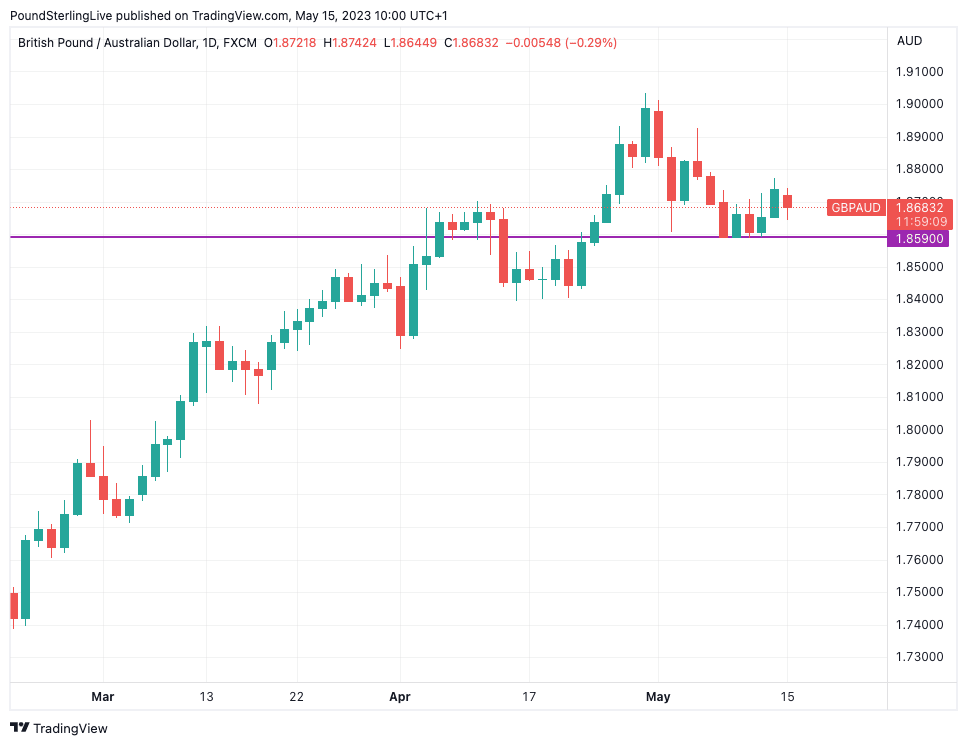

GBPAUD is up a per cent over the course of the past month and is up by a more substantive 5.0% in 2023 suggesting momentum remains in Sterling's camp.

The trend, therefore, favours further GBP/AUD upside, but near-term momentum has eased with the Pound shedding value to the Aussie in May.

From a short-term perspective (next few days), we are assessing whether the uptrend has indeed stalled and whether a period of consolidation can be entertained.

Above: GBPAUD at daily intervals.

If so, a retreat to support at 1.8590 could occur this week.

Over the medium-term (next few weeks) we are however looking for the uptrend to resume as there is little by way of technical indicators to suggest the rally is over yet.

As such, gains to 2023's high at 1.9053 are favoured, but a break to fresh highs could still require some patience.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes