GBPAUD Rebounds, But Upside Might be Limited for Now

- Written by: Gary Howes

Image © Adobe Images

The Pound to Australian Dollar exchange rate (GBPAUD) has bounced ahead of the weekend but a peaking of Bank of England rate hike expectations and a slowing economic data pulse could mean fresh 2023 highs are out of reach in the near term.

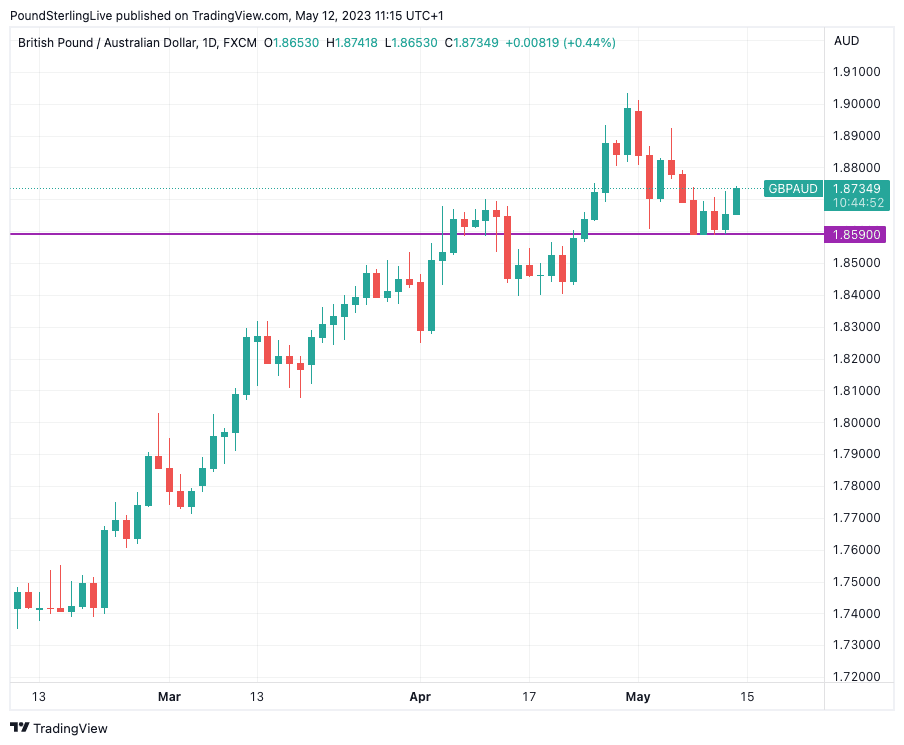

GBPAUD has generally trended lower in May having reached a new multi-month high at 1.9035 on April 28.

A half-per cent rally to 1.8738 on Friday builds on the previous day's 0.25% gain and suggests some of the recent near-term weakness might be easing with a support line now confirmed at 1.8590.

The rebound offers some relief for those looking to sell Sterling and buy Aussie Dollars.

Chris Beauchamp, Chief Market Analyst at IG, says the broader Australian Dollar suffered a sharp reversal lower on Thursday amidst weakness in commodity prices.

This, he says, "seems to have negated any hope of a break higher for now" and suggests GBP/AUD downside pressures are easing.

Above: GBP/AUD at daily intervals, showing support at 1.8590.

"Metals were slammed on soft US jobs data with copper down 3.4% to $8,188, zinc down 3% to 2,543, nickel down 2.9% to $21,780 and aluminium down 2.4% to $2,213. That’s a low back to December last year for copper," says Sean Callow, an analyst at Westpac.

Metals and commodities form the backbone of Australia's foreign earnings, therefore declines in the value of commodities can impact negatively on AUD.

"Weak Chinese inflation data added to the level of concern in metals markets," says Callow.

The Pound meanwhile advanced as investors bet the Bank of England will raise interest rates yet further, with a peak near 5.0% expected by the market following Thursday's Monetary Policy Report that was widely considered as 'hawkish'.

Money market pricing shows investors see a further 34 basis points of hikes from the Bank in 2023, this contrasts with a potential further 25bp hike expected from the RBNZ.

This suggests the peak in the UK's base rate could rest at 4.75%-5.0% but Australia's will be set lower at 4.10%.

The rate differential therefore sits in favour of the Pound and this has helped GBPAUD trend higher over recent months.

The exchange rate's 2023 gain now stands at 5.60% but the uptrend has taken a knock owing to May's 1.28% decline.

The retracement lower could suggest the uptrend is undergoing a period of consolidation, particularly given rate hike expectations in the UK are potentially peaking: it is hard to see the Bank of England deliver anything above 5.0%.

If the market's rate hike expectations retreat from here - for example to 4.75% - then Sterling could ease more broadly and GBP/AUD's rally will be negated.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The UK economic data impulse has been positive for much of 2023 with a string of economic surprises guiding the Pound higher. But, Friday's GDP reading for March disappointed at -0.3%, signalling that positive surprises might also start to fade.

Pound-Australian Dollar could therefore struggle to break through 2023's highs at 1.90 over the coming days with next week's UK labour market release a key risk.

A disappointing read here could put GBPAUD under pressure as the market pares back its Bank of England rate hike expectations.