Australian Dollar Dips after RBA Leaves Interest Rates Unchanged, Stays Cool on Prospect for Further Hikes

- Written by: Gary Howes

- RBA halts hiking cycle, AUD falls back

- Gov. Lowe says further hikes are possible

- But market not rushing to price in further hikes

- AUD support from rates channel looks limited

Above: File image of governor Lowe. Image © Crawford Forum, Reproduced Under CC Licensing.

The Australian Dollar was lower after the Reserve Bank of Australia (RBA) maintained unchanged interest rates but downside damage will likely be limited by a commitment to potentially raise interest rates again in the near future.

"AUD dipped lower on the RBA," says Elsa Lignos, Global Head of FX Strategy at RBC Capital Markets.

The RBA left the cash rate at 3.6% in a decision that was expected by markets, meaning the currency reaction was always likely to stem from the guidance pertaining to future hikes, or cuts.

"In its statement it still shows signs of a slight tightening bias but with a desire to wait a bit longer," says Lignos.

RBA Governor Lowe maintained a view further rate hikes might be coming in the key final paragraph of the statement, although the language was 'watered down' from previous statements:

"The Board expects that some further tightening of monetary policy may well be needed to ensure that inflation returns to target. The decision to hold interest rates steady this month provides the Board with more time to assess the state of the economy and the outlook, in an environment of considerable uncertainty."

The change in language in Tuesday's statement indicates the central bank is not entirely convinced it might have to raise rates again.

"The forward guidance was still softened via the insertion of the words “some” to further tightening and “may well” to tightening being needed," says Besa Deda, Chief Economist at St.George Bank.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

In the wake of the decision, the Pound to Australian Dollar exchange rate went a third of a per cent higher to 1.8365, suggesting the market is nervous about aggressively pricing too much by way of future hikes.

"Is the RBA done and dusted? Markets think so!" says Deda.

The Australian Dollar to U.S. Dollar exchange rate was higher by 0.40% at 0.6757. Against the New Zealand Dollar, the Australian unit was a third of a per cent lower at 1.0736.

"With the RBA meeting done, AUD/USD can fall further if the USD continues to unwind yesterday’s losses," says Joseph Capurso, a strategist at Commonwealth Bank of Australia.

However, one of Australia's major lenders reckons further hikes are incoming.

"While the RBA has taken the opportunity to pause, we see more rate hikes ahead," says Felicity Emmett, Senior Economist at ANZ Bank. If ANZ's view proves correct the market can price in further rate hikes, thereby limiting Aussie Dollar downside potential.

"We continue to think inflation will prove persistent enough to require the RBA to tighten monetary policy further in the months ahead. In our view, the question is not so much one of ‘where’ the RBA gets to (we still favour 4.1% as the terminal rate), but 'when' it gets there," says Emmett.

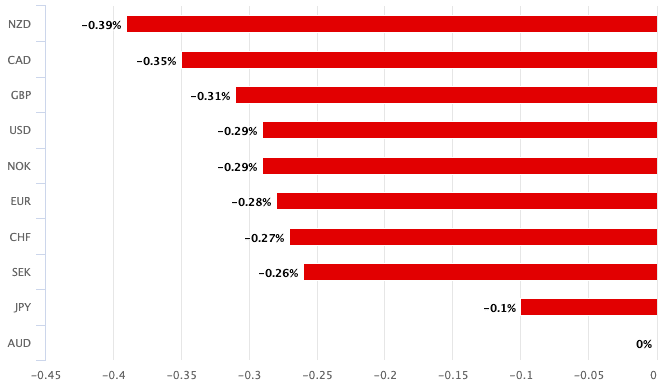

Above: AUD was down against all major peers on April 04.

The decision to pause the rate hiking cycle comes as Australian Dollar remains one of 2023's underperformers in the G10 FX space, with analysts pointing to the RBA's reluctance to aggressively pursue higher interest rates.

Political pressures on the RBA to stop hiking have become obvious, making this one of the least independent central banks in the developed world at present.

Politicians in Australia fear the hiking cycle has put excessive pressure on the housing market and the RBA will therefore be keen to avoid any accusations it has been too hasty in hiking interest rates.

This makes the RBA a central bank that will likely cut rates again at the first opportunity, suggesting the Aussie Dollar might not be able to depend on the interest rate channel for substantive support over 2023.

"Valuations remain attractive but a sustained appreciation in the AUD could be conditional on lower US yields and rally in Chinese securities," says Kenneth Broux, strategist with Société Générale.