Pound Extends Rally against Australian Dollar as RBA Signals Readiness to Slow Down on Rate Hikes

- Written by: Gary Howes

- GBP/AUD rallies to 1.7990

- As AUD retreats on 'dovish' RBA

- RBA indicates need to become more data dependent

- CBA says one more hike likely

- But ANZ sees two more

- Chinese import data also weighs on AUD

Above: File image of RBA Governor Lowe. Image © Crawford Forum, Reproduced Under CC Licensing.

The Australian Dollar was knocked lower following the Reserve Bank of Australia's (RBA) signal it was readying to end its interest rate hiking cycle, while data from China also came in weaker than expected.

The RBA raised interest rates by the expected 25 basis points but changed the wording in its statement to allow it the space to consider ending its hiking cycle.

"AUD is the worst performer overnight... on a dovish RBA" says Elsa Lignos, Global Head FX Strategy at RBC Capital Markets, adding the currency was not helped by weaker Chinese import data and simmering U.S.-China tensions.

In a statement delivered by Governor Philip Lowe, the RBA dropped a previous reference to "further interest rate increases" and replaced it with "further tightening".

Lignos says this change introduces more optionality, including the possibility of just one more hike.

"The accompanying statement was unequivocally dovish, especially the final paragraph," says Lignos.

The Pound to Australian Dollar exchange rate rallied over half a per cent to 1.7950.

"AUD/GBP dropped about 0.6% towards 0.5560 following the dovish RBA meeting. Our outlook for the RBA to soon pause its tightening cycle is one reason why we consider AUD/GBP will end the current quarter below our forecast of 0.59," says Carol Kong, currency strategist at Commonwealth Bank of Australia. (AUD/GBP at 0.59 = GBP/AUD ending the quarter above 1.70).

The Australian Dollar-U.S. Dollar exchange rate was a quarter of a per cent lower at 0.6714.

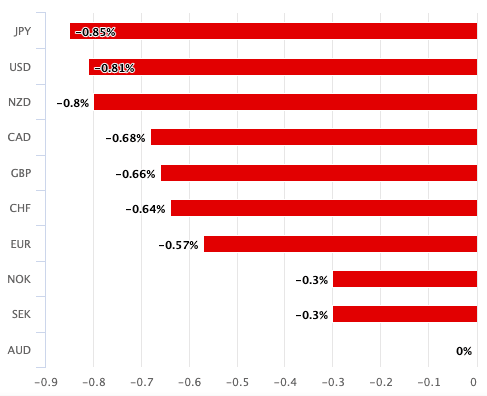

The Aussie is, in fact, lower against all its G10 peers across the one-day, one-week and one-month timeframes.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

CBA's Australian economics team maintain their call for one further 25bp hike in April to a peak in the cash rate of 3.85%.

"But the softening in forward guidance suggests a pause is possible in April," says Kong.

The March statement noted:

"The Board expects that further tightening of monetary policy will be needed to ensure inflation returns to target... In assessing when and how much further interest rates need to increase, the Board will be paying close attention to developments in the global economy, trends in household spending and the outlook for inflation and the labour market."

The same section in the February statement meanwhile read:

"The Board expects that further increases in interest rates will be needed over the months ahead... in assessing how much further interest rates need to increase."

The key difference is the shift from "how much" in February to whereas in "when and how much" in March, suggesting optionality and flexibility on timing have been introduced.

However, economists at ANZ see two more hikes in the cycle with a 25bp move coming in both April and May, taking the peak to 4.1%.

Above: AUD performance on March 07.

ANZ economist Felicity Emmett says the additional 50bp of tightening is because the RBA looks to be prioritising the inflation data in its deliberations and seems circumspect about the weakening labour market data.

She says the RBA pointed out services inflation remains elevated while also strengthening language around the costs of inflation becoming entrenched, citing the following paragraph in the statement:

"If high inflation were to become entrenched in people’s expectations, it would be very costly to reduce later, involving even higher interest rates and a larger rise in unemployment."

Bill Evans, Chief Economist at Westpac, agrees that it could be too soon to end the hiking cycle as early as April.

"By referring to tightening policy with issue about timing of further hikes the RBA is increasing its options – our view is that with the inflation outlook still too high it is too early to pause in April," says Evans.

China meanwhile reported a weak set of import figures (-10.2% year-on-year) which sent a warning to investors that China had a long road to travel before it fully recovered from Covid-19.

The decline came amidst lower import prices and subdued volumes.

This matters for countries that rely on Chinese demand, such as Australia.

For the Australian Dollar to strengthen again investors would likely need domestic economic data to pick up, in order to prompt the RBA into further rate hikes, as well as stronger data out of China to come through.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes