GBP/AUD Week Ahead Forecast: Losing Steam

- Written by: Gary Howes

- GBP/AUD at 1.78 and then 1.80 possible

- If data and Autumn Statement go GBP's way

- AUD buffeted by Chinese headlines

- Watch Tuesday's Chinese data dump

Image © Adobe Stock

The Pound to Australian Dollar exchange rate (GBP/NZD) is losing upside momentum and is at risk of testing last week's lows in a week fraught with intrigue for the Pound, The Aussie will meanwhile be subject to headlines out of China.

Pound Sterling is a key focus for foreign exchange markets this week amidst the release of key economic data as well as what promises to be a brutal Autumn Statement that will bring with it tax hikes and spending cuts.

The market's reaction to these domestic events could prompt a further weakening in GBP/AUD as investors reject Sterling in anticipation of a protracted period of economic decline.

GBP/AUD rallied through October as investors welcomed new Prime Minister Rishi Sunak and his commitment to sound finances.

But it is Sunak's promise to restore fiscal responsibility that could in fact hamper the UK's growth potential over coming years and gives investors reason to avoid the Pound.

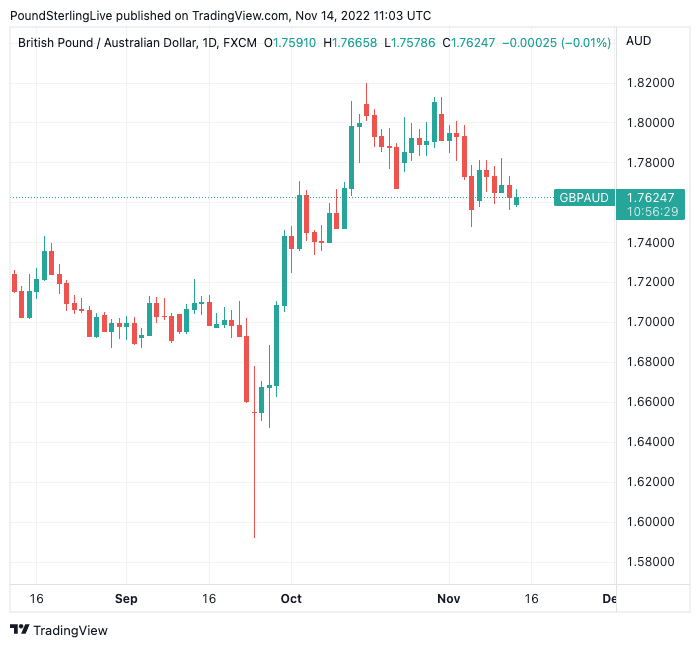

Above: GBP/AUD's October rally has faded and risks giving way to losses this November. To better time your payment requirements, consider setting a free FX rate alert here.

UK Chancellor Jeremy Hunt lays out the government's latest tax and spending plans on Thursday as he attempts to fill a 'black hole' in the country's finances, estimated to be around £55BN.

"Attention turns to the UK with the budget announcement on 17th November. We continue to expect GBP under-performance against most of the non-USD G10 currencies going forward," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG.

"Tightening fiscal policy into a recession to weigh on GBP," he adds.

The market's reaction could therefore be one consistent with further GBP/AUD downside and the November 04 low at 1.7479 could come into view, ahead of a more pronounced retracement of October's rally.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Ahead of Thursday's budget the market digests wage and employment data (Tuesday at 7:00 GMT), with the market consensus looking for the Average Earnings Index, with bonuses included, to rise 6.0% in September.

The unemployment rate is expected to remain unchanged at 3.5% but job losses of 155K are expected to be reported for the three months to September.

Should the data disappoint, then the Pound would be expected to fall and GBP/AUD would probe lower levels.

Wednesday's CPI inflation reading is however expected to be of greater importance for GBP/NZD, given it has a direct bearing on the future of Bank of England interest rate decision-making.

Headline CPI inflation is forecast to report at 10.6% year-on-year for October, up on September's 10.1%.

The core CPI reading is seen at 6.4%, well ahead of the Bank of England's 2.0% target and consistent with further interest rate rises.

It remains difficult to predict how the Pound would react to either a stronger-than-expected or weaker-than-expected reading.

The long-running assumption is that hotter inflation is good for a currency in that it prompts the market to raise bets for further central bank interest rates rises.

But the UK economy is suffering a significant hit under surging inflation, therefore a weaker reading could benefit the Pound as it implies less economic damage ahead.

Look for a test of 1.78 ahead of 1.80 over the coming days if the market gives a positive reaction to the week's data and fiscal event.

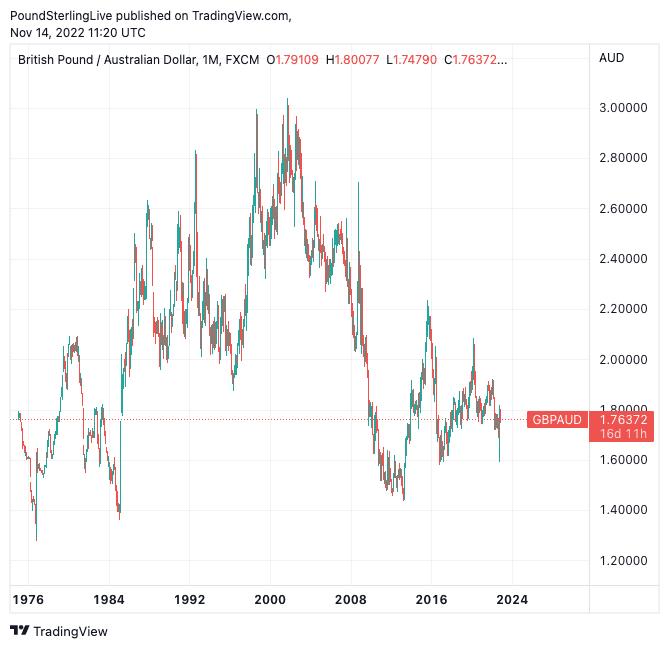

Above: GBP/AUD all-time, showing Sterling towards the lower end of historical levels.

Looking at the Australian Dollar side of the equation, the domestic calendar is relatively light, leaving markets reactive to events in China.

The Aussie Dollar surged in early November amidst rumours that China would be soon looking to exit its zero-Covid policy, which would promise a more pronounced economic recovery.

This would benefit Australia, given the significance of Chinese demand for Australian exports.

Recent news out of China has been mixed.

"Chinese regulators announced more support for the beleaguered property industry. However, over the weekend, Chinese health officials pushed back against the narrative they are loosening covid controls," says Joseph Capurso, an economist with Commonwealth Bank of Australia (CBA).

CBA expects Tuesday's 'data dump' to likely highlight the economic toll of the zero covid policy on China's economy. Economists estimate manufacturing and especially consumer spending was soft.

This could undermine the Aussie and allow GBP/AUD some upside traction, particularly if UK data comes in better than expected.

"The Chinese data dump also risks disappointment and weigh on AUD this week," says Capurso.

"Further economic disruptions may be in store given growing covid cases across a number of provinces in China. It is worth watch the government’s response to the outbreak in Guangzhou (a city in Guangdong province) which may provide clues to the government’s attitude to balancing health and economic concerns," he adds.