GBP/AUD Forecast: Could Test Top of Post-invasion Range Highs

- Written by: Gary Howes

- GBP/AUD has appreciated 1.86% over the past month

- Could test 1.79 says CBA

- As RBA hikes 50bp

- But global investor sentiment remains sour

Image © Adobe Images

The Australian Dollar is amongst the biggest losers amongst the major currencies of the past month and analysts say this week's Reserve Bank of Australia (RBA) policy update and a souring global investor sentiment should keep the unit under pressure against the Pound and U.S. Dollar.

Foreign exchange strategists at Commonwealth Bank of Australia hold a positive bias for the Pound against the Australian Dollar given they don't see Tuesday's RBA decision as offering lasting support to the Aussie.

The global economic slowdown is meanwhile expected to weigh on the Australian Dollar more than it does the Pound.

"The deteriorating global economic outlook is a weight on AUD/GBP. Support for AUD/GBP at 0.5586 is likely to prove soft while there is pessimism about the world economic outlook," says Joseph Capurso, Head of International Economics at Commonwealth Bank of Australia.

AUD/GBP support at 0.5586 gives a Pound to Australian Dollar exchange rate (GBP/AUD) resistance of 1.79.

The exchange rate is already up 1.80% over the course of the past month.

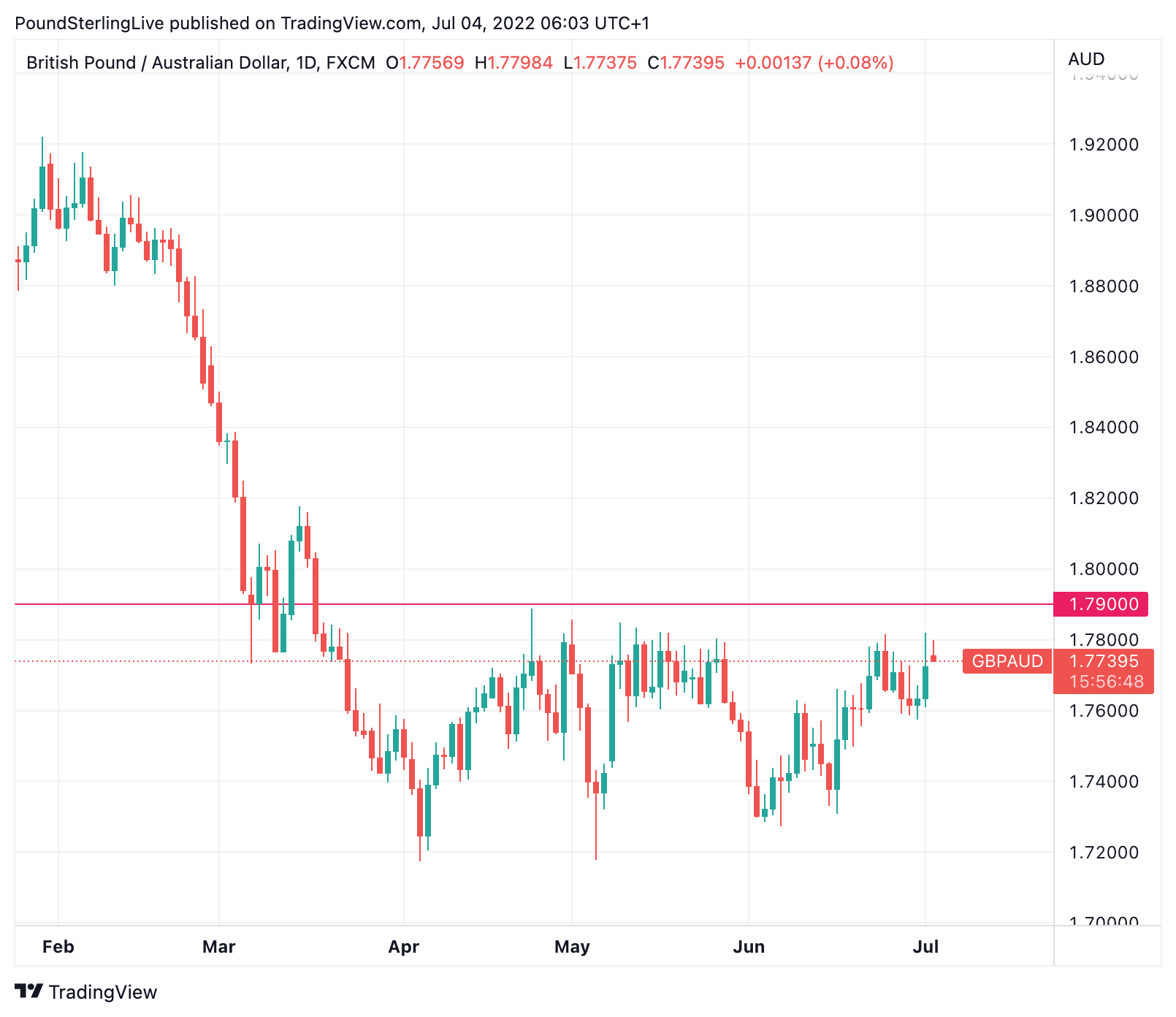

1.79 would represent the approximate location of the April 2022 high, a level that forms the top of a sideways range that has been in place since markets settled following the initial shockwaves of Russia's invasion of Ukraine:

Above: GBP/AUD at daily intervals.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

At the time of the invasion the Australian Dollar soared in value as commodity prices leapt amidst fears the war would cause global shortages.

Indeed, Australia is also a major substitute producer for any loss of output from Ukraine and Russia.

CBA's calculations therefore suggest any GBP/AUD strength will ultimately struggle with the resistance that top of the range provides.

"Tuesday’s RBA meeting is the main local event for AUD," says Capurso. "Governor Lowe suggested the Board will choose between raising the cash rate by 25bp or 50bp."

CBA's Australian economics team expect a 50bp increase to take the cash rate target to 1.35%.

"Financial markets have priced 40bp," adds Capurso.

He says there is therefore scope for a small lift in the Australian Dollar "if the RBA lifts the cash rate by 50bp as we expect".

Data shows AUD/USD increased intraday by 0.2% after the RBA increased the cash rate by more than expected in May 2022.

Nevertheless, CBA's weekly currency market briefing shows strategists at the bank don't expect the RBA to be a game changing event for the Australian Dollar which they say should remain under pressure.

"AUD/USD can fall further this week because of concerns about the world economy. There is downside support for AUD/USD at 0.6513," says Capurso.

"USD can lift this week because financial markets remain focused on the risk of a sharp slowdown in the global economy," he adds.

Global stock markets are largely now in a bear trend with investors tracking a sharp slowdown in U.S. economic activity.

"The slide in equities resumed last week, with the S&P 500 down 2.2% amid renewed concerns over central bank tightening and the impact of elevated inflation on consumer sentiment. The decline left the S&P 500 20.6% lower year-to-date to 30 June, the worst first half of the year since 1970," says Mark Haefele, Chief Investment Officer, UBS Global Wealth Management.

All the while the Federal Reserve continues to pursue a policy of higher interest rates, which raises the cost of global finance and ultimately raises expectations for a global economic slowdown.

This in turn weighs on pro-growth commodity currencies, such as the Australian Dollar.

"Our pessimistic view of the global economy underpins our forecasts for a stronger USD and further declines in commodity currencies over the next twelve months," says Capurso.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes