Pound-Australian Dollar Week Ahead: Underpinned Near 1.84 On BoE-RBA Divergence

- Written by: James Skinner

- GBP/AUD underpinned at 1.8380 as BoE-RBA stances diverge

- Any AUD/USD rebound may see GBP/AUD splutter near 1.95

- UK PMI’s in focus ahead of BoE in a quiet week for AUD data

Image © Adobe Stock

- GBP/AUD reference rates at publication:

- Spot: 1.8457

- Bank transfer rates (indicative guide): 1.7810-1.7940

- Money transfer specialist rates (indicative): 1.8290-1.8328

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Australian Dollar rate was trading close to one-year highs early in the new week and could benefit over the coming days from what has been a rising level of support, which now underpins the exchange rate a short distance below the 1.84 handle.

Pound Sterling was advanced broadly on Monday as it recovered from last week’s broad declines ahead of the latest IHS Markit PMI surveys due from the UK on Wednesday and the June monetary policy decision of the Bank of England (BoE), which are the highlights of the week for the British currency and could serve to reinforce a developing trend in GBP/AUD.

The Pound-to-Australian Dollar rate was higher by around half a percent owing after Sterling proved quicker and more eager to reclaim a portion of the ground ceded by all currencies to the U.S. Dollar last week after the Federal Reserve (Fed) acknowledged progress towards its inflation target and indicated a willingness to raise U.S. interest rates sooner than had previously been guided for if price pressures prove more resilient than anticipated.

That update and the current stance at the Reserve Bank of Australia (RBA) have led to a “contrasting messages from RBA Governor Lowe and FOMC chair Powell,” which is the foremost factor influencing AUD/USD and other Australian exchange rates at present, according to some analysts.

“The RBA expects to start a tightening cycle no earlier than 2024 based on current economic forecasts. By contrast, Chair Powell acknowledged the risk ‘that inflation could turn out to be higher and more persistent’. The dot plot reveals a majority of FOMC members expect to start a tightening cycle in 2023. A significant minority expect to start a tightening cycle in 2022,” says Joseph Capurso, a strategist at Commonwealth Bank of Australia.

“Market participants are taking the central bank chiefs at their word, helping to support gains in the USD and undercutting AUD,” Capurso says.

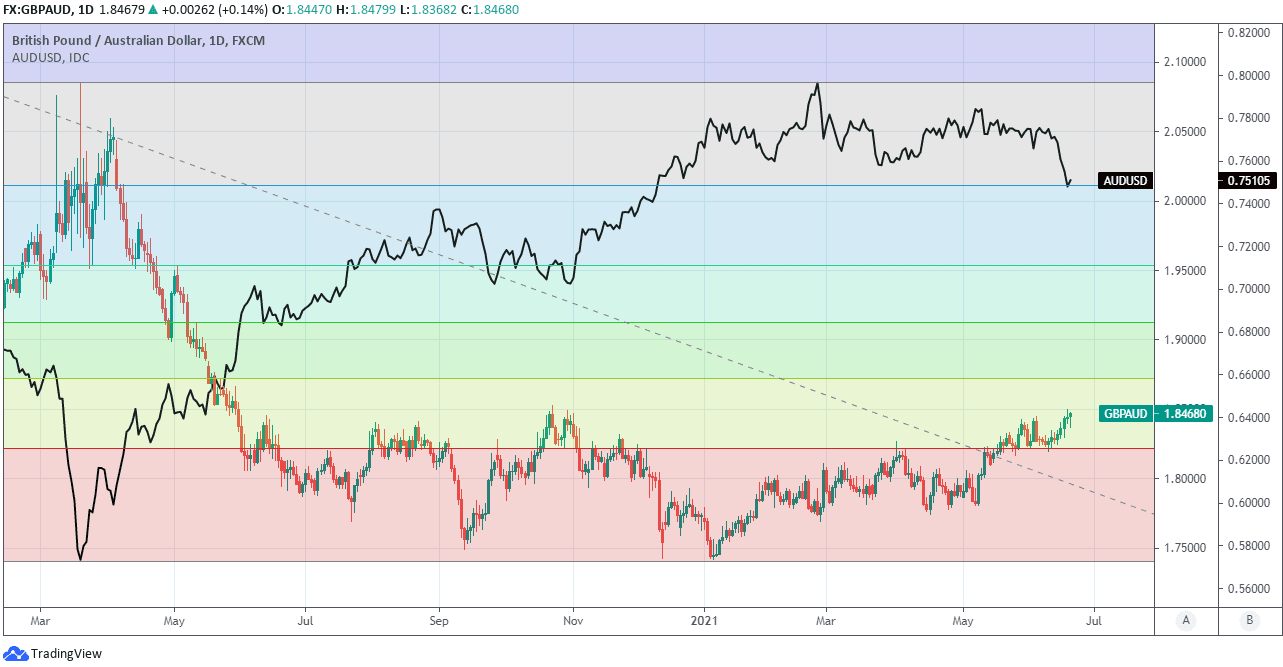

Above: Pound-to-Australian Dollar exchange rate at daily intervals with Fibonacci retracements of March 2020 decline and AUD/USD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

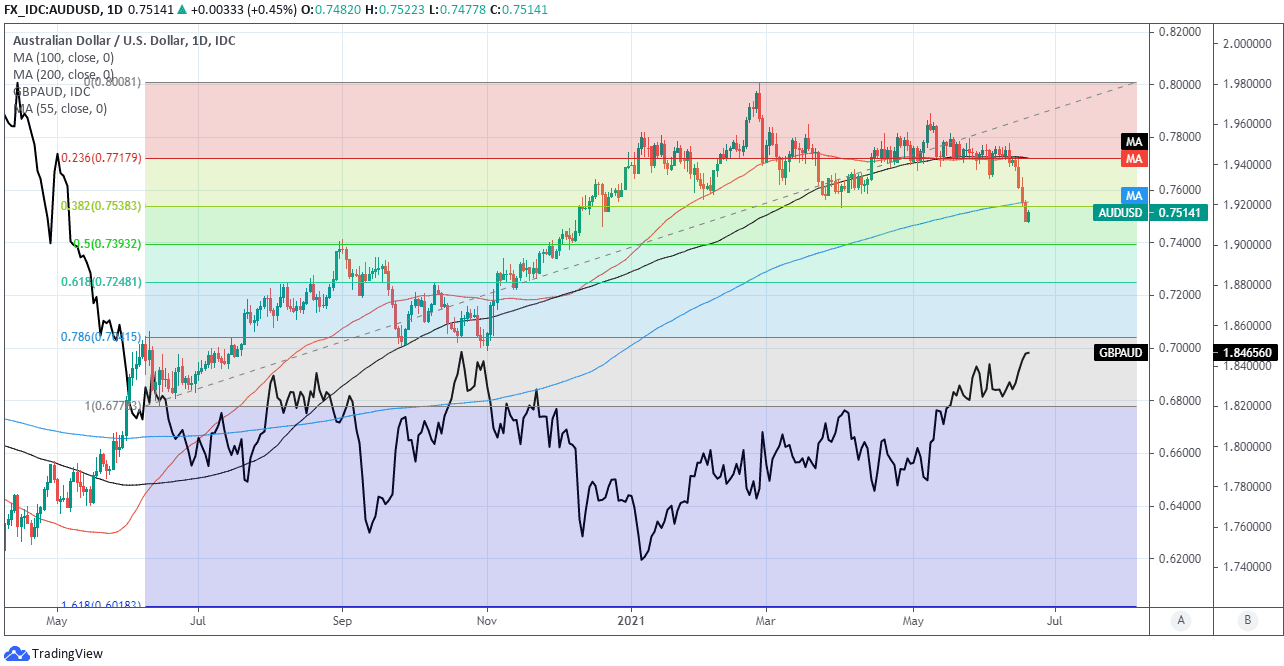

Last Wednesday’s Fed decision has also been a powerful yet indirect influence on GBP/AUD given the different ways in which the main Australian and British exchange rates, AUD/USD and GBP/USD, have gone about responding to it.

These exchange rates are the primary drivers of GBP/AUD although are also highly sensitive to the policy stances of the RBA and BoE, between which there’s now a degree of divergence that owes itself to differences in the degrees of difficulty the UK and Australian economies have had in generating inflation and meeting their respective central bank targets during recent years.

For readers’ background, it’s inflation which central banks are seeking to manage when they tinker with interest rates and other tools like quantitative easing programmes, and for various reasons including a long economic history of inadequate wage growth the RBA has struggled to meet its 2%-to-3% inflation target: For this reason was already knee-deep in a cycle of interest rate cuts before the coronavirus ever arrived on the global economic scene.

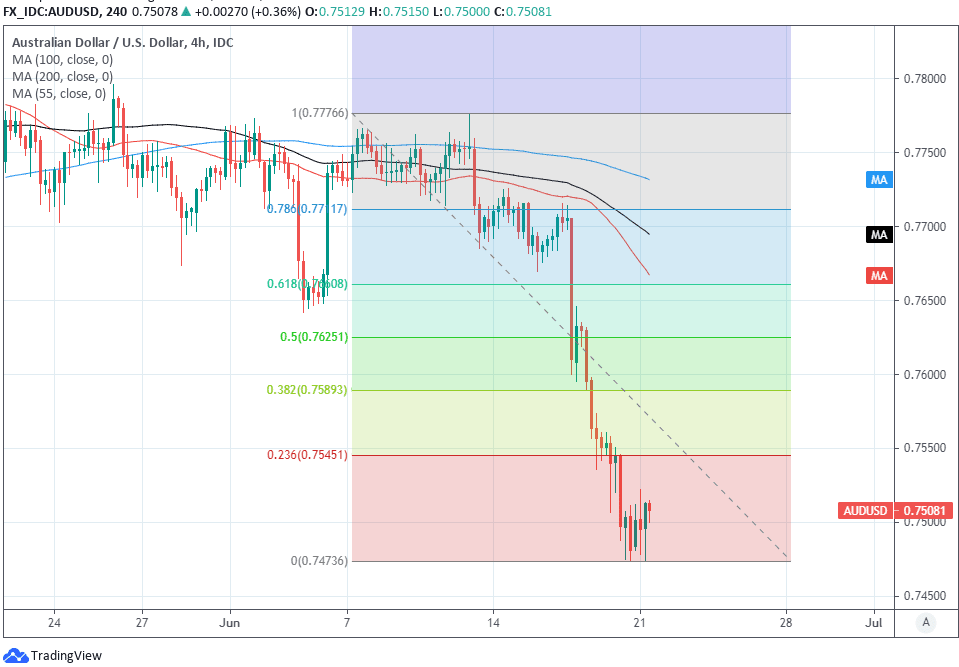

“The abrupt shift in terms of Fed guidance last week saw the 'great reflation trade' come to a shuddering halt and a wide range of assets that have benefited from expectations of a robust and extended global recovery hit hard. The A$ fell circa 3%,” says Sean Callow, a strategist at Westpac.

“Indeed, until we get a better sense of Fed taper/ tightening intentions, we could see the current move extend towards the 0.7400/25 level. We will remain focused on such a dip as another opportunity to buy,” Callow adds, referring to AUD/USD.

Above: AUD/USD shown at 4-hour intervals with selected moving-averages and Fibonacci retracements of last week’s decline.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

Pound Sterling has this year derived much support from a Bank of England (BoE) that is ever conscious of risks to its target to generate a 2% rate of inflation over a multi-year horizon, risks which have shifted to the upside in 2021 and may or may not eventually necessitate an interest rate response from the Monetary Policy Committee at the bank.

The currency market will listen closely to the update on Thursday for clues about the outlook, which may or may not be supportive of Sterling including the Pound-to-Australian Dollar rate, although the outlook for the latter is also heavily influenced by AUD/USD and so it matters to the week’s outcome whether AUD/USD continues its Monday retracement of last week’s declines.

A continued AUD/USD recovery of would eventually reign in a Pound-Aussie rate, although if Westpac and technical analysts at Commerzbank are right in their concerns about the outlook for the Aussie then GBP/AUD could sustain its upward trajectory for longer: Meanwhile, a combination of the above and this week’s outlook for GBP/USD suggests that GBP/AUD now benefits from support around 1.8380.

“AUD/USD tumbled through the 200 day moving average at .7554 and the .7533 April low close, and fell to the late December low at .7463,” says Axel Rudolph, a senior technical analyst at Commerzbank, who’s a seller of AUD/USD from 0.7590. “Below it the September high can be spotted at .7413.”

Above: AUD/USD shown at daily intervals with Fibonacci retracements of June 2020 rally, selected moving-averages and GBP/AUD.