Australian Dollar Strength Delayed to Third Quarter: Westpac

Image © Adobe Images

- GBP/AUD rate at publication: 1.8000

- Bank transfer rates (indicative guide): 1.7370-1.7500

- Money transfer specialist rates (indicative): 1.7550-1.7800

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

2021 is still likely to see the Australian Dollar appreciate says analysts at Australian lender Westpac, however a resumption of gains are tipped to be a feature of the second half of the year.

The Australian Dollar's ascension agains the U.S. Dollar stalled as 2021 brought with it a rebound in the U.S. currency, owing to a reappraisal amongst investors as to how the global economic recovery would shape up.

Thanks to a rapid vaccine rollout in the U.S., combined with hefty fiscal stimulus, it became clear that the U.S. economic rebound would outpace that of other developed nations in the first half of the year.

The Dollar has benefited on this exceptionalism, leaving the Australian Dollar 1.23% lower since the start of 2021 at the time of writing.

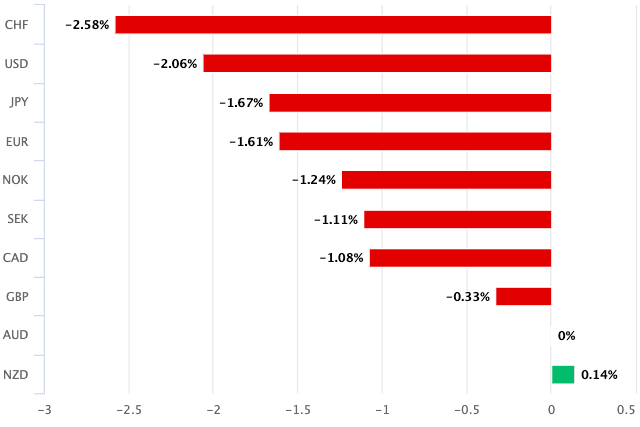

Above: The Australian Dollar has fallen against all but one of its major peers over the course of the past month.

Bill Evans, Chief Economist at Westpac reiterates however that his team have not changed their e end-year forecast target for AUD, which remains USD0.82.

"Our valuation models still point to the AUD being significantly undervalued while we expect a return to a “risk on” investment approach through the remainder of 2021. That will be consistent with improving expectations for global growth over the course of 2021, with year-average growth for the world economy expected to print around 6.0%," says Evans in a regular global economics briefing out Friday.

Westpac say the Australian economy remains well poised to expand over coming months and they forecast above-trend growth of 4.5% through 2021 and increase by 3% in 2022, recovering from the covid related 1.1% contraction during 2020.

Output will be back above pre–covid levels by the March quarter 2021.

"AUD/USD price action remains consistent with our view that while broadly range-bound for now, the Aussie is more of a buy on dips than a sell on rallies," says Sean Callow, a foreign exchange strategist at Westpac.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

He observes the Aussie has closed no lower than 0.7580 since late December.

"The accelerating U.S. recovery is underpinning global risk appetite, with MSCI World Index hitting fresh record highs this week," says Callow.

Westpac maintain a view that equity market performance still matters for the Australian Dollar, therefore a rally in global stock markets will be supportive of further upside.

But, Callow warns of a chance that Australia is heading into a period of softer Australian data in the wake of the expiration of the JobKeeper programme.

"The Aussie should continue to find support on dips to the mid-0.75s, but is likely capped for now in the 0.7700 area. A return to the 0.80 handle may have to wait until Q3," says Callow.