EU Nationals Seizing Job Opportunities in the City Prior to Brexit

- Written by: Gary Howes

Morgan McKinley’s London Employment Monitor for July 2017 suggests EU nationals are seizing the opportunity to find employment in the UK’s financial services industry ahead of Brexit.

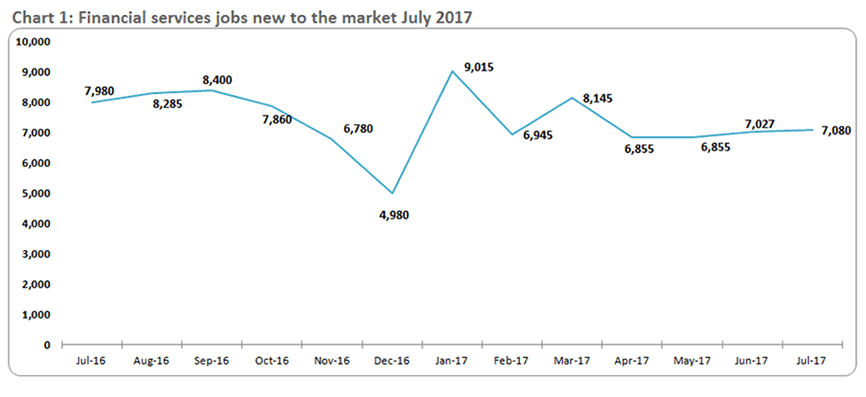

The monthly gauge of employment in the City of London shows a 1% increase in jobs available, month-on-month, which suggests growth is flat when compared to previous Julys which saw job reductions in the double digits.

But, Morgan McKinley say this 1% growth actually represents “a significant upturn”.

“Normally the City clocks out for July, but with the industry being swept from under them, people are scrambling to make the most of the time left in the EU,” said Hakan Enver, Operations Director, Morgan McKinley Financial Services. “EU nationals who want to stay in Britain have a shrinking window of opportunity to get a job and permanent residency, and many are seizing it.”

The government confirmed in July that freedom of movement for EU nationals would end when Brexit takes place in March 2019.

However, how restrictive these conditions will actually be is not clear as the Government has also said it is seeking a transitional period to make the process of leaving as simple as possible.

The confirmation from Government coincided with a series of major financial services institutions announcing a reduction or relocation of their London positions. Combined, the two events made for uncharacteristically high jobs activity during a month traditionally marked by summer holidays.

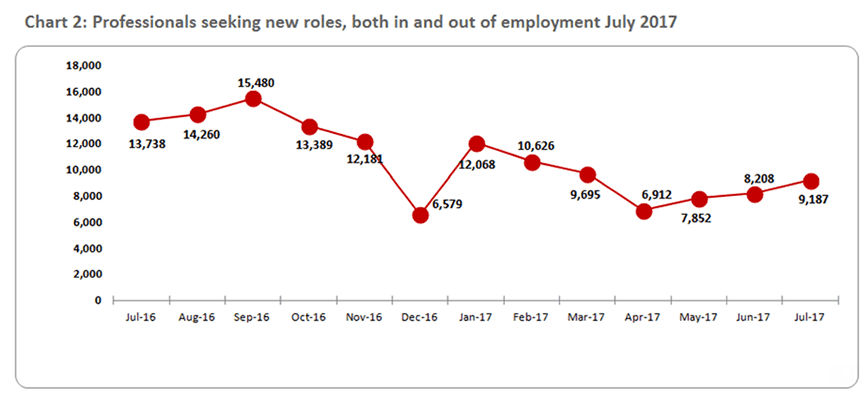

Morgan McKinley report July marked the fourth consecutive month of growth in both jobs and job seekers, but grounds for optimism remain elusive.

In part, concerns linger because the rate of growth has been slow, but, in addition, the year-on-year trends paint a more worrying portrait: an 11% decrease in jobs available and a 33% decrease in job seekers.

“The City is still haemorrhaging talent because of Brexit, and we risk losing jobs, too,” said Enver.

Threats to London’s Financial Services Ecosystem

July saw a series of announcements from leading financial services institutions that have opted to relocate a portion of their staff, or open to European hubs that would normally have gone to London in other locations within the EU.

“The language has changed. Employers and employees used to talk about ‘if’ they had to leave London. Now they’re talking about ‘when’ they leave London,” says Enver.

Among the headline moves were the Bank of America selecting Dublin as its European hub; HSBC announcing it would be moving 1,000 employees to Paris; and Lloyds selecting Brussels for its insurance company operations.

Until recently, it had been assumed that the financial services industry was hub dependent, either remaining in London, or moving to a specific new location.

A multitude of locations picking away at City jobs, however, suggests that a conglomeration of institutions may soon be a thing of the past.

“Technology is enabling the fragmentation of the financial services industry, as close proximity of institutions becomes increasingly unnecessary,” says Enver.

Brussels puts forth Euro-clearing plan that works for everyone. For now.

In July, the European Commission released its plans for stripping London of its Euro-clearing oversight role.

The €1 trillion-a-day operation has always been a sticking point for financial services, making Brussels’ plan of keen interest.

In a surprise to many, Brussels made clear it will not unilaterally strip the City of Euro-clearing, but will retain the ability to do so at the drop of a hat, if clearing houses are deemed to be of economic threat to the EU.

As a first sign of the EU’s approach to Britain’s financial services sector post-Brexit referendum, it was encouraging.

Many had feared the regulatory behemoth might take a more punitive approach, potentially stripping the City of thousands of jobs, and hurtling institutions into uncertainty.

“This is exactly the sort of cooperation Britain and the EU should be engaging in: mutually beneficial for our respective economies,” says Enver.