The Euro Charges Higher Against Pound and Dollar on Impressive German ifo Index and Eurozone PMI Data

- Written by: Gary Howes

- >> Euro to Pound Sterling exchange rate rises to 0.8652 - a 7-week high - following the release.

- >> Euro to Dollar exchange rate was last seen at 1.1231, near a fresh 8-month high.

The latest Eurozone economic data on tap has impressed economists and added to the pro-Euro theme dominating foreign exchange market trade at the present time.

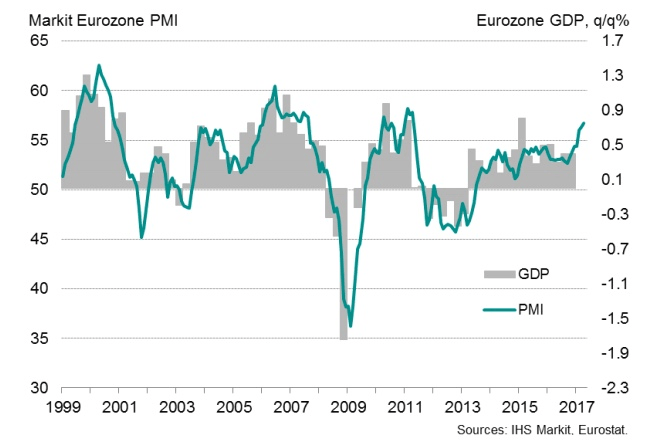

Data from IHS Markit showed that firms continue to see business expand at a strong pace, giving rise to expectations for a strong quarter for the Eurozone economy.

The composite PMI for May - a broad-based assessment of the business activity of Eurozone firms - read at 56.8, analysts had forecast a reading of 56.6.

Manufacturing PMI for May read at 57.0, ahead of expectations for 56.5.

Services PMI disappointed a tad coming in at 56.2, below forecasts for 56.4.

IHS Markit say the data confirms Eurozone economic growth is running at its fastest pace for six years.

Furthermore, job creation also perked up to one of the strongest recorded over the past decade amid improved optimism about future prospects.

“Capacity is being strained by the strength of demand, with backlogs of work showing one of the largest increases in the past six years. Job creation has surged to the second-highest rate in nearly a decade as firms seek to expand capacity and meet rising demand,” says Chris Williamson, Chief Business Economist at IHS Markit.

With this kind of data is it any wonder investors are pouring their capital into the Eurozone and driving up the Euro in the process?

The pressure will surely see the European Central Bank start to consider withdrawing its stimulus programme, something that would prove a massive boon to the Euro.

“Mario Draghi has a host of reasons to be positive in current markets as eurozone figures were notably strong,” says Alex Lydall, Head of Dealing at Foenix Partners. “Momentum for the single currency has been obvious with EURUSD peaking at 8-month highs at a time where political threats are quickly diminishing.”

And the positivity should extend.

“At a time where Trump is continually sending shockwaves across US markets, and the UK in the midst of an election, things in the eurozone appear somewhat settled,” argues Lydall

German Economy Steams Ahead

Meanwhile, data out from Germany was equally impressive.

The Ifo index rose further from 113.0 to 114.6 (Consensus: 113.1).

This is a record high since the index was started in 1991 after reunification.

Business expectations were up strongly from 105.2 to 106.5.

The current assessment component surged from 121.4 to 123.2 and hence also to its highest level since 1991.

When looking at sectors, especially manufacturing and construction companies became again more optimistic.

Both the forward-looking expectations and the current assessment components among manufacturers increased.

The current assessment figure in the construction industry hit another record-high level.

Undoubtedly the news is good for the Eurozone outlook and we would expect the Euro to remain supported. But the chance of such surprises being repeated in future months are unlikely.

“The latest renewed and strong rise in German business sentiment is great news. However, the air for further improvement is increasingly getting thin. While it is impossible to forecast exactly when the peak will be reached, it is clear that we are getting close to it. Repeatedly strong increases in the next few months towards levels seen before reunification (i.e. sentiment among companies in Western Germany) are unlikely in our view,” says Dr. Andreas Rees at UniCredit Research.