Economists & Business Owners Lay into Reeves

- Written by: Sam Coventry

🔒Lock in today's exchange rate to secure a future payment. You may also book an order to trigger your purchase when your ideal rate is achieved. Learn more.

04/11/2025. London, United Kingdom. Chancellor Rachel Reeves delivers a Budget scene setter speech at No 9 Downing Street. Treasury. Picture by Kirsty O'Connor / Treasury.

The pound is down, and Rachel Reeves, the UK Chancellor, is dominating the political cycle on Tuesday.

What she said: The government successfully "fixed the foundations" of the economy at her last Budget, but that since then "the world has thrown even more challenges our way".

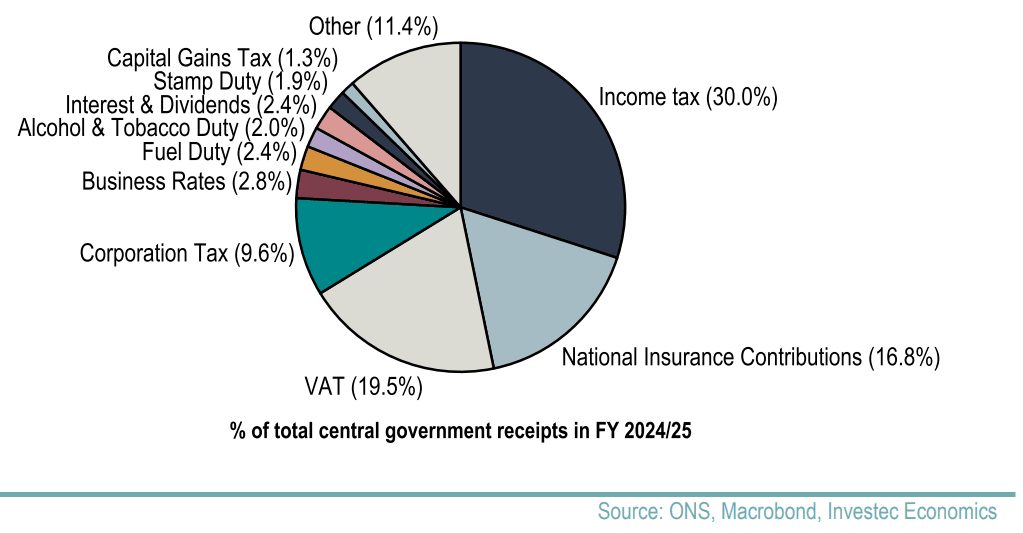

Asked about the manifesto promises not to raise income tax, National Insurance or VAT, she said: "As Chancellor, I have to face the world as it is not the world that I want it to be."

But what she is actually telling us is:

She is going to break Labour's manifesto pledge and raise income taxes.

Context: The government must cut spending and raise taxes to fill a budget 'black hole' of approximately £30BN. With the Labour Party traditionally coy on cutting spending, it falls on taxes to do the heavy lifting.

The problem is, Labour made a manifesto commitment to not raise the basic tax rates of VAT and income tax ahead of the election.

But it's clear, to keep markets onside, this must be done.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Owners at Britain's small businesses, which account for the majority of the UK economy's output, aren't happy:

"We are in for a wild few weeks," says Riz Malik, Director at R3 Wealth.

Ben Perks, Managing Director at Orchard Financial Advisers says "Reeves' speech this morning was reminiscent of a safety briefing before a bungee jump. She’s basically told the nation, in advance, to strap in and hope for the best."

Political commentators, meanwhile, think the speech was unusual, noting that it only creates a sense of crisis.

Economists think the Chancellor is being evasive as to the true causes of the government's current problems.

Andrew Sentance, former Bank of England Monetary Policy Committee member says: "What Rachel Reeves won’t admit this morning is that her decisions on public spending have caused the government’s financial problems. She has raised spending by £100bn a year relative to previous plans - hence the need for much bigger tax rises than £40bn announced last October."

Paul Johnson, former director of the IFS: "Odd speech from chancellor. In one sense fair enough to blame last govt for problems. But wrong to pretend all utterly unexpected and couldn’t possibly have been predicted at election or budget last year. We knew the risks when tax promises were made. And so did she."

Robert Peston, veteran economics reporter, currently at ITV, says the nutshell of the Chancellor's speech is: "I will never put expediency over the national interest".

Translation: “There is a massive hole in the public finances which is not my fault but the manifesto promise not to raise taxes on working people is in the incinerator and the basic rate of income tax will be increased in the budget on 26 November."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Simon French, Chief Economist & Head of Research at Panmure Liberum says the message that everyone will be asked to contribute to the effort to bring the country's finances onto a sustainable footing opens the door to broad-based tax increases.

"Probably sensible given tax rate for those on average incomes is the lowest in 50 years," he explains.

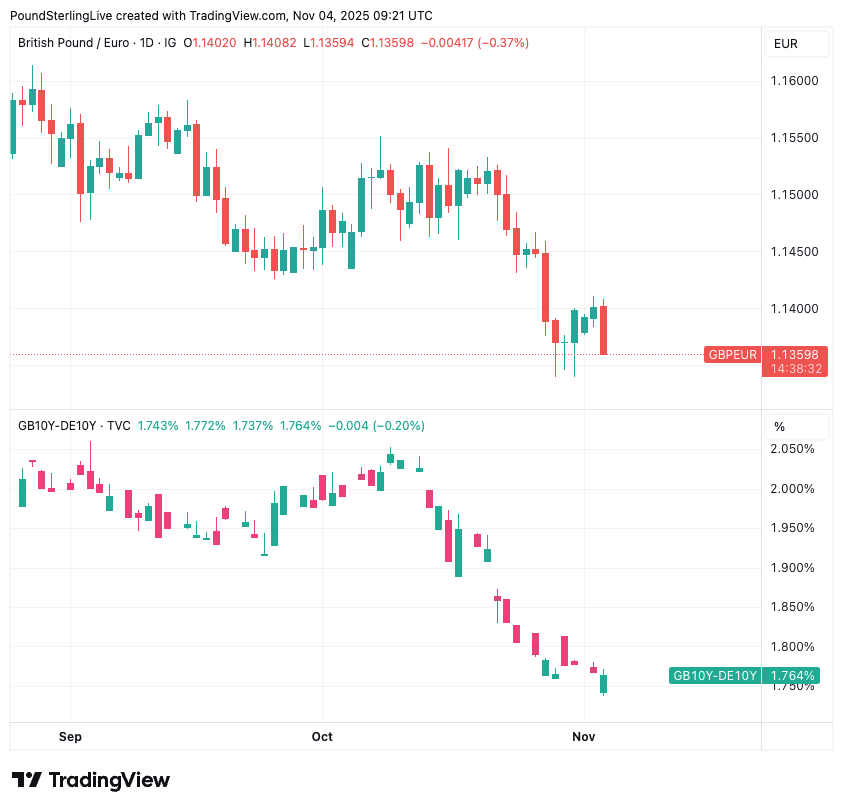

Market's agree as UK borrowing costs are falling faster than in Germany, the U.S. and in other major economies.

The rub is that this is causing the pound to be dragged lower by the falling lending costs. The below shows the falling difference in the UK and German 10-year bond yield (lower panel) and GBP/EUR :

Reeves' future of Chancellor might not survive the fallout from the manifesto-busting announcement.

What's more, it appears the government hasn't really grasped what's at the heart of the UK's malaise. Until then, we will keep coming back to this same problem.

French says, "here is the bit that really grated for me":

"Blaming poor productivity only on post GFC spending restraint/austerity - when decisions over energy policy, planning, migration and financial regulation are far more compelling reasons. Public spending is probably 4% of GDP too high for sustained per capita growth. If you want to grow the public sector’s capital allocation, then bearing down on current spending is the pivot, not tax."