How the UK can escape its fiscal rut, according to Oxford Economics

- Written by: Gary Howes

Oxford Economics urges the Chancellor to pair higher fiscal headroom with broader growth reforms and targeted spending restraint in the November 26 Budget.

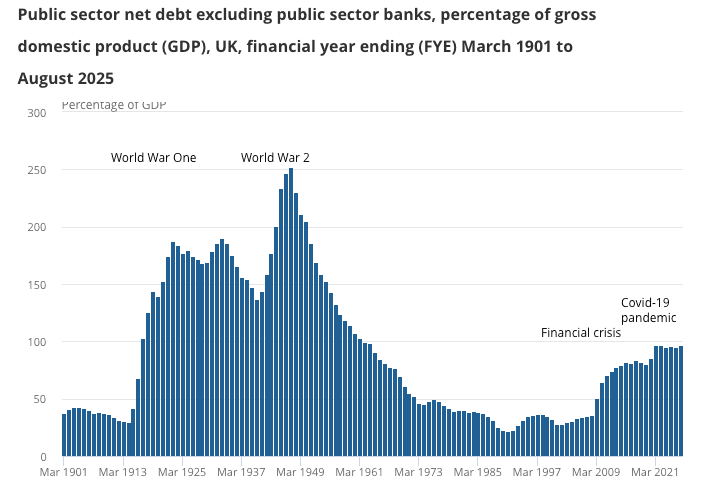

Public debt has risen from 37% to 95% of GDP over two decades.

Expected tightening of £20–30 billion meets rules but leaves vulnerabilities intact.

Oxford Economics proposes ~£35 billion in tightening with materially higher headroom.

Driving the news

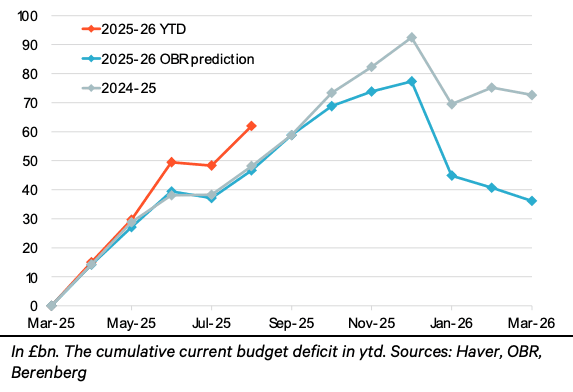

The Budget is likely to tighten policy by £20-30 billion to satisfy the fiscal rules by 2029–30.

Oxford Economics argues this would be a minimal fix that fails to address weak potential growth and persistent spending pressures.

The debt ratio has climbed faster than in any other advanced economy and could rise further if shocks recur.

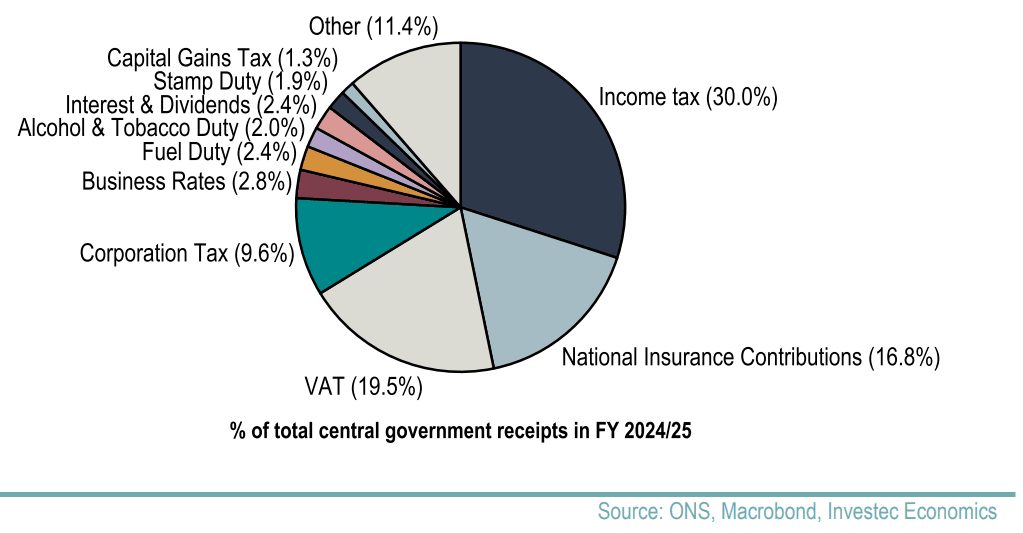

A consolidation skewed toward many small tax rises risks weaker confidence and lower success rates.

Why it matters

Low headroom and tax-heavy consolidation raise the chance of recurring fiscal black holes.

Uncertainty over taxes and spending can deter long-term investment and keep bond yields elevated.

Higher headroom would reduce sensitivity to forecast shifts and allow a focus on structural reform.

The plan

Oxford Economics calls for a multi-pronged approach that lifts potential GDP, restrains spending growth, and raises revenue efficiently.

The firm opposes altering the OBR process or loosening rules and instead backs materially higher headroom of £10–20 billion.

By the numbers

- Headroom: Increase by £10–20 billion to reduce fiscal fragility.

- Growth: Pursue closer EU trade links, expand subsidised childcare by £1.5 billion, incentivise older workers, and deploy targeted visas.

- Spending: Restore £4–5 billion disability-benefit savings and stabilise health outlays as a share of GDP.

- Taxes: Net £24 billion raise via a 2-point increase in basic and higher income-tax rates and windfalls on banks and betting.

- Distortions: Flatten very high marginal tax rates between £60,000 and £125,000 and reverse cost increases for low-pay hiring.

- Pensions: Replace the triple lock with earnings indexation once pensions reach a defined share of median pay.

What to watch

Whether the Budget targets a higher headroom buffer alongside reforms that raise labour participation and potential growth.

How ministers balance near-term consolidation with longer-term commitments on health, welfare, and pensions.

Tough choices that boost headroom, improve incentives, and restrain structurally rising costs would put the UK on a more sustainable path than incremental tax hikes alone.