Bank of England is a Go in November: Barclays

- Written by: Sam Coventry

Image © Adobe Images

Barclays sees an opportunity for the Bank of England to cut interest rates next month.

The big debate on whether or not the Bank of England will cut interest rates again in 2025 looks to be settled.

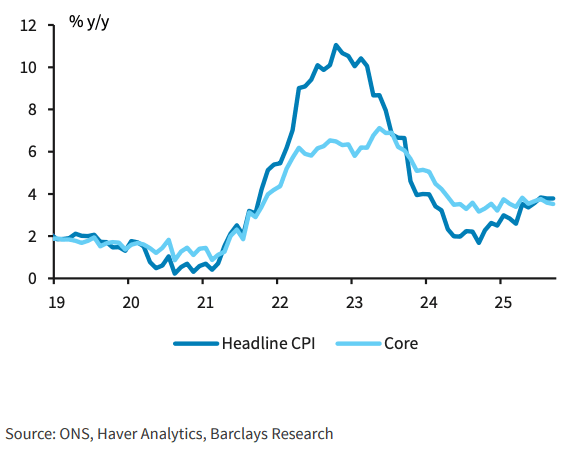

Following the below-consensus inflation print of 3.8% year-on-year in September, the odds of a cut before year-end have risen to about 75%, effectively settling the debate.

What's still in the air, however, is whether the Bank chooses November or December.

On the one hand, November is when the next Monetary Policy Report falls, which is traditionally when the Bank acts.

But December could be a better choice as it falls after the government's budget, which itself will lay the conditions for inflation's trajectory in 2026.

Analysts at Barclays reckon November will win out, judging September's UK inflation figures have effectively "teed up" a rate cut at the November meeting.

Headline inflation held steady at 3.8% year-on-year, against expectations for an uptick to 4.0%. That represents what Barclays calls “a lower-than-expected peak to the inflation hump.”

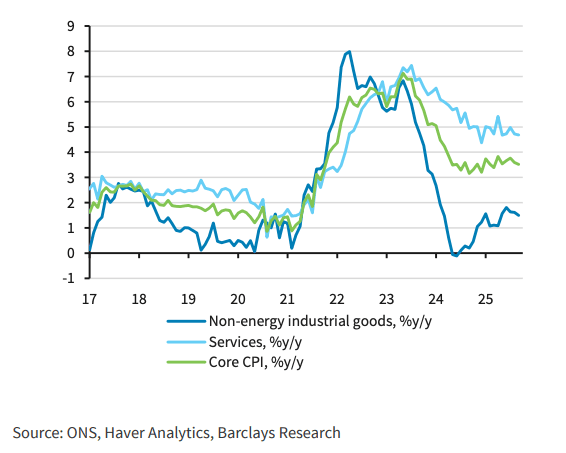

The softer reading was broad-based, with core CPI slipping to 3.5%, services inflation steady at 4.7%, and core goods easing to 1.5%.

Barclays notes that each of these readings came in below both their own and the Bank’s August forecasts.

"The downside news in core inflation was across core goods and services, and was broad-based," notes Barclays.

Within goods, durable items saw price growth slow by 0.4pp to 1.1% year-on-year, while food inflation cooled notably.

Processed food and beverage prices fell to 5.2% from 5.7%, and unprocessed food slowed to 3.7%.

Barclays calls this development "particularly salient as the BoE, and specifically the more hawkish members of the MPC, have flagged the important role food prices play in determining households’ inflation expectations."

The moderation in food and underlying services inflation, together with recent softness in wage growth and economic activity, creates what Barclays calls a "compelling trinity" of conditions for a policy shift.

"The flow of data since the September meeting has been soft on the labour market, soft on activity and now soft on inflation – a compelling trinity," analysts write.

They add that this "significantly reduces the risk of second-round effects" – where wage and price pressures reinforce each other – meaning inflation is now less likely to prove sticky at high levels.

The report also notes a change in political tone that could give the central bank cover to ease:

"This week, the chancellor stated publicly that she will use November’s budget to look at ways to bring prices down and clear the way for the BoE to ease rates and support demand in the economy."

"All of this combines to reinforce our existing view that a 25bp rate cut at the coming November meeting is the most likely outcome," says Barclays.