Inflation to Breach 4.0% Warn Economists

- Written by: Gary Howes

Image © Adobe Images

Inflation is marching higher, say economists, citing strong wage growth and impending tax hikes for businesses.

"On the road to 4% inflation," says Andrew Wishart, Chief UK Economist at Berenberg Bank. "The big picture is that the disinflation process is stalling."

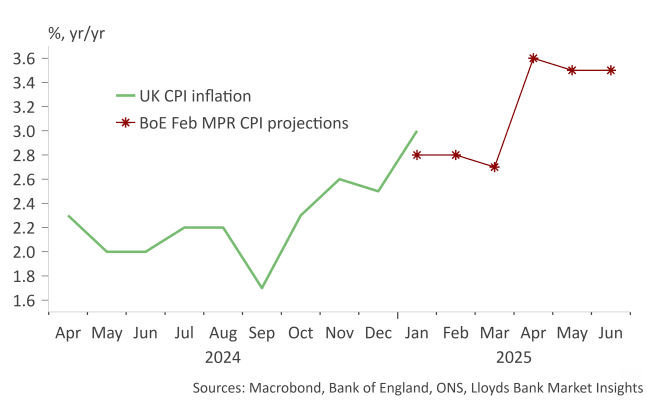

Britain's consumer price inflation (CPI) rose to 3.0% in January 2025, up from 2.5% in December, driven by higher costs in transport, food, and education, the Office for National Statistics (ONS) said on Tuesday.

The data wrong-footed economists, where the consensus expected a more subdued rise of 2.8% and suggests the Bank of England is still overly confident in its predictions that inflation will fall back to 2.0% at some point in the medium term:

Above image courtesy of Lloyds Bank.

Economists see inflationary pressures increasing owing to a combination of global and domestic factors, with risks to existing projections skewed higher.

"While there remains significant uncertainty around the path of energy prices, we see CPI reaching a peak of 4.25% over the summer before making its descent back to target in 2026," says Sanjay Raja, Chief UK Economist at Deutsche Bank.

Raja cites a considerable amount of administrative and tax changes for the revision. These include a rise in water bills, further increases in dual-fuel bills, vehicle excise duty, alcohol duty increases, TV license fees, rail fares, and tuition fees.

"Last but not least, the double hit from a higher minimum wage and the increase in payroll tax will also likely see CPI push higher - with many firms likely to pass on cost increases in the first half of the year," says Raja.

In the spring, UK businesses will have to contend with significant tax increases and minimum wage rises, with many indicating they will pass on the costs to consumers.

"In April, the private sector must determine its response to significantly higher employment costs, and this may well push up consumer prices," says Dr. Roger Barker, Director of Policy at the Institute of Directors.

"Strong pay growth and the increase in employers National Insurance Contributions (NICs), a UK payroll tax, at a time when productivity is flatlining means that firms are facing a large increase in labour costs. Reasonable domestic demand will allow companies to pass much of the increase in costs they face onto customers in the form of higher prices," adds Berenberg's Pickering.

According to ONS data, the labour market remains a source of inflationary pressure as regular pay rose 5.9% year-on-year in December, even as growth figures show the economy has flatlined around 0% since Labour took power.

Rising wages and stagnant supply mean prices must rise.

"UK labour market data once again highlighted that the Bank of England (BoE) must be extra careful when considering further monetary policy easing," says Illiana Jain, an Economist at Westpac.

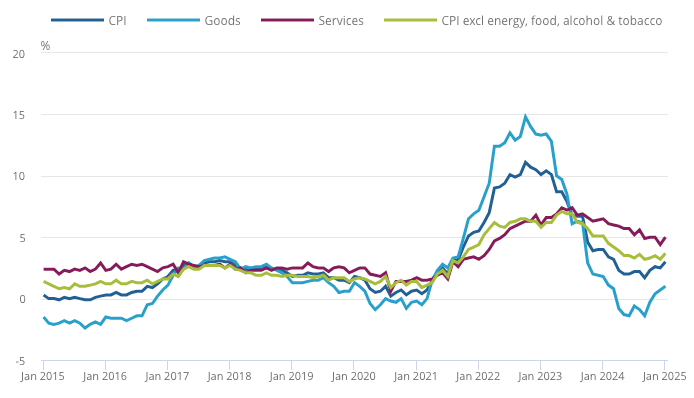

The increase in the headline rate is underpinned by a rise in services inflation to 5.0%, its highest level since August 2024, suggesting persistent price pressures in labour-intensive sectors.

Core CPI, which excludes volatile energy, food, alcohol, and tobacco prices, also rose to 3.7% from 3.2%, indicating that underlying inflationary trends remain strong.

As the below chart indicates, until services inflation begins to fall, the headline CPI inflation rate will remain sticky above the Bank of England's 2.0% target:

Above: Services inflation continues to prop up headline inflation.

“Transport services, particularly air fares, saw significant increases, along with education costs,” the ONS said in its report. Food prices also contributed to the upward trend, while housing and household services exerted downward pressure on the index.

On a monthly basis, CPI fell by 0.1%, compared with a 0.6% decline in January 2024, but the consensus thought a more notable -0.3% would be recorded.

Viraj Patel, a strategist at Vanda Research, says, "worryingly, inflation breadth was high for January (50% of basket running at >2.5% inflation)."

Inflation "breadth" describes the extent of inflation: when the breadth is wide, it means more items in the goods basket are rising. When it's narrow, it means inflation's top-line rise is being pushed by a fewer items, which economists suggest means the rise is likely to be temporary and driven by one-off events.

Patel explains the wide breadth of January's price increases doesn't support the case for faster Bank of England interest rate cuts.

Berenberg's Pickering also thinks the breadth of inflation is a cause for concern. "Inflation in all major categories increased in January," he explains.

Looking ahead, rising household energy prices will mean energy switches from weighing on inflation to boosting it.

"Together, that is likely to push CPI inflation up to c4% in September and cause the BoE to take a long pause after lowering bank rate from 4.50% to 4.25% in May," says Pickering.

The National Institute of Economic and Social Research (NISER) also warns that rising inflation will severely constrain the Bank of England's ability to cut interest rates.

"Persistent wage growth this year, together with an expansionary fiscal policy and exchange rate depreciation, will all act to limit the scope for monetary loosening this year. We therefore anticipate just one further rate cut in 2025," it says.