Bank of England Could Cut Rates 50bp Before Year-end Following Inflation's Slump

- Written by: Gary Howes

Image © Adobe Images

The Bank of England could cut interest rates by 50 basis points in November after UK inflation plummeted in September says an analyst we follow, but not all agree.

Bank of England Governor Andrew Bailey said at the beginning of October the Bank could be more "activist" in cutting interest rates if inflation data allowed.

Fast-forward to mid-month, and the data has complied with his wishes: a slump in headline inflation to 1.7% would be welcome enough. But services inflation, which is arguably more important for Bank policymakers, fell to 4.9% from 5.6%.

To put this into context, the Bank's projections had it falling to 5.5% at this point.

Core inflation, meanwhile, recorded the biggest monthly decline in 25 years after it fell from 3.6% to 3.4%.

"It's not just that UK CPI missed big. This was one of the weakest September MoM prints for core over the last 25yrs," says Viraj Patel, a strategist at Vanda Research.

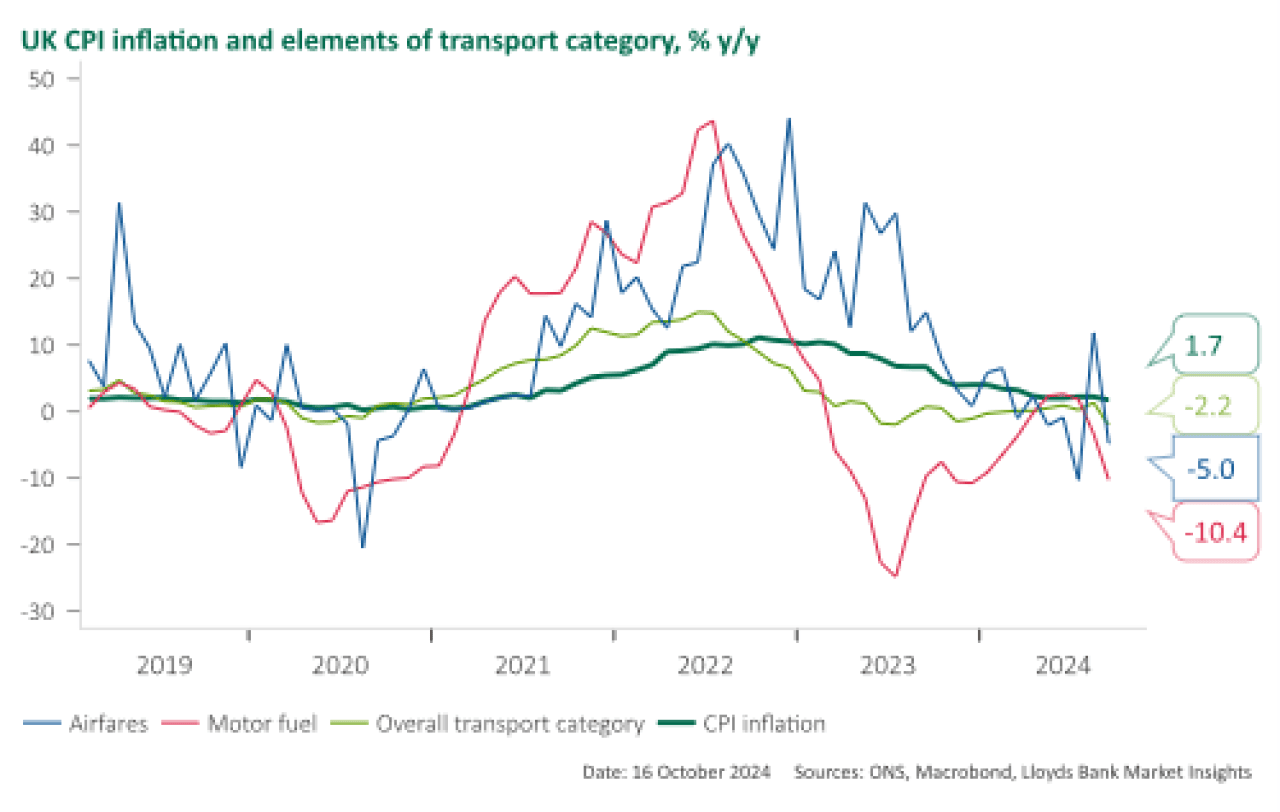

Image courtesy of Lloyds Bank.

Patel says the undershoot in UK inflation opens the door to a 50 basis point interest rate cut at the Bank of England in November, which he says would be a recognition that they were too cautious in opting to leave rates unchanged in September.

The rise in expectations for the quantum of Bank of England interest rate cuts that will come can put downward pressure on the Pound and mortgage rates.

However, Paul Dales, Chief UK Economist at Capital Economics, says it could be premature to expect a 50bp cut from the Bank.

"Since a lot of the unexpected weakness is due to a big fall in airfares inflation, we think it's a bit more likely the Bank sticks to cutting rates by 25bps every other meeting," he explains.

The fall in headline inflation to below 2.0% was anticipated by economists owing to the fall in global oil prices leading into the September data capture period.

This mechanically brought the cost of refuelling the car and buying airline tickets down.

Dales explains that the fall in airline tickets accounts for a sizeable decline in core inflation, which "the Bank won’t consider a sign that domestic price pressures are becoming less persistent."

Sam Hill, Head of Market Insights at Lloyds Bank, also says the rate doves should not get too carried away.

"Remember the extra emphasis the BoE put on a very specific core measure of services that excluded ‘volatile items’. As such, the part of the easing in CPI that comes from airfares isn’t likely to carry much weight with the MPC, even if initially the undershoot in CPI influences market expectations more," he explains.