Next Government Will Inherit "Economic Tailwind"

- Written by: Sam Coventry

Above: Keir Starmer, leader of the Labour Party, is expected to inherit a steady economic recovery. Picture: Keir Starmer on Flickr.

The UK economy flatlined in April but this won't upset a steady multi-month trend of recovery, and analysts say the next government will inherit a tailwind of growth.

The UK economy registered 0% month-on-month growth in April, as expected by a consensus of economists, according to the latest GDP monthly estimate from the ONS.

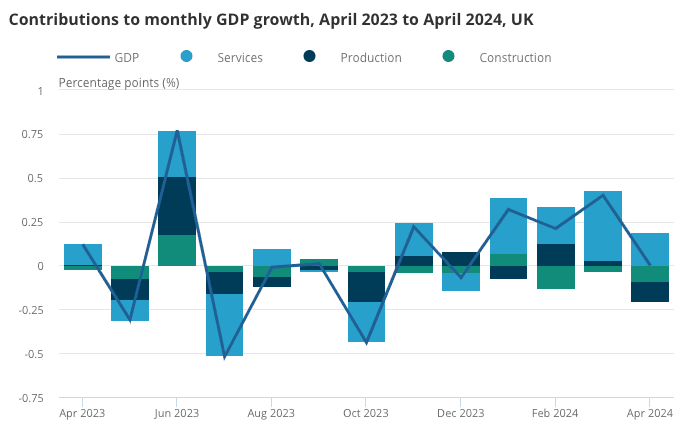

This follows the 0.4% growth recorded in March. Despite April's flat reading, the economy is still on course to register a second consecutive quarter of growth, with GDP estimated to have grown by 0.7% in the three months to April 2024 compared with the three months to January 2024.

"The stagnation in GDP in April doesn’t mean the economic recovery has been extinguished, but it’s hardly great news for the Prime Minister three weeks ahead of the election," says Paul Dales, Chief UK Economist at Capital Economics.

Saving the UK economy from contraction was a 0.2% growth in the services sector in April, which countered a -0.9% outcome for production output. Construction output fell by 1.4% in April 2024, its third consecutive monthly fall, and fell by 2.2% in the three months to April 2024.

Dales says the 1.4% m/m fall in construction output and 2.0% m/m decline in retail activity suggest to him that a chunk of the weakness was due to April’s unusually wet weather and will be reversed in May.

Although April's data disappointed, all signs continue to point to a steady expansion, meaning the next government will inherit a growing economic recovery.

"Despite the stalling of the recovery in April, the dual drags on economic growth from higher interest rates and higher inflation will continue to fade throughout the year. That will generate a bit of an economic tailwind for the next government," says Dales.

"There is good news," says Sanjay Raja, Chief UK Economist, Deutsche Bank. "The flat April print will likely be temporary. And moreover, we continue to see GDP maintaining its upward momentum through the rest of the year."

AXA Investment Managers look for growth to average around 0.3% quarter-on-quarter over the rest of the year, driven largely by a rebound in private consumption, leaving the annual growth rate at 0.7%.

"As such, we think the Monetary Policy Committee will continue to see this recovery in activity as broadly neutral for the policy outlook, instead directing their focus towards the incoming inflation and labour market data," says Gabriella Dickens, G7 economist at AXA Investment Managers.

AXA points out, however, that an annual increase of 0.7% is still below its estimates of trend growth of around 1.3% to 1.4%.