GBP/USD Stable as Market Takes Election Announcement in its Stride: XTB

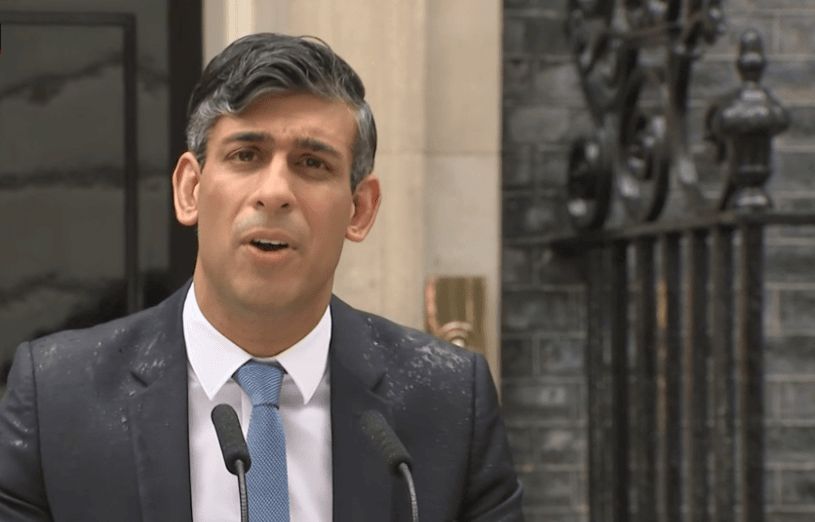

Written by Kathleen Brooks, research director at XTB. Image: Pound Sterling Live / BBC.

The UK will head to the polls on July 4th. This election has been expected for some time, so it is no wonder that UK asset prices have been remarkably stable on the back of this news.

GBP/USD has given back some earlier gains, but it is still higher on the day. The FTSE 100 is lower on Wednesday, in line with markets in Europe and the US, as global stock indices pull back from record highs. Bond yields in the UK have surged today, but this has nothing to do with Rishi Sunak and instead was driven by the stronger than expected inflation data for the UK.

A July 4th election date is high stakes move from Sunak. Not only is the date auspicious, American Independence Day, but he has announced it on the same day that UK interest rate cut expectations have been rapidly scaled back, which could lead to banks increasing mortgage and lending rates just before the national vote.

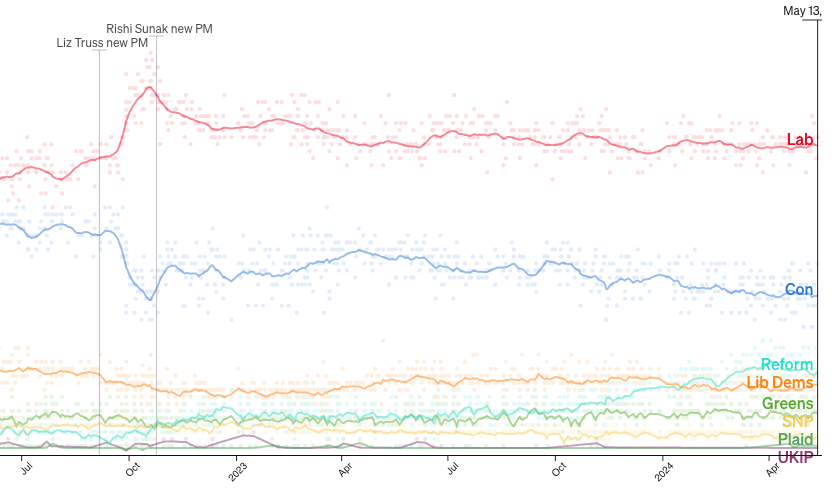

Above: Poll of polls by Politico.

There will now be no interest rate cut before the election to sweeten voters, traders are currently pricing in a mere 11% chance of a rate cut next month. Instead, the market now expects the first rate cut from the BOE in November. From the BOE’s perspective, this is better timing, since it will free them from any scrutiny of political bias as the election will be long gone by the time they are expected to cut interest rates.

This recalibration of interest rates has pushed up 10-year UK Gilt yields by 10 basis points and 2-year yields by 14 basis points on Wednesday. However, if you look at bond yields from 2023, UK yields look stable compared to recent years. Added to this, while the inflation rate did not moderate as much as expected last month, the UK has made good progress on inflation and is no longer a global outlier. In fact, the annual headline inflation rate in the UK is below the US rate.

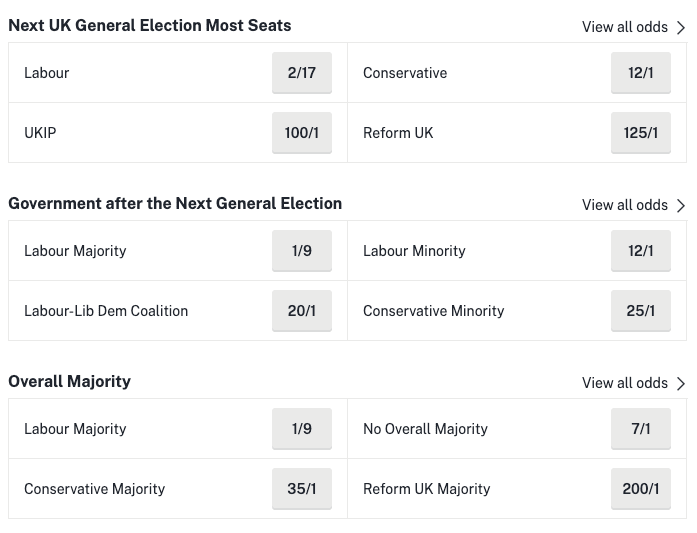

Above: Odds heavily favour a Labour majority outcome on July 04. Image: Oddschecker.

The election comes just days after the IMF raised its growth forecast for the UK, and nearly three weeks since the Bank of England raised its growth projections and revised lower its inflation forecasts for the UK this year. Perhaps Sunak and his strategists think that this is as good as it gets for the UK economy.

The sharp rise in commodity prices, including copper and wheat prices have pushed up the Bloomberg Commodity Price Index to its highest level since September 2023. Rising commodity prices are a threat to UK inflation, however, they are unlikely to be a problem before the UK election, but they might become a problem later in the summer. Thus, now is as good a time as any to call an election.

It is worth noting that the latest polling data still predicts a strong win for the Labour Party. YouGov reports that they have a 30-point lead over the Tories. If this is correct, then it would end the Tories’ 14 years in power. In that time, Sunak is the Tories fifth UK Prime Minister. The gap between voting intentions for Labour and the Conservatives started to widen after the short-lived Liz Truss government in October 2022, and it has not recovered since then. Thus, Sunak will know who to blame if the Conservatives do lose the election on 4th July.

The economic backdrop to this election is mixed. On the one hand the economy is growing and inflation is moderating, albeit at a slower pace than expected, but on the other hand the tax burden is at its highest level for decades, and the government is still on track to borrow £80bn this fiscal year, which limits the amount of pre-election pledges that either party can make.

As we progress through this election cycle, the focus will turn to Labour’s economic policy. However, Kier Starmer is aware of what happened to Liz Truss when she promised to slash taxes, blowing up a fiscal whole in the UK’s balance sheet. Thus, his election campaign may be light on spending plans due to the tight fiscal situation that the UK finds itself in.

We expect Kier Starmer and Rachel Reeves to pledge limited spending increases without raising taxes on a large scale. We also expect them both to focus on being ‘business friendly’ and trying to entrench Labour’s reputation as being fiscally responsible and able stewards of the UK’s economy.

Overall, we don’t see too much difference between Labour or Conservative election pledges on the economy. Both parties want to do their best to try and avoid any drama in the UK bond or FX markets, so we expect them to tread carefully going forward.

While an election itself can be an exciting time for financial markets, during this election, we expect both parties to try and sound as boring as possible on the economy, with issues such as immigration and the NHS likely to dominate.