Bank of England Might Not Be Able to Cut in 2024 Warns JP Morgan

- Written by: Gary Howes

Image © Adobe Stock

Economists at JP Morgan expect the Bank of England to cut interest rates in August, but details in the April inflation print warn of growing risks that a 2024 rate cut might not happen at all.

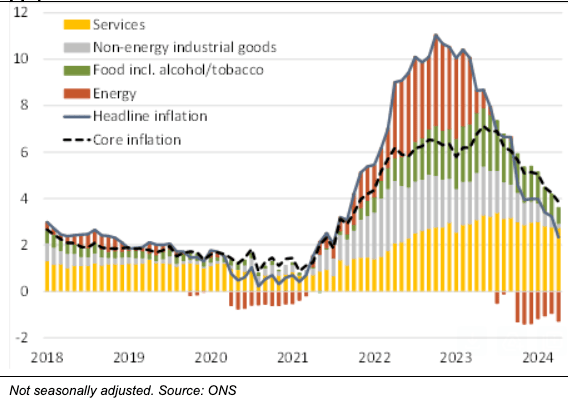

Headline CPI inflation fell to 2.3% y/y, which was above expectations for 2.1%, but headline services inflation read at 5.9%, whereas the market and Bank of England were expecting a reading of 5.5%.

Looking at the details of the shorter-term trends reveals a recent acceleration in price pressures.

Analysts at JP Morgan warn the April inflation release "bears the hallmarks of last year" with a broad-based 0.9% m/m, seasonally adjusted surge in services prices that takes the 3m/3m rate back up to 5% (with supercore at 6%).

"Most of the underlying measures the BoE has drawn attention to look not just strong, but are strengthening (on a 3m/3m basis)," says Allan Monks, an economist at JP Morgan.

The analyst says firms are feeling confident enough to pass costs on, and recent experience suggests they will continue to do so in the coming months.

"The biggest risk at present comes from stronger growth, which is running well above BoE expectations. That could increase business pricing power and tilt inflation risks to the upside," says Monks. "The BoE recently downplayed signs of ongoing inflation persistence and tried to set up for a June cut, but the data aren’t listening."

The odds of a June interest rate cut at the Bank of England have fallen to just 15% from above 50% in the days before Wednesday's UK inflation release.

Money market pricing meanwhile shows an August rate cut is now no longer fully priced by the market, reflecting fears UK inflation will remain perched above the Bank of England's 2.0% target for the foreseeable future.

Mechanically speaking, inflation cannot fall below 2.0% on a sustained basis if services inflation continues to run at current levels:

Image courtesy of Berenberg.

Key members of the Bank of England have recently signalled they are comfortable with inflation's direction, with Dave Ramsden saying recently he sees rising chances that inflation surprises to the downside.

He will be surprised that the evidence is clearly pointing to the opposite.

Looking at the details, core prices were up 0.7% over the month. There was an upside surprise for goods, where prices rose 0.4% with some help from vehicles, water, and other goods, but the big beat came from services prices, which shot up 0.9% m/m.

"Gains were very broad-based," says Monks. "The BoE has recently started looking at measures excluding rents (rents rose 0.9% in April) but that won’t help much either due to the breadth across services."

Communication prices saw a sizeable 2.7% m/m advance, and recreational and personal services (e.g. sporting, cultural) saw a chunky 1.9% gain.

"A category such as primary housing services (which is not rents, but plumbers, electricians, etc.) tends to get overlooked because of its small weight, but it can be symbolically important of broader pricing trends, and rose 4.4% in April," says Monks.

He notes, too, that most of the underlying measures the BoE has drawn attention to look not just strong but are strengthening (on a 3m/3m basis). Of concern to the economist is that the persistence-weighted supercore measure, "which the BoE surprisingly stopped talking about in its May communications," rose 0.7% in April while the 3m/3m annualised pace shot up from 5.4% to 6.0% based on our seasonal adjustment (the 3m, saar rate is 6.6%).

"We stick with our August call but believe the risks have clearly tilted back towards a later cut, and the talking point now will be whether the BoE can ease at all this year," says Monks.