Bank of England GDP Growth Forecast Upgrade Might Be Too Timid

- Written by: Gary Howes

Image © Adobe Images

Economists at Berenberg have raised their GDP forecasts in light of the first quarter's strong reading and say it supports the case for an August rate cut.

The call comes after the ONS said the UK economy expanded 0.6% quarter-on-quarter in the first quarter of the year, exceeding estimates for 0.4%.

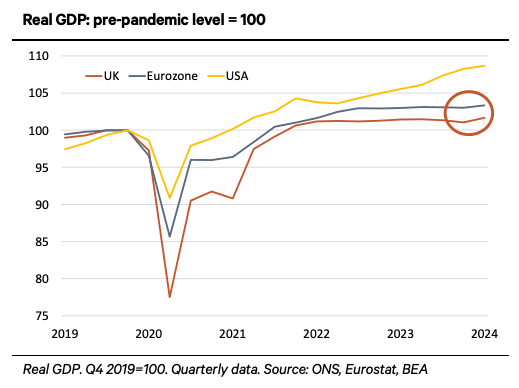

"The UK economy bounced back even more strongly than expected in early 2024," says Holger Schmieding, Chief Economist at Berenberg. "After years of self-inflicted Brexit turmoil, the UK economy can – from a somewhat depressed level – expand at a pace at least in line with that of its biggest trading partner, the Eurozone."

Following the Q1 GDP release, Berenberg raises its call for UK GDP growth for 2024 as a whole from 0.6% to 0.8%. Bloomberg consensus is projecting a muted expansion of just 0.3% for this year.

Above: "UK economy: finally catching up a bit" - Berenberg.

The Bank of England said Thursday the UK economy will grow by around 0.5% in 2024, an upgrade on its previous estimate of just 0.2%. The OECD last week downgraded its forecast for UK growth this year to 0.4% from a November forecast of 0.7%.

The Pound rallied following the GDP release as markets pared back expectations for a June rate cut at the Bank of England from approximately 55% odds to 45% odds.

Berenberg says these economic growth figures justify a later starting date. "It supports our forecast that the Bank of England (BoE) is likely to wait to make its first easing move until 1 August, instead of 20 June," says Schmieding.

Berenberg notes business investment has turned into a key driver of UK growth, something it describes as encouraging.

"Business investment surged by 0.9% in Q1, following a 1.4% increase in Q4 2023. Clarity on the outlook for relations with the EU has probably contributed to this positive development," says Schmieding.