Booming Business Optimism Reported by Lloyds Business Barometer

- Written by: Gary Howes

Image © Adobe Images

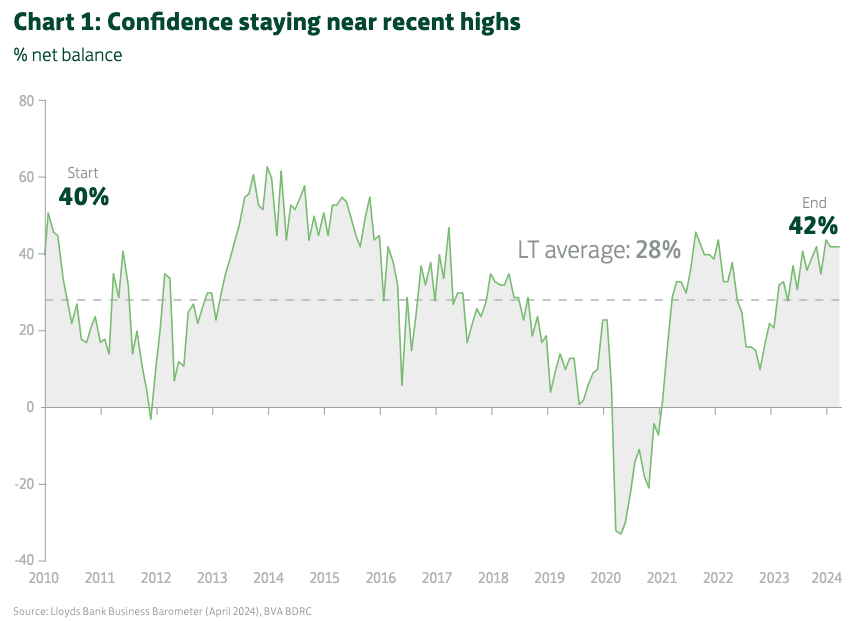

UK business confidence is "blooming into spring," reports the Lloyds Bank Business Barometer as it finds confidence remained steady for a second month at a high level.

The headline business confidence reading remained at 42%, staying above the survey’s benchmark long-term average of 28%, an indication that firms remain more upbeat than usual about both their own trading prospects and the broader economy.

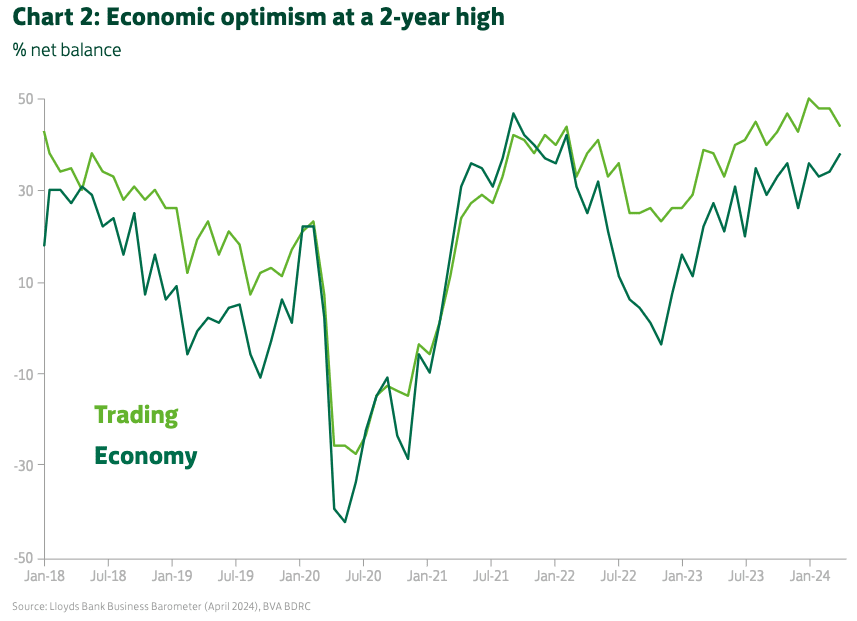

Economic optimism rallied to a 2-year high as 57% (up from 56%) of businesses expressed greater optimism about economic prospects, while 18% (down from 21%) were more pessimistic.

Official GDP data to February concur with this survey evidence and suggest the economy started growing again early this year.

"We are beginning to see a consistent trend emerge from our Barometer results in recent months. Businesses are feeling increasingly confident about the economy, coinciding with falling inflation and hopes that interest rates will start to fall this year," says Hann-Ju Ho, an economist at Lloyds Bank.

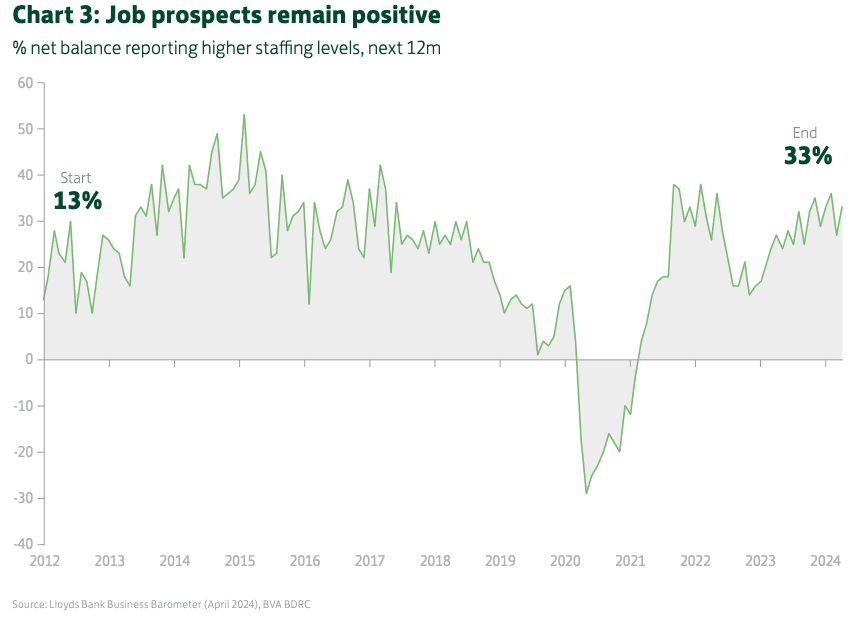

The survey also shows that the jobs market could be improving: Staffing expectations regain momentum with nearly half of firms planning to hire.

What's more, businesses' own price expectations climbed this month, pointing to a re-broadening of upward price pressures among domestic firms.

Wage pressures, meanwhile, remain elevated by historical standards, albeit they are off the peaks seen earlier in the year.

Lloyds Bank says expectations for lower interest rates in the coming months are helping to boost confidence; however, the Business Barometer speaks of a strong economic rebound that questions whether interest rate cuts are actually required.

With ONS data showing services inflation running close to 6.0%, there is a chance inflation will settle above the Bank's 2.0% target in the coming months, particularly if the labour market strengthens again.

Analysts at BCA Research say bringing down inflation will require interest rates to remain elevated for longer in order to slow activity and raise unemployment.

"With the UK economy rebounding, but with the UK requiring recessionary conditions to drive down inflation, the BoE is clearly in a tough spot with regards to monetary policy. Simply put, the window for rate cuts to begin in 2024 is rapidly closing," says Robert Robis, Chief Fixed Income Strategist at BCA Research.