Key Bank of England Survey Confirms Easing Inflation Expectations

- Written by: Gary Howes

Image © Adobe Images

There are further signs that inflation expectations at UK businesses continue to decline, boosting bets that the Bank of England can cut interest rates in June.

The Bank of England's DMP survey of UK businesses showed one-year ahead CPI inflation expectations declined further to 3.2% in March, down from 3.3% in February.

Economists say inflation expectations are a crucial component of realised inflation, meaning declining inflation expectations are a sign the Bank of England is on course to bring inflation back to the 2.0% target.

Three-year ahead CPI inflation expectations fell to 2.7% in the three months to March, 0.1 percentage points lower than reported in the three months to February.

Although inflation expectations continue to fall, this medium-term expectation remains well above the Bank's 2.0% target.

Some Bank of England members have recently argued that interest rates must remain at 5.25% for an extended time to ensure the 2.0% is met, while others like Governor Andrew Bailey appear to be leaning towards a June interest rate cut.

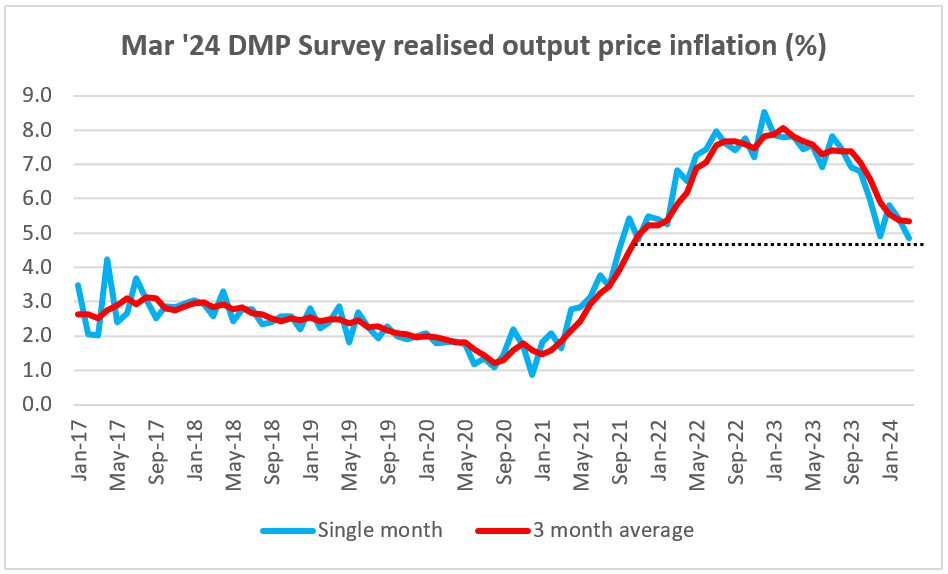

The trend in inflation expectations and dynamics at UK businesses is nevertheless clearly lower. Year-ahead own-price inflation was expected to be 4.1% in the three months to March, down from 4.3% in the three months to February.

Image courtesy of @Viraj Patel

Wage growth, a key driver of domestically-generated inflationary pressures, remains elevated, but is also trending lower.

Annual wage growth was 6.4% in the three months to March, down 0.3 percentage points from the three months to February. Based on three-month averages, firms expect their wage growth to decline by 1.5 percentage points over the next 12 months.

Expected year-ahead wage growth declined to 4.9% on a three-month moving-average basis.

Annual employment growth of 2.0% in the three months to March, lower than the 2.3% reported in the three months to February Expected year-ahead employment growth was 1.4% in the three months to March, down 0.2 percentage points from the three months to February.

This provides further evidence of easing labour market conditions that will ensure wage growth continues to fade and inflation can fall sustainably to target.