Shop Price Inflation Falls Below 2.0% Says BRC, But Fresh Challenges Loom

- Written by: Sam Coventry

Image © Adobe Stock

Relief for consumers as the disinflation journey in the UK continues, but the BRC warns looming challenges posed by government policy could arrest the process.

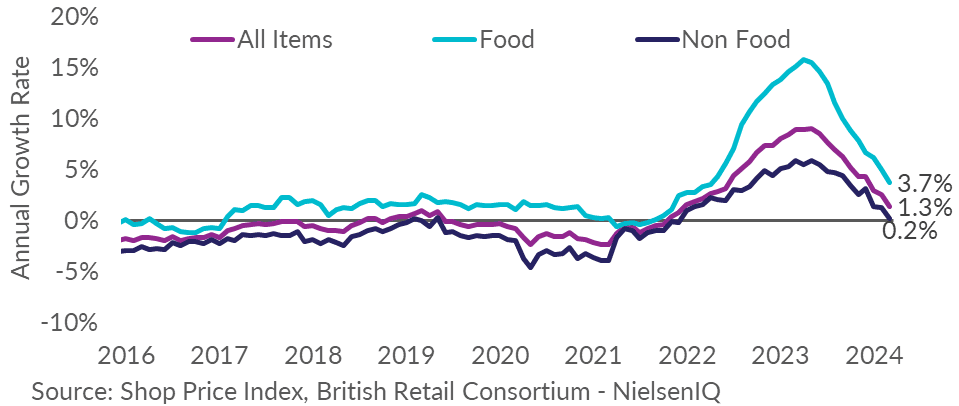

Shop Price inflation in the UK fell to 1.3% year-on-year in March, according to the British Retail Consortium, down from 2.5% in February.

This is below the 3-month average rate of 2.2% and adds fresh evidence to signs that the disinflation process is well underway in the UK.

"The slowdown in inflation continues and a key driver this month was a further fall in food prices. A year ago, food inflation was 15%," says Mike Watkins, Head of Retailer and Business Insight at NielsenIQ.

Non-Food inflation fell to 0.2% in March, its lowest since January 2022, and down from 1.3% in the preceding month. This is below the 3-month average rate of 0.9%.

Food inflation decelerated to 3.7% in March, down from 5.0% in February. This is below the 3-month average rate of 4.8% and is the tenth consecutive deceleration in the food category. Inflation is its lowest since April 2022.

Research from Capital Economics finds that all signs point to the UK falling into outright deflation over the coming months.

New analysis shows that CPI inflation will fall below 1.0% and remain below the Bank of England's 2.0% target through 2025, raising the risk of deflation in the UK. "We think CPI inflation will fall to just 0.5% later this year, and there is a risk of deflation," says Paul Dales, Chief UK Economist at Capital Economics.

However, retailers warn that the process of disinflation could be challenged in the coming months as businesses face fresh challenges.

"While these figures are good news for consumers, from this month, retailers face significant increased cost pressures that could put progress on bringing down inflation at risk. These costs include a 6.7% business rates rise, ill-thought-out recycling proposals, and new border checks – all at the same time as the largest rise to the National Living Wage on record," says Helen Dickinson, Chief Executive of the British Retail Consortium.

Business rates are due to rise from April 2024, and under the government's 'multiplier', the rates will increase in line with this September's inflation as measured by the Consumer Price Index (CPI).