PwC Upgrades UK Economic Forecast, Says Recession to be Avoided

- Written by: Sam Coventry

Image © David Holt, Accessed: Flikr, Licensing Conditions: Creative Commons

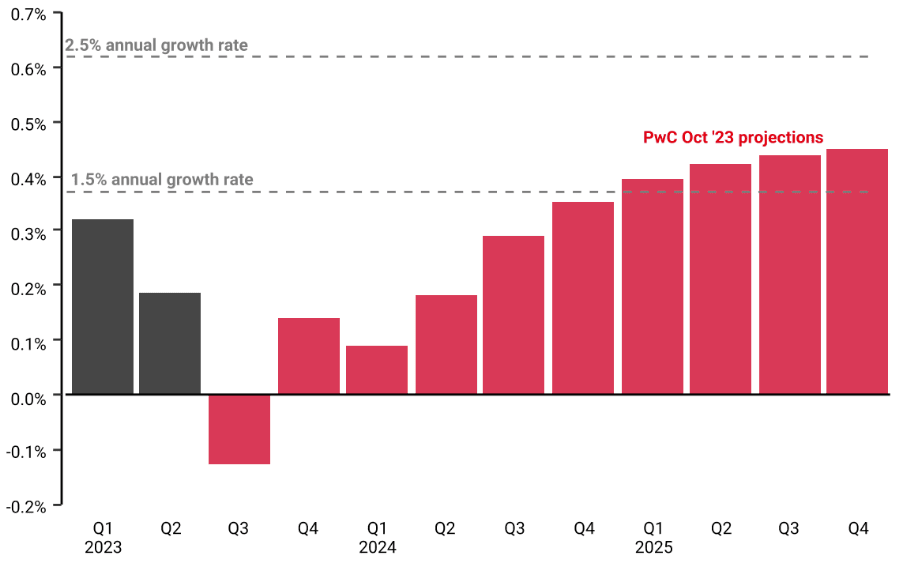

The UK will avoid recession but is likely to contract in the third quarter of this year, says PwC.

The professional services firm says it has upgraded its forecasts for the UK economy, now expecting growth of around 0.5% in real GDP this year and next.

PwC's previous outlook, released in April, predicted 0.1% growth for 2023.

CPI inflation is expected to end the year at under 5%, meaning the government will meet its target to halve inflation.

Inflation is now forecast to end the year at around 4.6%, which is higher than predicted in the previous outlook publication (3.5%) but comfortably below the Government's target of 5.4% for the fourth quarter of 2023.

"There will likely not be a linear decline in 2024 as current natural gas and peak futures prices are pointing to household energy prices rising in the new year due to current geopolitical instability in the Middle East," warns PwC on the inflation outlook.

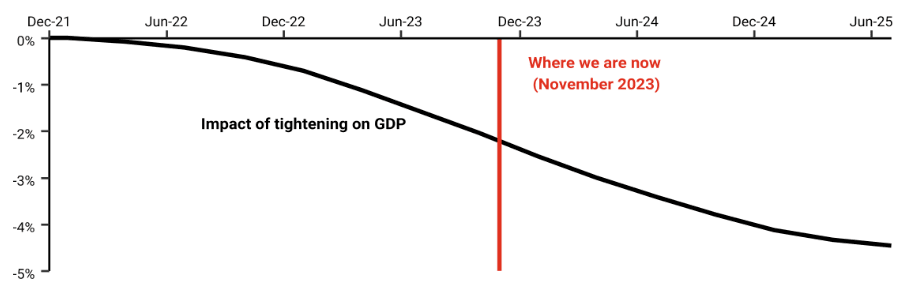

Above: PwC estimate of cumulative real GDP impact of policy tightening relative to no tightening. The chart shows Bank of England interest rate hikes have further work to do in slowing the economy. Image: PwC.

A full return to the Bank of England's 2% inflation target is unlikely to be met until 2025.

Most of the recent falls in inflation have been driven almost exclusively by lower energy prices.

Services inflation is likely to drop to around 6% by the end of the year as wage growth remains above historical norms.

Core goods inflation is expected to steadily drop as supply chains are in a better state, cost pressures are less intense and demand is slowing.

Owing to inflation, and despite the ONS reporting record wage increases, real earnings are expected to be lower in 2023 on average than in 2006 as a result of high inflation combined with long-term productivity challenges.

Incredibly, this is equivalent to no net earnings growth for 17 years, with the average worker earning around £17,000 less (in 2022 prices) than if real earnings had grown at their historical rates.

Above: PwC main scenario real UK GDP projections, quarter-on-quarter growth.

Barret Kupelian, Chief Economist at PwC UK, says the outlook will remain challenging as the impact of higher interest rates works through the economy:

"According to our estimates, the UK economy has felt around half of the impact of the Bank of England’s policy tightening. So in the coming few months we expect to see large swathes of the economy to adapt to the impact of tighter monetary policy."

PwC says homeowners looking to remortgage next year are likely to see average annual repayments increase by around £3,000 per year.

"The more encouraging news is that it is unlikely we will see additional Bank of England base interest rate rises, assuming no unexpected shocks to the economy," says Kupelian.

"We are certainly in a better position now compared to the beginning of the year, but we aren’t out of the woods just yet," he adds.