Lloyds Bank: What to Expect from Bank of England Next Week

- Written by: Sam Coventry

Image © Pound Sterling Live

The Bank of England is expected to raise interest rates a further 25 basis points to 5.5% next Thursday but there is "significant scope" to soften guidance as to whether another such hike is warranted.

Economists at Lloyds Bank see enough evidence in the data to allow the Bank to signal it is closing in on the finish line, although it will be keen to avoid boosting expectations for an imminent interest rate cut.

A further rise in interest rates will be justified by this past week's labour market data that revealed pay growth was still too elevated, having risen at 8.1% year-on-year in the three months to July.

This tracks well above the Bank of England's most recent forecasts for the rate to be at 6.9% in the third quarter.

Money market pricing shows investors have nevertheless lowered the odds of a hike next week to around 80%, having been fully priced for such an outcome just two weeks ago courtesy of weakness in the data elsewhere.

"In our view, this is understandable and follows a spate of soft data releases which point to an increasingly weaker economic outlook for the second half of the year than that embodied in the BoE’s current projections," says Nikesh Sawjani, Senior UK Economist at Lloyds Bank.

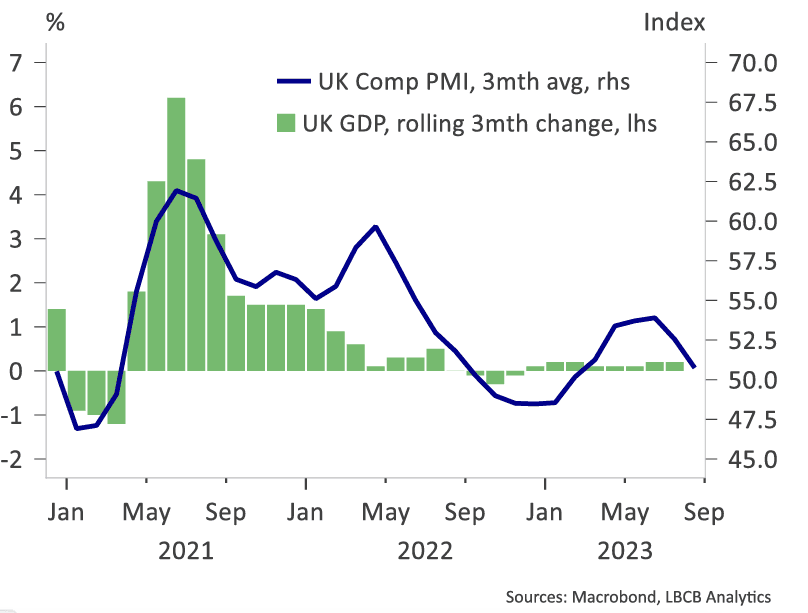

Above: PMIs point to a softening in growth. Image courtesy of Lloyds Bank.

In a note to clients, Lloyds Bank says monthly GDP contracted by more than expected in July which, in the absence of strong rebounds in GDP in August and September, means that achieving the BoE’s forecast of a 0.4% q/q rise in Q3 now looks highly unlikely.

"That view of a softer growth outlook has also been borne out in moderations in survey measures. Notably, the Composite PMI dropped below 50 in August, with both the headline manufacturing and services indices falling into contractionary territory," says Sawjani.

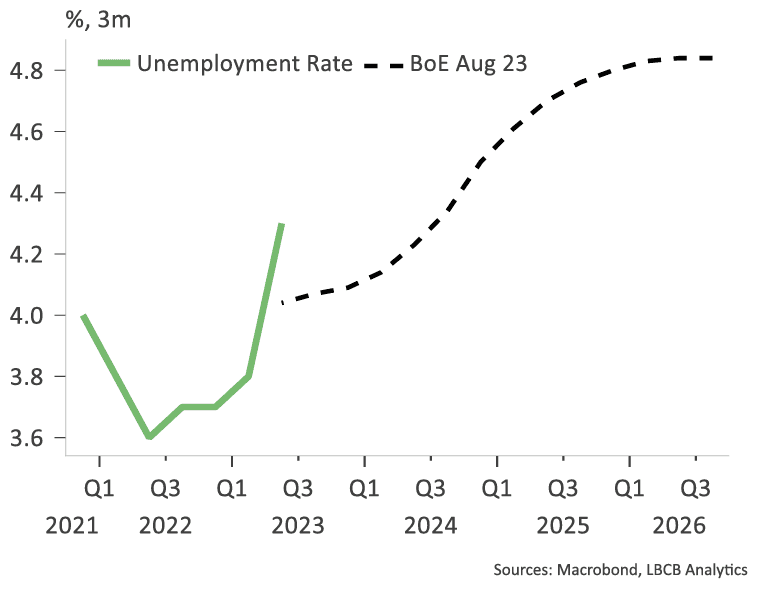

Although the ONS reported wages remain high, economists agree the outlook for wages is set on a downward path as the labour market continues to soften with the unemployment rate rising to 4.2% in the second quarter and 4.3% in the three months to July.

"That leaves the unemployment rate tracking noticeably above the BoE’s forecasts from its last Monetary Policy Report, which envisaged it averaging 4.1% in the second half of 2023," says Sawjani.

Above: "Higher unemployment rate points to cooling in the labour market" - Lloyds Bank.

In terms of the outlook beyond the September meeting, Lloyds Bank sees significant scope for the Bank of England to soften its guidance and make the prospect of further rate increases even more conditional.

"That would sit neatly with the Governor’s recent comments in front of the Treasury Select Committee that interest rates were near a peak in the UK," says Sawjami.

That said, the analyst expects the Bank to reiterate that policy will remain "sufficiently restrictive for sufficiently long".