When Will Interest Rates Go Down? September 2024 is the Current Bet

- Written by: Gary Howes

Image © Adobe Images

When will interest rates go down? Money market data and guidance from the Bank of England suggest the first interest rate cut could occur towards the autumn of 2024, but there are signs the cost of borrowing is already coming down.

This is because the Bank of England has signalled it is close to ending its interest rate hiking cycle, a development that takes the pressure off speculative elements of the money markets which in turn impact everyday pricing on mortgages and other forms of credit.

But, the Bank is equally keen to emphasise it thinks interest rates must stay higher for longer as inflation is not expected to drop to the 2.0% target rapidly, which could mean a return to the ultra-low rates of the past decade is unlikely.

So while there is some relief for mortgage holders, that relief could prove limited in the multi-year context.

"The Bank is likely to become less focused on how high rates need to go, and instead the central goal will increasingly be to keep market rates (with say two/three-year tenors) elevated long after it stops hiking," says James Smith, Developed Markets Economist at ING Bank.

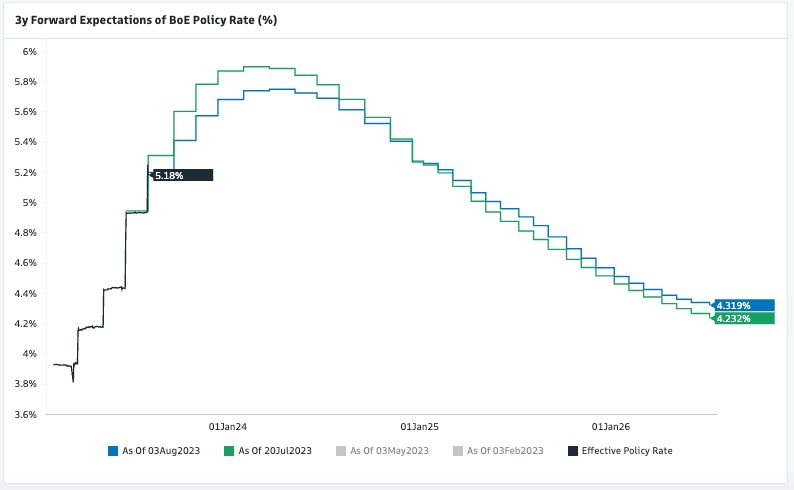

Money market data shows investors expect the first interest rate cut to have been delivered by the Bank of England by September of 2024, with a second cut potentially coming by December.

Ahead of the Bank's August policy update expectations for cuts were more aggressive, suggesting the Bank has successfully pushed back against market expectations it believes are inconsistent with its aim of pushing inflation lower.

"The updated guidance suits our call that the BoE will hike once more in September and then stop," says Kallum Pickering, an economist at Berenberg Bank. "However, the new guidance also suggests that the risks to our call for the first cut in Q1 next year is skewed towards a later start of the easing process we expect for next year."

Above: The odds of rate cuts in 2024 have declined, even as the peak in Bank Rate expectations has shifted lower. Image courtesy of Goldman Sachs.

If we assume the market is correct in its expectation for cuts to transpire around the autumn of 2024 then the Bank of England would start giving guidance consistent with a cut by the summer of 2024.

This would prompt markets to adjust accordingly and we would expect UK bond yields to fall further.

For mortgage holders, this would be a significant development as it is these bonds that determine the pricing of mortgages.

Therefore, the wheels for a decline in mortgage rates would be in motion by the midpoint of 2024.

Note that at one point in July, the same money markets were anticipating a peak in Bank Rate at just above 6.5%, but expectations have since fallen sharply to reflect the peak is now expected just below 5.75%.

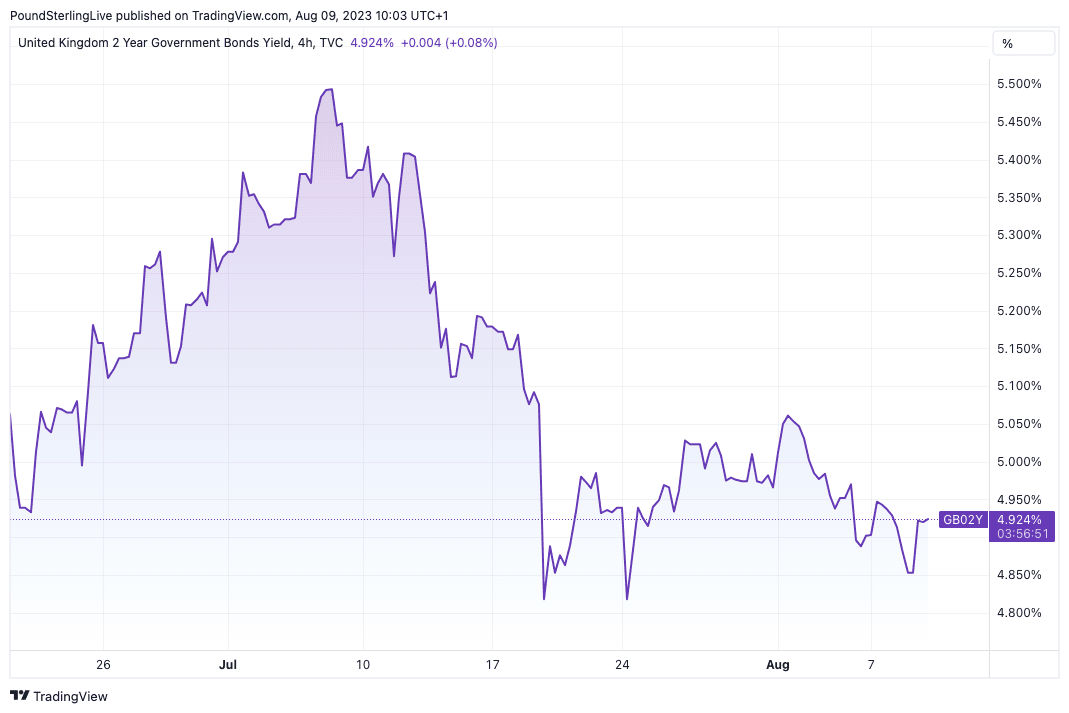

Above: The yield of two-year UK bonds peaked in July and has since come down, bringing mortgage rates down alongside.

Bond yields have reacted accordingly, having fallen from peaks in July and this has meant the peak pain point in mortgages has passed, with lenders already bringing down rates in July.

ING Bank's base case is that the Bank of England hikes again in September and pauses in November as wage growth is likely to prove stubbornly elevated, falling to 6.0% by year-end.

"This is likely to become a central argument for keeping rates higher for longer," says Smith.

Bank of America finds the August interest rate decision and guidance suggest UK interest rates will stay "higher for longer" although some near-term weakness in the UK currency remains possible.

Mark Wood, UK Economist at Bank of America, says two important sentences were added to the Bank of England's guidance on Wednesday.

First, it noted that policy is now restrictive and second, that the Bank would hold policy restrictive for long enough to bring inflation down to target.

"These additions suggest the BoE prefers a policy of holding at terminal for longer to hiking more and cutting sooner," says Wood.