Small Businesses Most at Risk from Recent U.S. Banking Turmoil

- Written by: James Skinner

"The reason that small banks disproportionately lend to small businesses in the first place is because their closer geographic proximity to individual small businesses gives them an informational advantage in gauging the riskiness of those businesses" - Goldman Sachs.

Image © Adobe Stock

Small businesses in provincial townships account for around a quarter of output from the world's largest economy and are likely to be the most adversely impacted by the tighter lending standards resulting from last month's trouble in the banking sector, according to research from Goldman Sachs.

Lenders of all sizes are widely expected to become more cautious about extending credit to avoid being caught short in the event of any unexpected increase in demands for deposits to be returned over the coming months.

This is after 'bank run' type behaviour among corporate customers left Silicon Valley Bank and Signature Bank unable to immediately meet demands for deposits in March, and is something that will potentially have far-reaching implications for the U.S. economy.

"We have recently estimated that bank stress is likely to reduce lending growth by 2-6pp," says Ronnie Walker, an economist at Goldman Sachs.

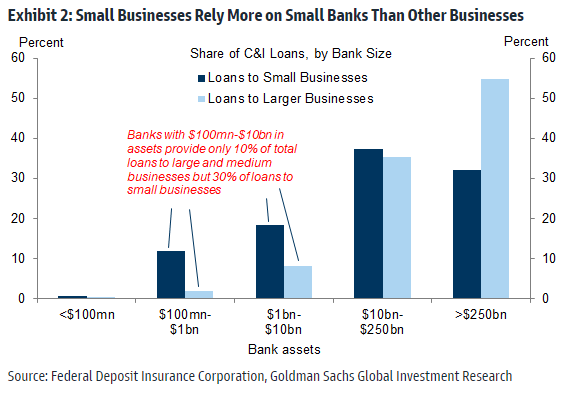

"Because small banks are likely to tighten credit more aggressively and small businesses disproportionately borrow from them, the hit to lending to small businesses will likely be larger," Walker and colleague Manuel Abecasis write in a research briefing last week.

Source: Goldman Sachs Global Investment Research.

Source: Goldman Sachs Global Investment Research.

Small businesses with less than 100 workers employ an estimated 35% of the private sector labour force in the U.S., and tend to generate around a quarter of all economic output but will be disproportionately exposed to any tightening of credit conditions among small and medium-sized banks.

This is because in the U.S. almost three-quarters of small business loans are provided by small and medium-sized banks with less than $250BN of assets, with a large portion of those loans coming from the smallest of institutions that will often have less than $10BN of assets in total.

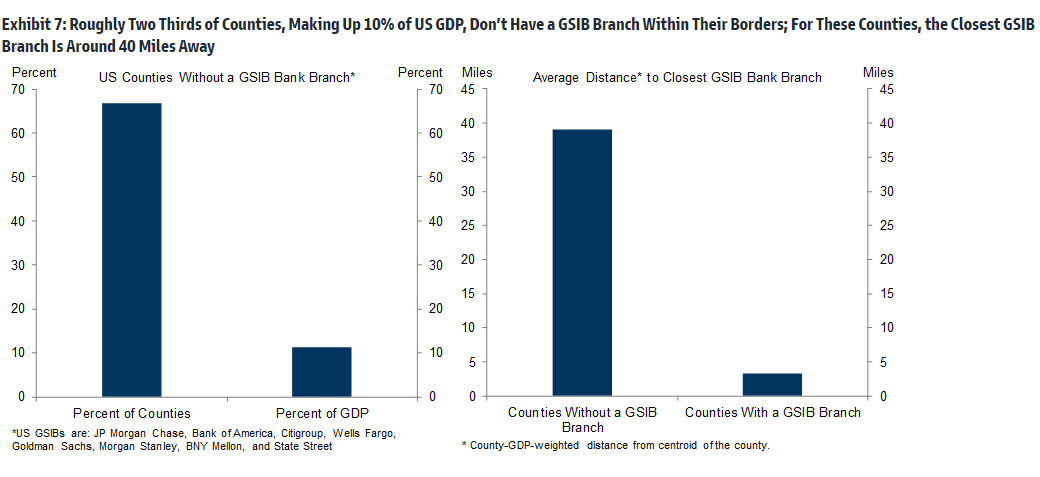

The biggest problem for these firms and the main risk for the U.S. economy is that many businesses will not be able to easily replace the financing provided by small banks due to larger competitors having only limited geographical footprints and business relationships outside of the big metropolitan areas.

"Research suggests that part of the reason that small banks disproportionately lend to small businesses in the first place is because their closer geographic proximity to individual small businesses gives them an informational advantage in gauging the riskiness of those businesses," Walker and Abecasis say.

"In many counties across the US, there is no nearby alternative to smaller banks. The left panel of Exhibit 7 shows that there is no GSIB branch in roughly two thirds of counties, making up 10% of US GDP," they add.

Source: Goldman Sachs Global Investment Research.

Source: Goldman Sachs Global Investment Research.

Tighter lending standards are likely to be felt first and foremost by firms in the construction and services sectors, which are home to the largest share of all small businesses, though the overall economic impact is likely to be broader.

The direct and indirect effects of the turmoil in the banking sector are why many Federal Reserve (Fed) policymakers remained content with their earlier forecasts for the economy and interest rates at last month's monetary policy meeting.

Those forecasts suggested as many as two further increases in the Fed Funds rate are likely to be announced later this year but whether these materialise will depend in no small part on how well the economy holds up in the face of earlier increases in borrowing costs, and tightening credit conditions.

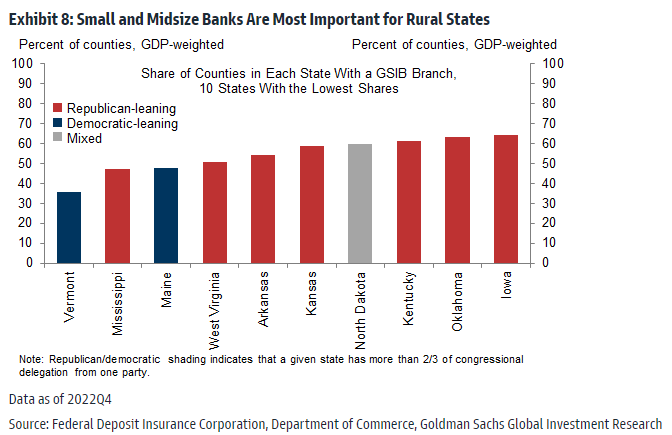

"States that are more rural and Republican-leaning tend to have fewer GSIB branches, and as a result may see a larger drag on lending growth. Exhibit 8 shows that seven of the ten states with the lowest GDP-weighted share of counties with a GSIB branch are Republican-leaning states and only two—Vermont and Maine—are Democratic-leaning states," Walker and Abecasis say.

"The most timely and direct information about small business borrowing conditions will come from the National Federation of Independent Business’s monthly survey on small business economic trends. The survey includes a few questions about borrowing conditions, including whether it was harder for a business to receive credit relative to a few months ago," they add.

Source: Goldman Sachs Global Investment Research.

Source: Goldman Sachs Global Investment Research.