Inflation Rise "Not a One Off" says NIESR

- Written by: Gary Howes

Image © Adobe Stock

Economists have reacted with surprise to data confirming the UK's inflation rate is rising, with most saying they cement a 25 basis point hike at the Bank of England on Thursday.

The Bank will be unable to ignore signs that inflationary pressures are becoming entrenched and their recent economic projections showing a crash in inflation over coming months could prove wide off the mark.

UK headline inflation unexpectedly increased to 10.4% year-on-year in February from 10.% in January, said the ONS.

"These figures suggest that the increase in headline inflation is not a one-off movement, but rather reflects rising inflationary pressures," says Paula Bejarano Carbo, Associate Economist at the NIESR.

The think-tank says what is of particular concern is how broad-based inflation is, as opposed to being driven by temporary one-offs.

NIESR’s measure of underlying inflation, which excludes 5% of the highest and lowest price changes, rose to a new series high of 9.7% in February, after remaining flat at 9.0% for three months.

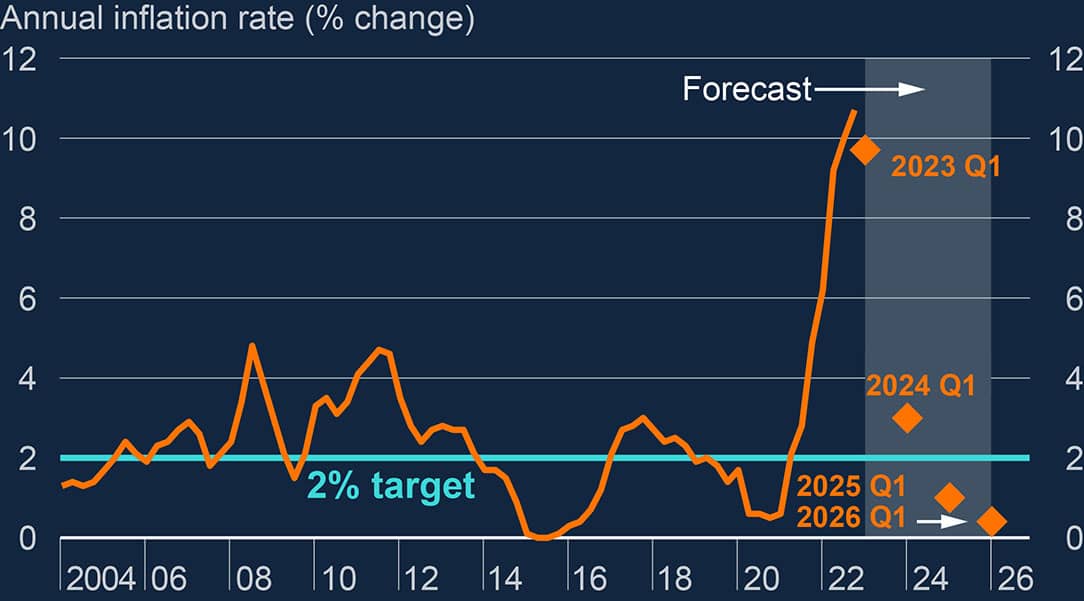

Above: The Bank of England's February forecasts showed a sharp drop in inflation was coming.

At the same time, the ONS’s measure of core inflation – CPI excluding food, energy, alcohol and tobacco – rose to 6.2% in February from 5.8% in January.

"The data suggests that inflationary pressures in the economy have yet to be tamed," says Carbo.

The ONS said food inflation grew at an annual rate of 18.2% in February, a significant rise from 16.7% in January – the highest rate for this category observed in over 45 years.

Given today's data, and the expected effect of incoming wage rises on inflation in the coming months, Carbo says it "would be a mistake" if the Bank of England kept interest rates unchanged on Thursday.

Bank of England Governor Andrew Bailey signalled on March 02 there was no firm commitment to raising interest rates on March 23, saying "I would caution against suggesting either that we are done with increasing Bank Rate, or that we will inevitably need to do more."

Markets have steadily slashed expectations for another rate hike following the comments, particularly in light of recent banking market turmoil.

However, Bailey confirmed the Bank remains sensitive to the data and Wednesday's inflation release leaves it little room within which to manufacture a reason to keep interest rates unchanged.