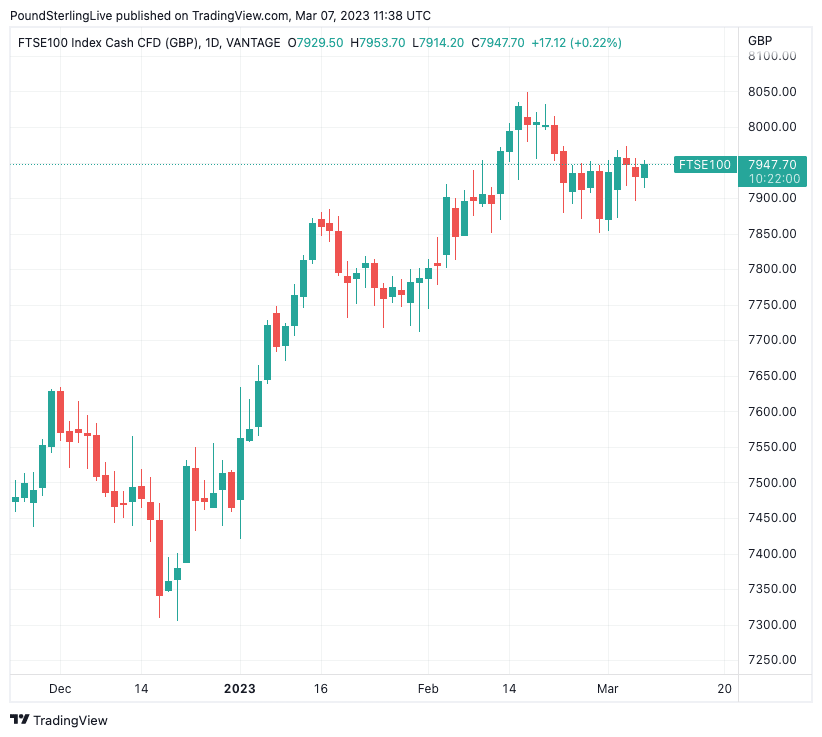

FTSE 100 Softer on China Scare, Powell Dominates Today's Agenda

- Focus on Fed Chair Jerome Powell’s testimony before Congress

- China’s exports fall and imports plunge

- FTSE 100 opens lower after unsettled sessions in Asia stocks

- BRC data shows love spend brightens February

- But volatility set to stay for retailers

- Halifax reports lull in house price declines

- But a storm still could be ahead.

Image © Adobe Images

Caution is set to stay the name of the game on financial markets as investors await testimony from the world’s most influential central banker.

With investors on tenterhooks about just how far interest rates will rise, and what effect this will have on the world’s largest economy, Fed chair Jerome Powell's words in Washington as he speaks to senators later are likely to set off a ripple effect through indices.

Any hint that he's swirling the latest data and is finding a pattern of inflation that’s stubbornly hard to shift, could trigger fresh falls in equities and may see bond yields edge up.

Nervousness that more punishing interest rate hikes are on the way, and monetary policy is set to stay tight for longer saw the S&P 500 erase most of Monday’s gains.

Unsettled sentiment crept into trade in Asia, while the FTSE 100 opened lower before recovering a little, with this week’s more downbeat mood continuing.

Above: FTSE 100 at daily intervals.

China Worries

Worries have risen again about the fragility of global growth, with weak import and export data from China highlighting that its economy has caught a chill from the slowdown in other nations, even as it recovers from its lockdown-induced maladies.

Exports in the two months were 6.8%, lower than a year before, while imports plunged by 10.2%, a much greater drop than anticipated.

This highlights not just sluggish domestic demand, but also that Chinese companies aren't importing as many materials or parts to manufacture goods destined for overseas.

With economies still so interlinked, rising rates in some parts of the world are still having powerful knock-on effects across others, and as they are set to be ramped up further, investors are bracing for further impact.

Oil Prices Clinging On

Nevertheless, oil prices are clinging on to recent gains, with Brent still hovering at $86 a barrel as optimism hangs around about how the re-opening of China’s economy should help stabilise demand while supply concerns linger about Russia’s output cuts.

UK Consumers Signal Caution

Caution about the months ahead is coming through loud and clear in the latest snapshot on UK consumer spending behaviour.

Although shoppers upped spend in a flush of love around Valentine’s Day, February volumes were down overall as painful price rises meant they put less in their baskets.

Retailers will be bracing for some volatile months ahead, as household budgets are squeezed further through higher energy costs, tax rises, and the relentless ramping up in food inflation.

The spate of bargain hunting we have seen is set to continue, with stores offering the best deals, and known for their ‘value’ proposition likely to stay more resilient.

Halifax Data Signals Surprise Uptick in House Prices

Falling mortgage rates may appear to have pressed pause on house price declines, but this is likely to just be a lull before more stormy weather ahead.

Halifax data showed that in February, annual price rises stuck at 2.1% for the third consecutive month as some confidence has crept back in, but with fresh swathes of homeowners having to find new deals this year, the monthly hikes in payments will still come as a shock.

Other data shows homeowners are already baulking at paying high asking prices, so although the market might not drop as steeply as was feared, there is still set to be a big stumble ahead.

Market Report by Susannah Streeter, Head of Money and Markets at Hargreaves Lansdown.

Market Report by Susannah Streeter, Head of Money and Markets at Hargreaves Lansdown.