Near Tightest Labour Market in World Looms Over UK Stocks and Companies

- Written by: James Skinner

"Higher labour costs will be a major driver of lower margins. Wage inflation is likely to be particularly painful as GDP growth decelerates, as it becomes more difficult for companies to pass on higher costs to their consumers" - Goldman Sachs Global Investment Research.

Image © Adobe Images

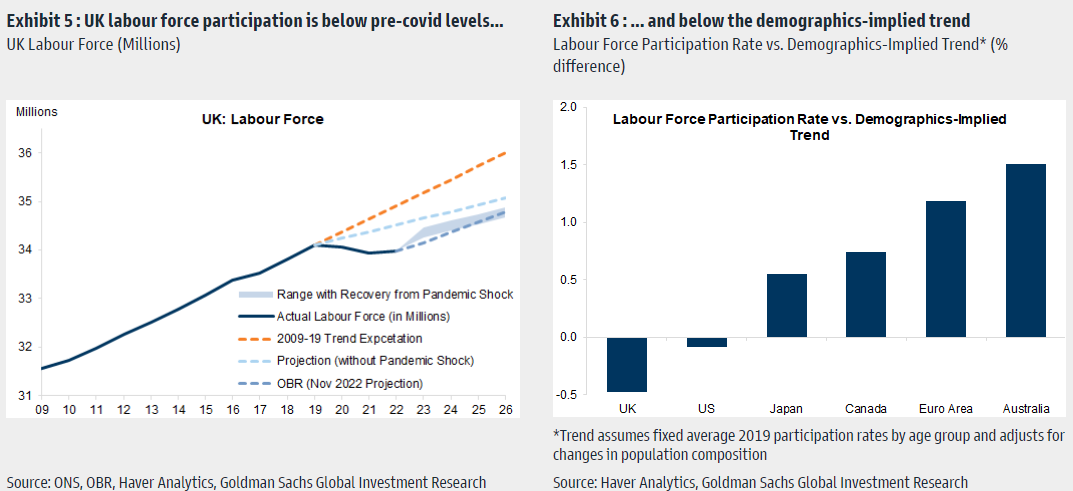

The UK is often said to have one of the tightest labour markets in the world and recent Office for National Statistics figures have appeared to confirm it but the portfolio strategy research team at Goldman Sachs says this has implications for corporate profits and share prices in London and beyond.

February's release of employment figures for December suggested growth in permanent pay settlements accelerated to a new high at year-end in an important development for the UK economy and asset prices across the board.

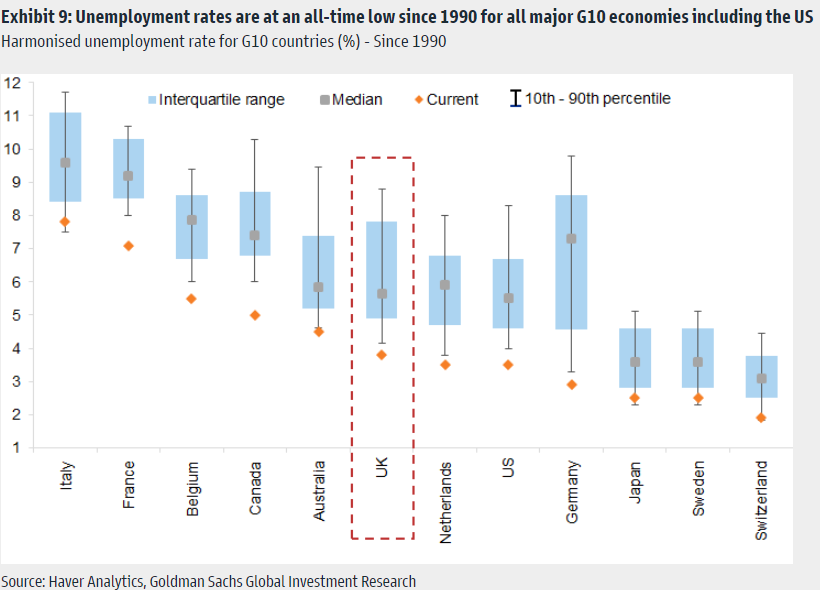

"The UK stands out as having one of the tightest labour markets globally. Unemployment is at 3.8%, the lowest level since 1974. This comes at a time when the job opening rate remains elevated and there is an increased focus on de-globalisation and re-shoring," says Guillaume Jaisson, a strategist in the portfolio strategy team at Goldman Sachs.

Source: Goldman Sachs Global Investment Research. Click image for closer inspection. To optimise the timing of any international payments you could consider setting a free FX rate alert here.

"Underlying inflation pressures remain firm. The last labour market report showed wage growth surprising to the upside yet again; private sector wage growth was up 7% y/y and our economists expect it to remain elevated this year at +5.5% on average – well above the 3% rate that is usually considered compatible with the BoE’s 2% inflation target," Jaisson and colleagues add.

There are many factors driving the evolution of labour costs including relatively recent increases in commodity prices, and these are in line with some of the likely symptoms of the "Post Modern Cycle and Secular Change" thesis under development within the portfolio research team since early last year.

This thesis argues that a combination of "cyclical and structural factors" including recent corporate tendencies toward things like "re-shoring" of production for certain systemically important or necessary goods and services are at the forefront in driving this trend.

Source: Goldman Sachs Global Investment Research. Click image for closer inspection. To optimise the timing of any international payments you could consider setting a free FX rate alert here.

That tendency has been cast by many third-party observers as the beginning of "de-globalisation" or a shift toward some sort of "regionalisation" but irrespective of whether it is or isn't, the recent and ongoing developments in labour markets have adverse implications for corporate profits.

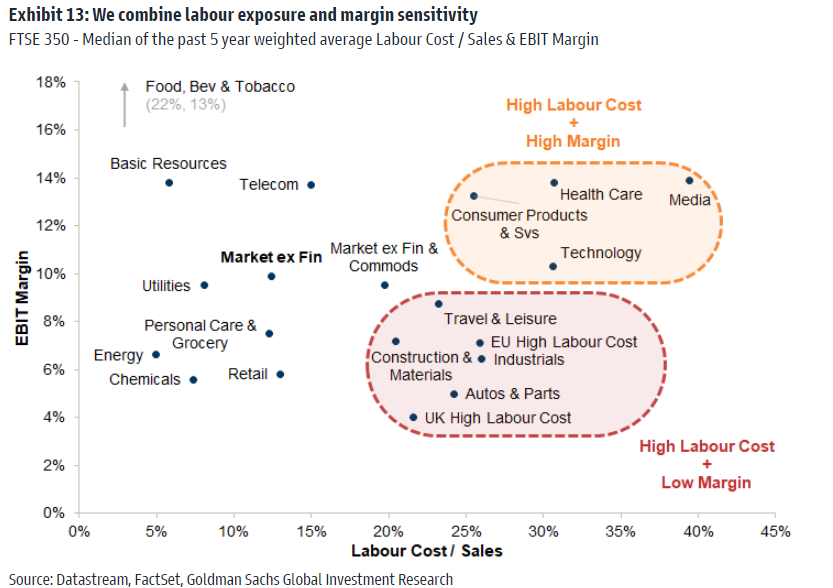

"Higher labour costs will be a major driver of lower margins. Wage inflation is likely to be particularly painful as GDP growth decelerates, as it becomes more difficult for companies to pass on higher costs to their consumers," Jaisson and colleagues write in a Friday research briefing.

"Looking at the past 5 years, for the FTSE 350, Salaries & Benefit Expenses represent 13% of revenues and more than 110% of Operating Income. Salaries & Benefit Expense represents 15% of Total Costs, while Net Income Margins are now around 7% (of revenues). So, a 5% increase in wages – all other things equal – could lower the earnings of the FTSE 350 by c. 10%," they add.

Source: Goldman Sachs Global Investment Research. Click image for closer inspection. To optimise the timing of any international payments you could consider setting a free FX rate alert here.

Source: Goldman Sachs Global Investment Research. Click image for closer inspection. To optimise the timing of any international payments you could consider setting a free FX rate alert here.

The trouble for companies and shareholders is that what impacts corporate profitability also tends to impact share prices too, although some companies are more exposed than others, and likewise with the various sectors of industry.

"Some sectors are more exposed but the 'true' exposure depends on companies’ ability to pass on these costs. Combining labour exposure and margin sensitivity, we find that the most exposed sectors are: Construction & Materials, Industrials, Travel & Leisure, Autos & Parts and some Retailers," Jaisson and colleagues say.

"We updated our list of UK companies with High Labour Costs. Our analysis points to a potential underperformance of these names. Year-to-date, the list has outperformed with the cyclical rebound, a reflection of its factor exposure. We think this bounce is premature given wage inflation remains elevated and margins continue to be revised down," they add.

![]() Source: Goldman Sachs Global Investment Research. Click image for closer inspection. To optimise the timing of any international payments you could consider setting a free FX rate alert here.

Source: Goldman Sachs Global Investment Research. Click image for closer inspection. To optimise the timing of any international payments you could consider setting a free FX rate alert here.