"Stubborn Rate of Core Inflation" to Keep ECB on the Hiking Path

- Written by: Gary Howes

Image © Adobe Stock

A sharp drop in Eurozone CPI inflation last month was offset by a stubbornly high core inflation reading, which will likely keep the European Central Bank on course to deliver further interest rate hikes.

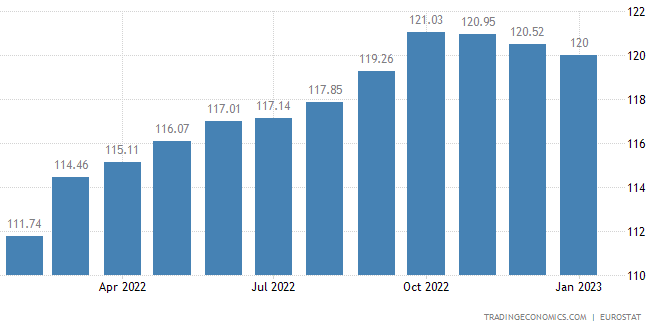

Inflation dropped sharply to 8.5% year-on-year in January, from 9.2% in December said Eurostat, putting it below consensus expectations for 9.0%.

However, there will be high uncertainty as to this month's preliminary reading as Germany's figures were estimated owing to technical issues.

The sharp drop in inflation would be welcomed by Eurozone consumers, but for the European Central Bank (ECB) there is little reason to relax.

This is because the core component of the data came in unchanged at 5.2%, whereas markets we expecting a reading of 5.1%.

"We think today’s data reinforces an expected hawkish tilt at the ECB's upcoming meeting," says Hugo Le Damany, Economist at AXA Investment Managers.

The ECB is expected to raise interest rates by 50 basis points in February and March, but a weaker-than-expected inflation reading would have challenged this expectation.

In the event, the strong core CPI reading means the dial for ECB policy is unmoved.

"While it is tempting to conclude that the big downside surprise in terms of headline inflation is very dovish, the stubborn rate of core inflation really counteracts the dovish signal from today’s inflation release. As such, we do not think it will be a game-changer," says Fabio Balboni, Senior Economist at HSBC.

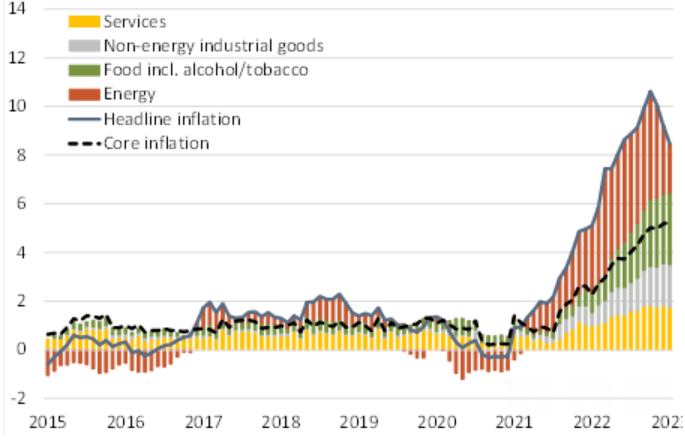

Above: Eurozone HICP inflation: headline and contribution from special aggregates (in % yoy and ppt). Not seasonally adjusted. Sources: Eurostat, Berenberg.

"Although the falling headline rate will be welcome news to the ECB, inflation remains far too high. This includes the stubborn core rate. We therefore expect the central bank to persist on the path it all-but-announced in December and hike rates by 50bp tomorrow as well as on 16 March. A final 25bp move on 4 May would then bring the main refinancing rate to a peak of 3.75%. The ECB will likely hold steady at that level for the remainder of the year," says Salomon Fiedler, an economist at Berenberg.

But Vitor Constâncio, Former ECB Vice President and current President of the Council of ISEG, University of Lisbon, said today's data showed inflation was now on the path to far more comfortable levels.

"Euro Area flash estimate of inflation for January shows another significant decrease, beyond what markets expected. The significant inflation decline will accelerate from March onwards. Expect a number for Dec around 3%," says Constâncio.

Such a rapid rate of decline, if borne out by the official data, would suggest the ECB would soon be in a position to slow down its rate hiking cycle.

The ECB is the most 'hawkish' central bank in the G10 with markets expecting a further 150bp worth of interest rate hikes over the duration of the first half of 2023.

With expectations elevated, the potential for the ECB to underwhelm grows, particularly if Constâncio prediction is correct.

For the Euro, any downshift in rate hike expectations would likely weigh.